Bitcoin Options: Unveiling Why a $200K Rally Isn’t Expected by Year-End

0

0

BitcoinWorld

Bitcoin Options: Unveiling Why a $200K Rally Isn’t Expected by Year-End

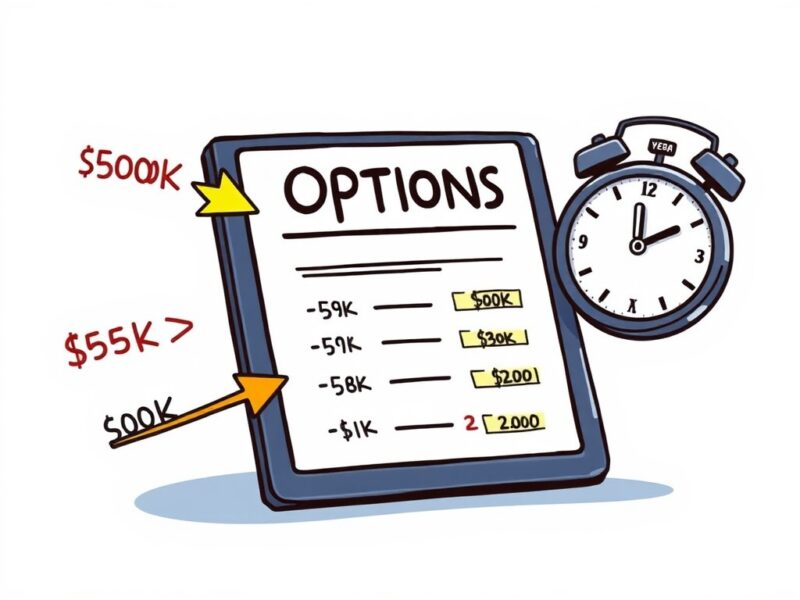

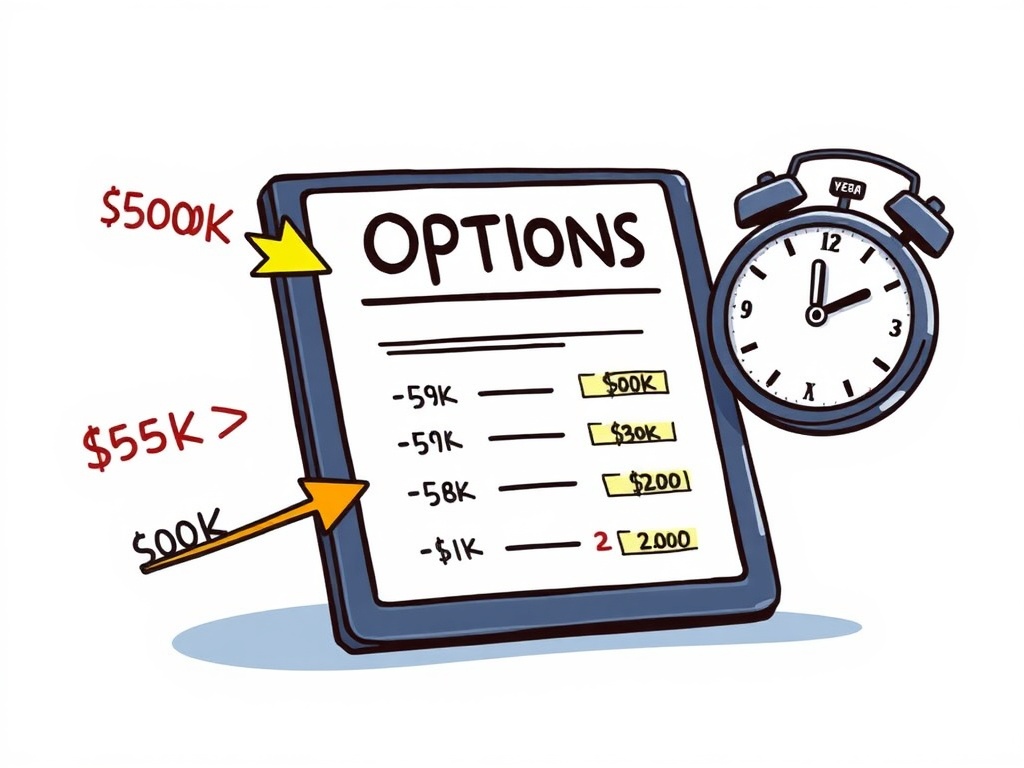

The cryptocurrency world is abuzz as traders gear up for a monumental event: the impending $8.8 billion Bitcoin options expiry on December 26. This isn’t just another date on the calendar; it’s a critical moment offering deep insights into the immediate future of BTC expiry and broader market expectations. While some might dream of parabolic price surges, current data suggests a more grounded reality.

Understanding the Massive BTC Expiry Event

What exactly is this massive BTC expiry event? It refers to the date when a large volume of Bitcoin options contracts expire. On this date, traders must either exercise their right to buy or sell Bitcoin at a predetermined price, or let their contracts lapse.

According to Cointelegraph, citing data from crypto analytics platform Laevitas, a staggering $8.8 billion in contracts is set to expire. Interestingly, over $1 billion of these contracts would only activate if Bitcoin somehow hit $200,000.

Why the $200K Target Seems Distant for Bitcoin Options

Despite the eye-popping $1 billion tied to the $200,000 strike price, Bitcoin options traders are not anticipating such a dramatic 72% rally. The open interest, which measures the total number of outstanding options contracts, shows a bullish skew: $6.45 billion in call options (bets on price increase) versus $2.36 billion in put options (bets on price decrease).

However, this bullish skew can be misleading. Many traders utilize far-out-of-the-money (OTM) calls as part of low-risk, leveraged crypto trading strategies. These options are relatively inexpensive and offer significant upside if a massive rally does occur, without risking much capital if it doesn’t. It’s more of a long-shot lottery ticket than a firm prediction of a $200,000 Bitcoin price.

Navigating Downside Risks: What Derivatives Market Data Shows

While the focus is often on upside potential, the derivatives market also reveals significant hedging against potential price drops. Approximately $900 million in put options are concentrated in the $50,000 to $80,000 range. This indicates that many traders are actively protecting their portfolios against a downside move, even as they hold speculative call options.

The presence of substantial put options suggests a pragmatic view among experienced traders. They understand that while bullish potential exists, prudent risk management is essential. These downside hedges are a clear signal that a significant portion of the market remains cautious, preparing for various outcomes rather than just the most optimistic ones.

Decoding Overall Market Sentiment from Options Data

So, what does all this complex options data tell us about the overall market sentiment? It paints a picture of cautious optimism, rather than unbridled euphoria. Traders are willing to place small, speculative bets on extreme upside, but they are also diligently protecting against significant downturns. This measured approach suggests a mature market that is learning from past cycles.

The upcoming BTC expiry will likely resolve without a massive price shock in either direction, unless unforeseen macroeconomic events or major market catalysts emerge. The options market is currently priced for stability within a broad range, reflecting a nuanced outlook on Bitcoin’s immediate future.

The approaching $8.8 billion Bitcoin options expiry is a fascinating window into the collective mindset of the crypto trading community. While the dream of a $200,000 Bitcoin by year-end captures headlines, the reality within the derivatives market points to strategic, risk-managed positions. Traders are balancing speculative upside bets with prudent downside hedges. This sophisticated approach suggests a maturing market that values stability and careful planning over pure speculation. As December 26 approaches, the focus remains on navigating the present market dynamics rather than chasing improbable targets.

Frequently Asked Questions (FAQs)

- What is a Bitcoin options expiry?

It’s the date when Bitcoin options contracts expire, requiring traders to decide whether to exercise their right to buy or sell Bitcoin at a set price, or let the contract lapse. - Why aren’t traders expecting a $200K Bitcoin rally despite high open interest?

Much of the high open interest at far-out-of-the-money (OTM) strike prices represents low-cost, leveraged speculative bets rather than firm predictions of such extreme price movements. - What are “far-out-of-the-money” calls?

These are call options with a strike price significantly higher than the current market price. They are cheap to acquire and offer high returns if the price skyrockets, but are likely to expire worthless if it doesn’t. - What do the $50K-$80K put options signify?

These put options indicate that many traders are hedging against potential downside price movements in Bitcoin, protecting their portfolios in case of a significant drop. - How does options data reflect overall market sentiment?

Options data, by showing the balance between calls and puts across different strike prices, provides insights into traders’ collective expectations for both upside potential and downside risk, indicating cautious optimism or bearish outlooks.

Did this deep dive into Bitcoin options help you understand the market better? Share this article with your fellow crypto enthusiasts and traders on social media to spread valuable insights!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

This post Bitcoin Options: Unveiling Why a $200K Rally Isn’t Expected by Year-End first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.