Ethereum Whales Remain Divided – What Lies Ahead for ETH Investors?

0

0

In early May 2025, the Ethereum (ETH) market witnessed contrasting actions from large investors, commonly known as whales.

These opposing behaviors from whales present investors with both risks and opportunities.

Contrasting Ethereum Whales’ Actions

On one hand, several Ethereum whales are accumulating ETH in large quantities. An ETH whale purchased 3,029.6 ETH valued at $5.74 million. However, this whale currently faces a temporary loss of $142,000 as the price has dropped to $1,842 per ETH.

On May 1, 2025, Lookonchain reported that multiple whale addresses accumulated thousands of ETH within two hours. These actions indicate that some major investors remain confident in ETH’s long-term potential despite short-term price volatility.

On the other hand, selling pressure from Ethereum whales is significant. On May 2, 2025, OnchainLens reported that a whale deposited 2,680 ETH on Kraken, incurring an estimated loss of around $255,000.

Meanwhile, analysts revealed that another whale transferred 3,000 ETH to Kraken within 10 minutes on the same day, signaling a strong intent to sell.

Notably, a whale who received 76,000 ETH during the 2015 ICO sold 6,000 ETH, potentially securing a profit of $10.92 million.

Additionally, on May 1, 2025, on-chain data showed a whale increasing their short position by borrowing an additional 4,000 ETH. This whale is bringing their total short position to 10,000 ETH, equivalent to approximately $18.4 million.

These moves highlight a clear divergence in Ethereum whale strategies, with accumulation and selling creating significant pressure on ETH’s price.

Market Context and Investor Sentiment

The volatility in whale behavior coincides with a crypto market influenced by various factors. According to BeInCrypto, ETH’s price gained 10% in a week but slightly decreased in the last 24 hours. It is hovering around $1,842—a notable decline from its March 2025 peak of $2,500.

Ethereum Price Chart in the Past Month. Source: TradingView

Ethereum Price Chart in the Past Month. Source: TradingView

Despite this, market sentiment shows some positive signs. Ethereum investment products also saw US$183m inflows last week following an 8-week run of outflows. The Ethereum spot ETF had a total net inflow of US$6.4932 million yesterday. This reflects sustained long-term interest from institutions, even amid short-term selling pressure from whales.

Furthermore, a whale’s large 10,000 ETH short position suggests expectations of a near-term price decline, potentially amplifying downward pressure if market sentiment turns negative.

Meanwhile, retail investors appear to be affected by this uncertainty, with ETH trading volume on exchanges dropping 10% over the past 24 hours.

Risks and Opportunities

The opposing actions of whales place investors at a crossroads of risks and opportunities. On the risk side, the selling pressure from whales, particularly the significant short position, could lower ETH’s price in the short term, especially given the overbought market conditions.

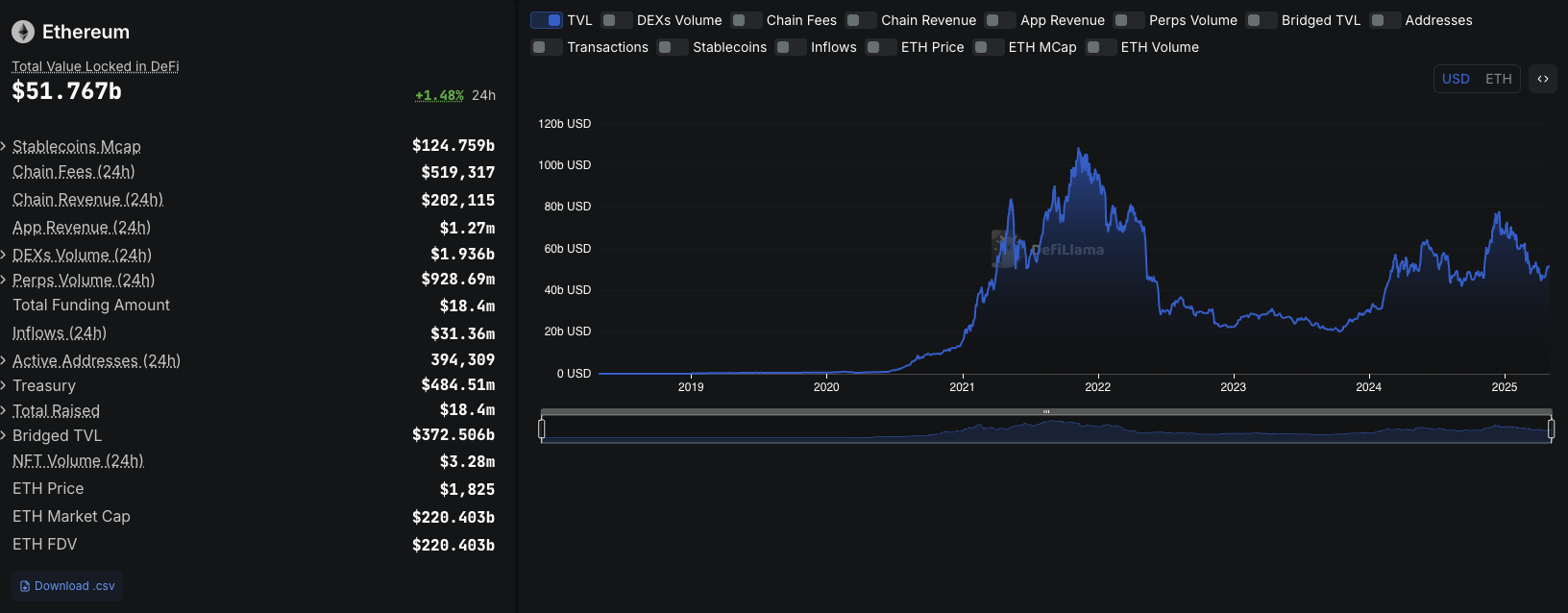

Ethereum TVL. Source: DefilLama

Ethereum TVL. Source: DefilLama

However, opportunities also abound. Whales’ accumulation of thousands of ETH reflects long-term confidence in Ethereum’s potential, particularly as the network continues to lead in DeFi, with a total value locked (TVL) of $52 billion in May 2025, according to DefiLlama.

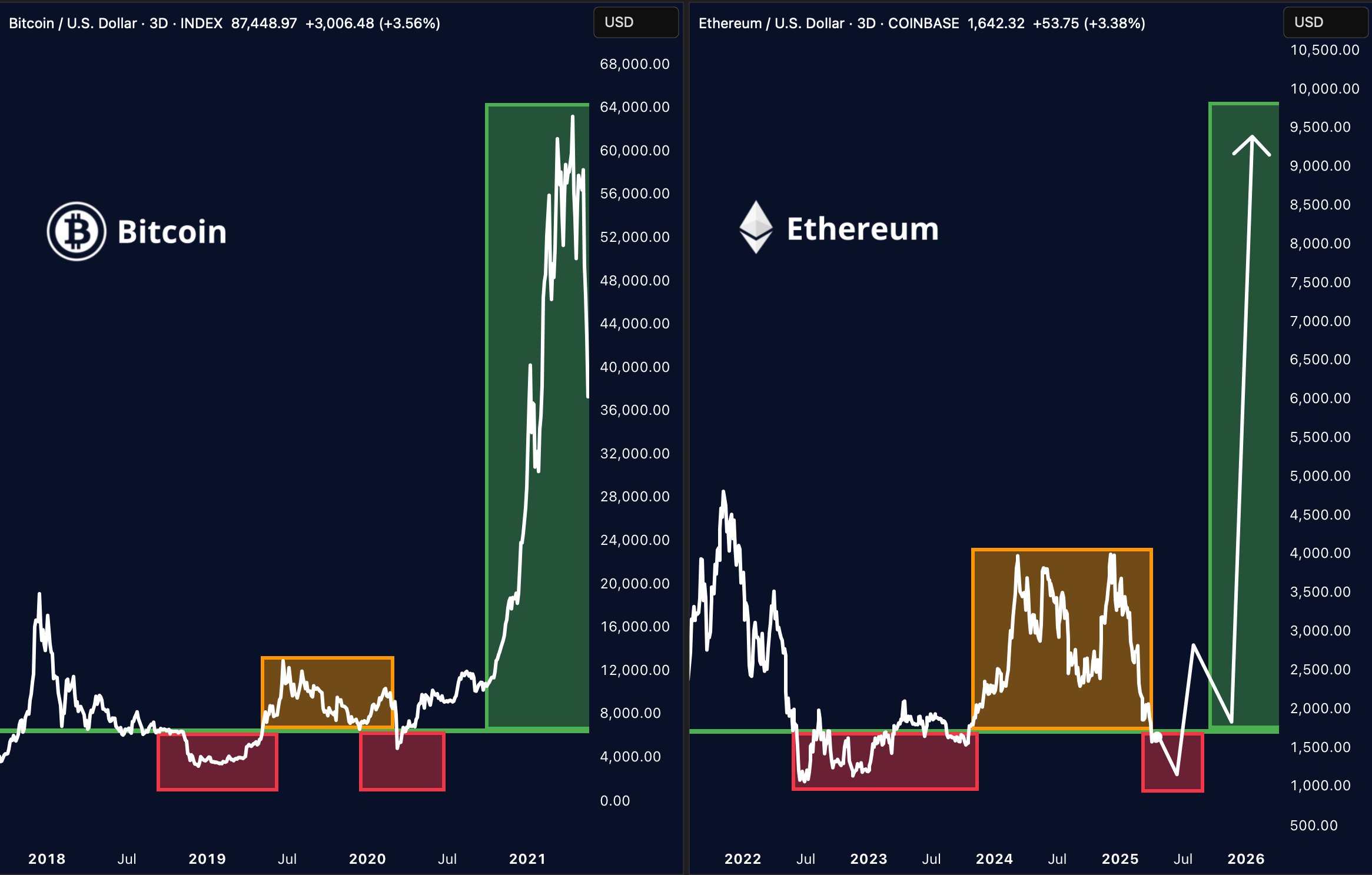

Analyst Merlijn has shown that Ethereum’s current price structure is similar to that of Bitcoin in 2020. Accordingly, he believes that Ethereum will witness a strong boom if history repeats itself.

Ethereum is showing the same structure. Source: Merlijn

Ethereum is showing the same structure. Source: Merlijn

Ethereum risks losing developers to Solana, which is gaining momentum due to better startup support and a streamlined user experience.

Yet, technical upgrades like Ethereum 2.0 and the growth of Layer 2 solutions such as Arbitrum and Optimism also support ETH’s long-term development.

Investors might view the current lower price levels as an opportunity to accumulate, but they should closely monitor whale activities and technical indicators to mitigate correction risks.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.