Crypto Fear & Greed Index Surges to 74: Unlocking Market Confidence

0

0

BitcoinWorld

Crypto Fear & Greed Index Surges to 74: Unlocking Market Confidence

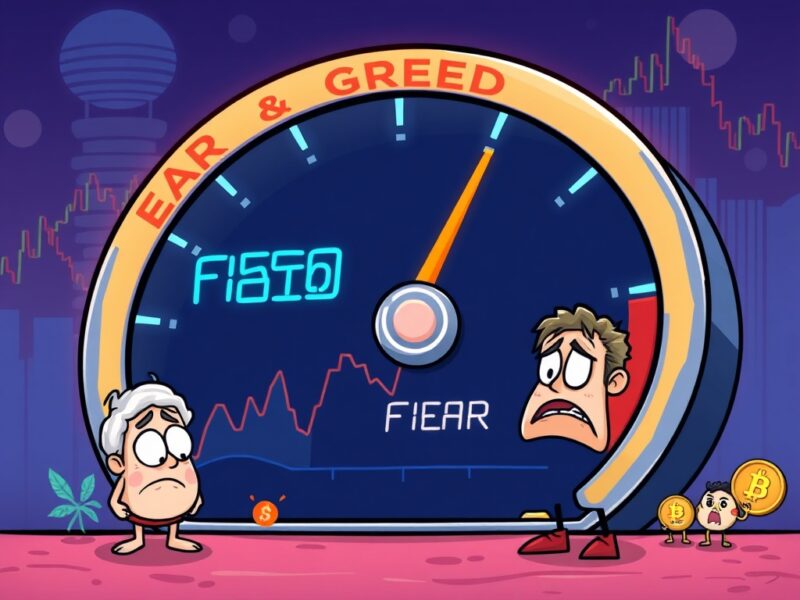

The cryptocurrency world is currently buzzing with optimism, and a key barometer of this feeling, the Crypto Fear & Greed Index, has recently climbed to a notable 74. This significant rise firmly places the market in the “Greed” zone, signaling a strong shift in positive crypto market sentiment among participants. What does this mean for your investment strategy, and how can you interpret this crucial market indicator?

What Does the Crypto Fear & Greed Index Reveal?

The Crypto Fear & Greed Index, provided by the software development platform Alternative, offers a powerful snapshot of investor sentiment in the dynamic cryptocurrency market. It simplifies complex market data into a single, understandable number from 0 to 100.

- 0 (Extreme Fear): Investors are overly worried, potentially leading to panic selling. This can present buying opportunities.

- 100 (Extreme Greed): Indicates the market might be due for a correction, as prices could be overinflated by irrational exuberance.

As of August 8th, the index stood at 74, a substantial 12-point jump from the previous day. This upward movement clearly reflects an improving mood across the crypto space, indicating growing confidence.

Key Factors Driving This Market Indicator

Understanding how the Crypto Fear & Greed Index is calculated enhances its reliability. It aggregates data from several critical sources, providing a holistic view of the cryptocurrency market‘s emotional state. Six primary factors are considered:

- Volatility (25%): Measures Bitcoin’s current volatility and maximum drawdowns. Higher volatility often signals fear.

- Market Momentum/Volume (25%): Analyzes current volume and momentum. High buying volume on positive days suggests greed.

- Social Media (15%): Scans social media for crypto-related hashtags, measuring sentiment and engagement.

- Surveys (15%): Polls investors directly. (Currently paused.)

- Bitcoin Dominance (10%): Tracks Bitcoin’s share of total crypto market capitalization. Rising dominance can indicate fear or strong Bitcoin bull run.

- Google Trends (10%): Analyzes Google search data for crypto terms, looking for spikes in fear-related or greed-related searches.

By combining these diverse data points, the index offers a comprehensive, data-driven perspective on prevailing investor sentiment.

Navigating the “Greed” Zone: Implications for Your Portfolio

The index’s current position at 74 firmly places it in “Greed” territory. While exciting, it demands a balanced perspective. High greed levels can be a double-edged sword:

- Potential for Further Gains: Strong crypto market sentiment often fuels upward price movements as more capital flows in.

- Risk of Correction: Historically, extreme greed can precede market corrections. Widespread optimism might lead to profit-taking.

Savvy investors often use the Crypto Fear & Greed Index as a contrarian indicator. When it’s in “Extreme Fear,” some see it as a buying opportunity. Conversely, “Extreme Greed” might signal caution or time to consider taking profits. It’s one of many valuable market indicators to consider.

Leveraging This Market Indicator Effectively

The Crypto Fear & Greed Index is a powerful tool, but most effective when integrated into a broader investment strategy. It helps you understand the prevailing emotional climate, vital in volatile markets like cryptocurrency.

Actionable Insights:

- Gauge Market Psychology: Use the index to discern if the market is driven by emotion.

- Avoid FOMO: A high index helps resist buying into hyped assets at inflated prices.

- Identify Opportunities: A very low index might signal a good time to research and potentially invest in projects you believe in.

- Complement with Research: Always combine the index’s insights with your own fundamental and technical analysis. Do not rely solely on one market indicator.

The current 74 reading suggests a robust and confident cryptocurrency market. However, continuous monitoring of the index, alongside other research, remains key to making informed decisions.

Conclusion: Understanding Investor Sentiment is Key

The surge of the Crypto Fear & Greed Index to 74 signifies heightened confidence and positive investor sentiment within the cryptocurrency market. While this “Greed” zone indicates strong momentum, it also reminds prudent investors to stay vigilant. By understanding what this powerful market indicator represents and how its components work, you can better navigate the ups and downs of the crypto world. Remember, informed decisions are always your best asset.

Frequently Asked Questions (FAQs)

Q1: What does the Crypto Fear & Greed Index measure?

A1: The Crypto Fear & Greed Index measures the current emotional state of the cryptocurrency market, ranging from 0 (extreme fear) to 100 (extreme greed), by analyzing various market factors.

Q2: Why is the index currently in the “Greed” zone?

A2: The index is at 74, indicating “Greed,” due to increased market momentum, volume, and positive social media sentiment, reflecting strong investor sentiment and confidence.

Q3: How can investors use the Crypto Fear & Greed Index?

A3: Investors can use this market indicator to gauge overall market psychology, avoid FOMO (Fear Of Missing Out) during periods of high greed, or identify potential buying opportunities during extreme fear, always complementing it with further research.

Q4: Are surveys still a factor in the index calculation?

A4: While surveys are a listed factor, the platform Alternative has currently paused the survey component of the Crypto Fear & Greed Index calculation.

If you found this analysis helpful, share it with your network! Stay informed and empower others to understand the fascinating dynamics of the crypto market.

To learn more about the latest crypto market trends, explore our article on key developments shaping investor sentiment and market indicators.

This post Crypto Fear & Greed Index Surges to 74: Unlocking Market Confidence first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.