What Tron’s USDT Transfer Volume Surpassing PayPal’s Says about Crypto Adoption

0

0

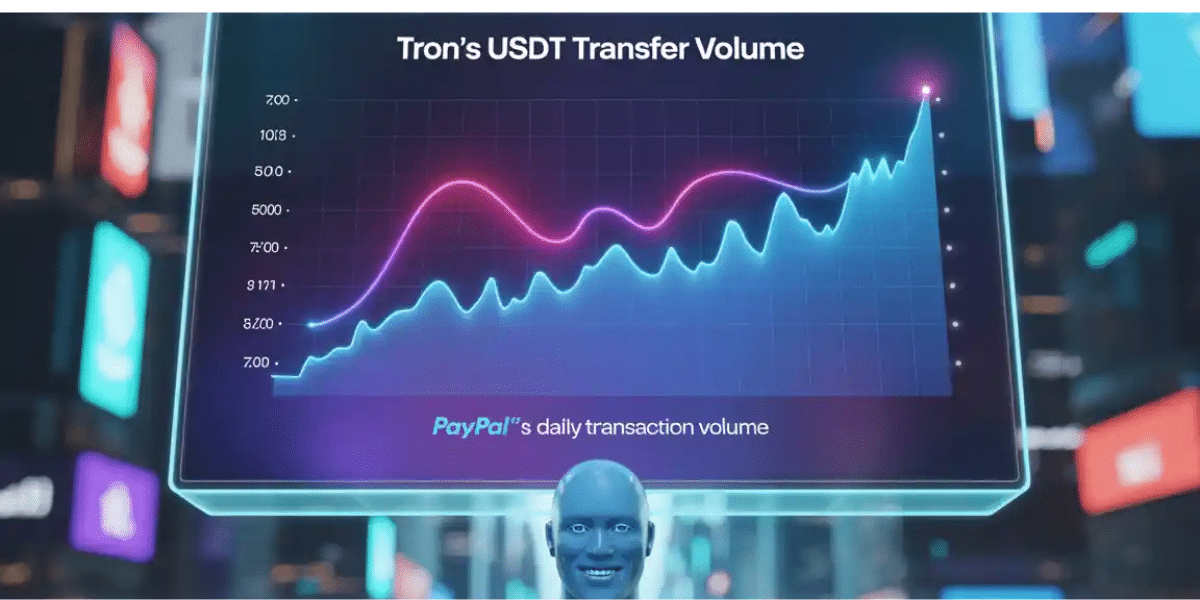

In a striking revelation from the cryptocurrency world, Tron’s USDT transfer volume reached $36.5 billion, a figure that is over 7 times that of PayPal’s daily transfer volume of $4.93 billion.

According to onchain data from Lookonchain, the cryptocurrency platform has continued to outperform traditional fintech platforms like PayPal and Stripe as far as daily stablecoin transactions are concerned.

Whales Anticipate FED Policy Decision

The surge in Tron’s USDT transfer volume in daily stablecoin transactions reflects a growing trend where institutional players are pre-positioning liquidity as the financial markets await the Federal Reserve’s decision. Data from CryptoQuant shows that wallets controlling over $100 million each have recently moved at least $10 billion worth of USDT on the Tron network.

Also read: Tron Outpaces Ethereum in USDT Volume: Price Set for Lift-Off?

The figures have contributed to the sharp increase in Tron’s USDT transfer volume from $6.4 billion in whale transfers just a few days earlier to $10 billion at a time. The Binance Liquidity is building up ahead of the highly anticipated FED Policy Decision. The data from CryptoQuant may suggest that users are making large-scale transfers in anticipation of potential market volatility following the Fed’s announcement.

According to other sources, Tron, a Layer-1 blockchain, has on average processed at least $21 billion in stablecoin volume per day, which puts it far ahead of other financial players in digital payment activity.

In addition to Tron’s USDT transfer volume, the rate of USDT issuance on the Ethereum blockchain has also reportedly surged around the same widow, with daily stablecoin transfers hitting approximately $2 billion.

Spike in On-chain Activity

The Tron blockchain is renowned for its high-speed and affordable transactions, which may be a reason behind the massive surge in Tron’s USDT transfer volume. Apart from surpassing PayPal’s daily stablecoin transaction levels, the figures also indicate Tron’s increasing role in cross-border payments and decentralized finance (DeFi) activities.

For individuals and entities involved in cryptocurrency trading, the surge in Tron’s USDT transfer volume could indicate an imminent bullish momentum on TRX, Tron’s native cryptocurrency. Historically, spikes in on-chain activity, such as the current rise in daily stablecoin transactions on the Tron network, are usually correlated with price increases as the utility of TRX increases.

Also read: Can Tron Break $0.37? What Traders Are Watching for TRX in 2025

Traders interested in the impact of the surge in Tron’s USDT transfer volume should now consider looking for entry points around TRX’s current support level. This makes especially sense if the current trend continues, as it could eventually push TRX towards a resistance zone seen in previous bull runs.

Conclusion

The rise in Tron’s USDT transfer volume could indicate that USDT (Tether) is becoming the most widely used stablecoin in daily stablecoin transactions, with Tron becoming the most preferred blockchain.

The combination of high-speed and low transaction fees makes Tron a favorite among users interested in cross-border and peer-to-peer transactions. As the gap between traditional platforms like PayPal and decentralized networks narrows, the figure indicates a continued adoption of cryptocurrencies, not only as an alternative but also as they become mainstream.

Read more Tron news on Our Website

Summary

- Tron’s USDT transfer volume has surpassed PayPal and Stripe by over 7x in daily stablecoin transactions.

- Whale-driven USDT transfers show institutions pre-positioning liquidity before Fed moves.

- USDT minting also surged on Ethereum, signaling strategic preparation ahead of Federal Reserve Policy news.

Glossary of Key Terms

Stablecoins: A type of cryptocurrency designed to maintain a stable value by being pegged to a stable asset, such as a traditional currency like the USD.

USDT: USDT stands for Tether, the name of a digital currency known as a stablecoin that is pegged to the US dollar.

Crypto whale: An individual or institution that holds a large enough amount of cryptocurrency.

Bull Run: A period of time where the majority of investors are buying, demand outweighs supply, market confidence is at a high, and prices are rising.

Frequently Asked Questions about Stablecoins

What are the basics of stablecoins?

Stablecoins are digital assets issued by private companies as tokens on a blockchain, typically pegged to a fiat currency like the US dollar, and backed by reserves such as cash or highly liquid securities.

What are the leading stablecoins?

The top six stablecoins by market capitalization are Tether (USDT), USDC (USDC), Ethena USDe, Dai (DAI), Tether Gold, and PayPal USD (PYUSD).

Who controls USDT?

Tether Limited is the company that introduced Tether (USD₮ or USDT), an asset-backed cryptocurrency stablecoin, in 2014.

Do stablecoins need liquidity?

Fully reserved stablecoins are generally backed one-to-one by high-quality, liquid assets like fiat currency or short-term government securities held in reserve.

Read More: What Tron’s USDT Transfer Volume Surpassing PayPal’s Says about Crypto Adoption">What Tron’s USDT Transfer Volume Surpassing PayPal’s Says about Crypto Adoption

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.