Crypto SEC News: Gemini Nears Settlement in Earn Case After 3-Year Battle

0

0

The post Crypto SEC News: Gemini Nears Settlement in Earn Case After 3-Year Battle appeared first on Coinpedia Fintech News

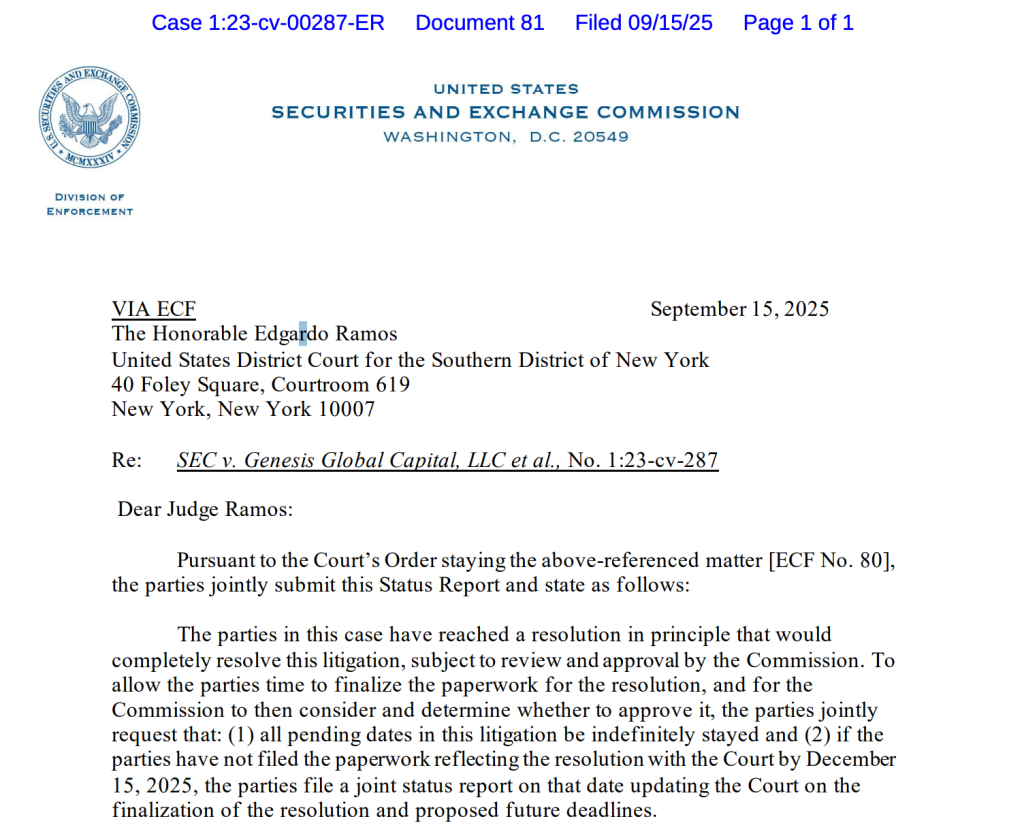

After nearly three years of back-and-forth, the U.S. Securities and Exchange Commission (SEC) and Gemini Trust Company are close to ending their legal dispute. The case centered on the Gemini Earn program, which regulators said violated securities laws. Both parties have now told the court they reached a “resolution in principle,” pausing litigation while final terms are finalized.

What Sparked the Dispute?

The conflict began in January 2023, when the SEC accused Gemini and its partner Genesis Global Capital of running an unregistered securities offering. Through Gemini Earn, retail investors lent crypto to Genesis in exchange for interest payments.

The SEC argued this setup was essentially the sale of securities, since billions in customer funds were pooled without required disclosures. When Genesis collapsed in late 2022, investors lost access to their money, prompting the SEC to treat the case as a landmark test for crypto lending regulations.

Why Are They Settling Now?

Several factors pushed both sides toward compromise:

- Genesis Settlement: Genesis already paid $21 million earlier this year, easing part of the dispute.

- SEC’s Shift: Under acting chair Mark Uyeda, the SEC indicated in February it would not pursue another Gemini case.

- Gemini’s IPO Plans: The company, having raised $425 million, wants to clear regulatory hurdles before its initial public offering.

Impact on Crypto Lending

A final settlement may reshape how crypto lending products are designed in the U.S. If Gemini accepts stricter compliance rules, other platforms will likely follow.

The case highlights the SEC’s firm stance: yield-bearing crypto accounts fall under securities law. This could limit how far crypto firms push high-interest offerings without registration and disclosures.

Policy and Business Turning Point

The timing is crucial. Gemini’s founders, the Winklevoss twins, have been active in Washington, pushing for friendlier crypto laws. Their presence at the signing of the GENIUS stablecoin bill shows their influence on U.S. policy.

Whether the Earn case ends quietly or sparks stricter rules, it represents a key moment where business, politics, and regulation collide in crypto.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The SEC accused Gemini Earn of operating as an unregistered securities offering by pooling investor funds with Genesis Global Capital without proper disclosures.

Because it offered yield-bearing accounts that regulators argued should be treated as securities, requiring registration and risk disclosures.

Genesis agreed to a $21 million settlement earlier this year.

Not entirely, but the SEC already signaled it would not pursue additional enforcement in a separate Gemini probe, easing legal risks.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.