$467M BTC Withdrawn From Exchanges in 24 Hours: What This Means for the Bitcoin Market

0

0

Following today’s data released by IntoTheBlock, sentiment around Bitcoin appears heightening towards bullishness. Just from yesterday alone, over $467 million BTC was withdrawn from virtual currency exchanges, according to the data. This is a strong indicator that traders are feeling enthusiastic about the asset’s future movement. They are embracing a long-term investment approach, transferring their holdings to private wallets.

Long-term buyers accumulating BTC

Amid the ongoing downtrend in the broader virtual currency market, the largest digital asset continues to experience substantial growth, cementing its status as a safe haven.

Adding more proof to this statement, today, the data disclosed an interesting trend in the BTC market. Over $467 million worth of BTC was withdrawn from crypto exchanges yesterday. This market activity suggests a rising preference among traders to hold BTC off exchanges. This shows long-term optimism in the token’s value. It also indicates a rising accumulation of BTC as a store of value and a financial haven to help protect investors’ portfolios in times of market distress.

This substantial outflow coincides with the current times of slowdown across investment markets. Investors are buying in Bitcoin in large quantities in expectation for future price rise. They are preparing themselves accordingly.

Bitcoin price updates

BTC is currently experiencing renewed buying pressure. Investors and whales are accumulating the asset, contributing to a noticeable surge in price. Several on-chain indicators suggest the token’s bullishness.

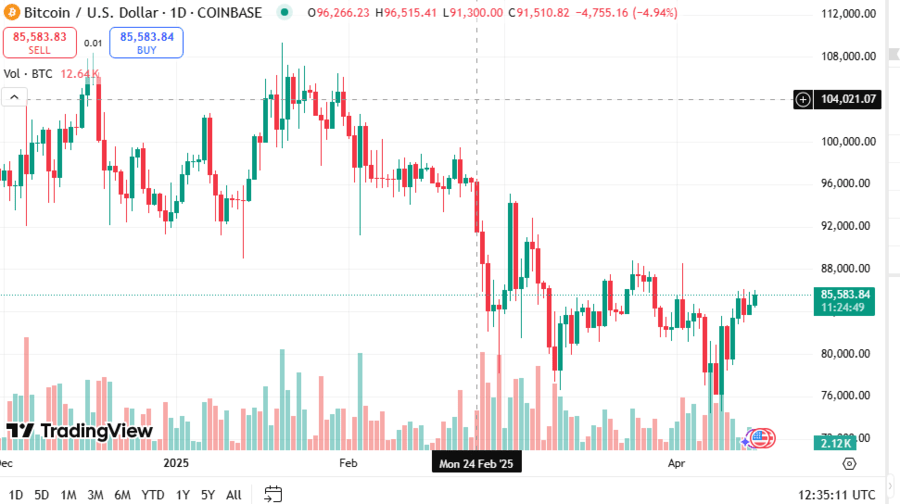

First, the token’s value today stands at $85,623, up a 1.2% from yesterday. Of late, the asset has been making impressive recovery, with its price has been up 8.5%, 1.5%, and 2.1% over the past week, two weeks ago, and a month ago, respectively. These figures shows that buyers are in control, supporting the asset’s bullish outlook.

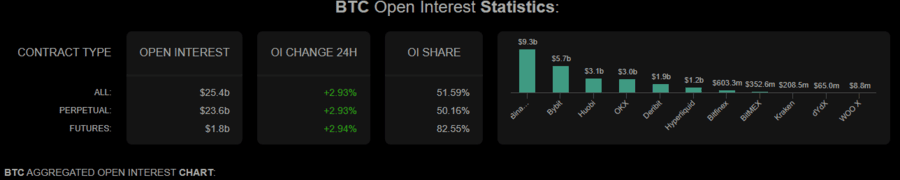

From another perspective, the derivative market indicates a bullish sentiment for the asset. Data shows that increased numbers of derivatives traders are creating long positions on the market, as seen in BTC’s Open Interest. According to today’s metrics from Coinalyze, Bitcoin’s Open Interest has increased by 2.93% from yesterday, suggesting that traders are increasingly placing premiums to maintain their positions. This shows market confidence in the asset, signifying that buyers are enthusiastic about BTC’s future growth potential.

With the current positive market action and robust bullish sentiment from buyers, Bitcoin appears to positioning itself for a possible price rise. It is preparing to break the resistance level of $86,331 and $87,779 in the coming days. However, it if loses strength, it may retrace back to support levels of $83,122 and $81,360.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.