Ripple vs SEC Lawsuit Update: Judge Likely to Approve, But Big Legal Hurdles Remain

0

0

The high-stakes legal battle Ripple vs SEC, between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) is entering what could be its final act. In a recent joint motion filed by both parties, Ripple and the SEC have proposed a reduced penalty and partial relief from restrictions.

Legal experts and XRP investors are now closely watching Judge Analisa Torres, who is expected to decide whether to approve the motion, a move that could bring long-awaited clarity to XRP’s regulatory future.

Inside the Joint Motion: Reduced Fines and Relaxed Restrictions

According to multiple reports, Ripple and the SEC are seeking approval of a joint motion to reduce Ripple’s penalty from $125 million to $50 million, effectively refunding $75 million in what would be a major win for the crypto company. In addition, the motion requests that institutional sales restrictions be lifted, which, if granted, could open doors for renewed large-scale XRP partnerships and sales.

Legal commentator Bill Morgan, known for his pro-XRP stance, highlighted that while the motion seems promising, courts typically require “exceptional circumstances” to approve such settlements. In a previous motion filed in May, the court rejected a similar proposal within seven days, raising doubts that approval is guaranteed this time around.

“It only took 7 days for Judge Torres to reject the last joint motion,” Morgan tweeted. “There’s a good chance this one meets the same fate—unless it’s better argued.”

Experts Divided: Strong Approval Case or Weak Legal Ground?

The crypto legal community is split on whether the judge will greenlight the motion.

Prominent crypto attorney John Deaton estimates a 70% chance that the judge will approve the motion, pointing out that although the motion lacks strong legal argumentation, the broader regulatory environment may work in Ripple’s favor in Ripple vs SEC case.

“The SEC has been backpedaling on multiple fronts, and this motion fits a growing trend of settlements,” said Deaton. “While not legally bulletproof, it’s politically viable.”

Meanwhile, other legal scholars warn that Judge Torres was previously dissatisfied with the justification and may once again demand a stronger rationale. The court is expected to weigh whether the joint motion aligns with public interest, fairness, and judicial standards.

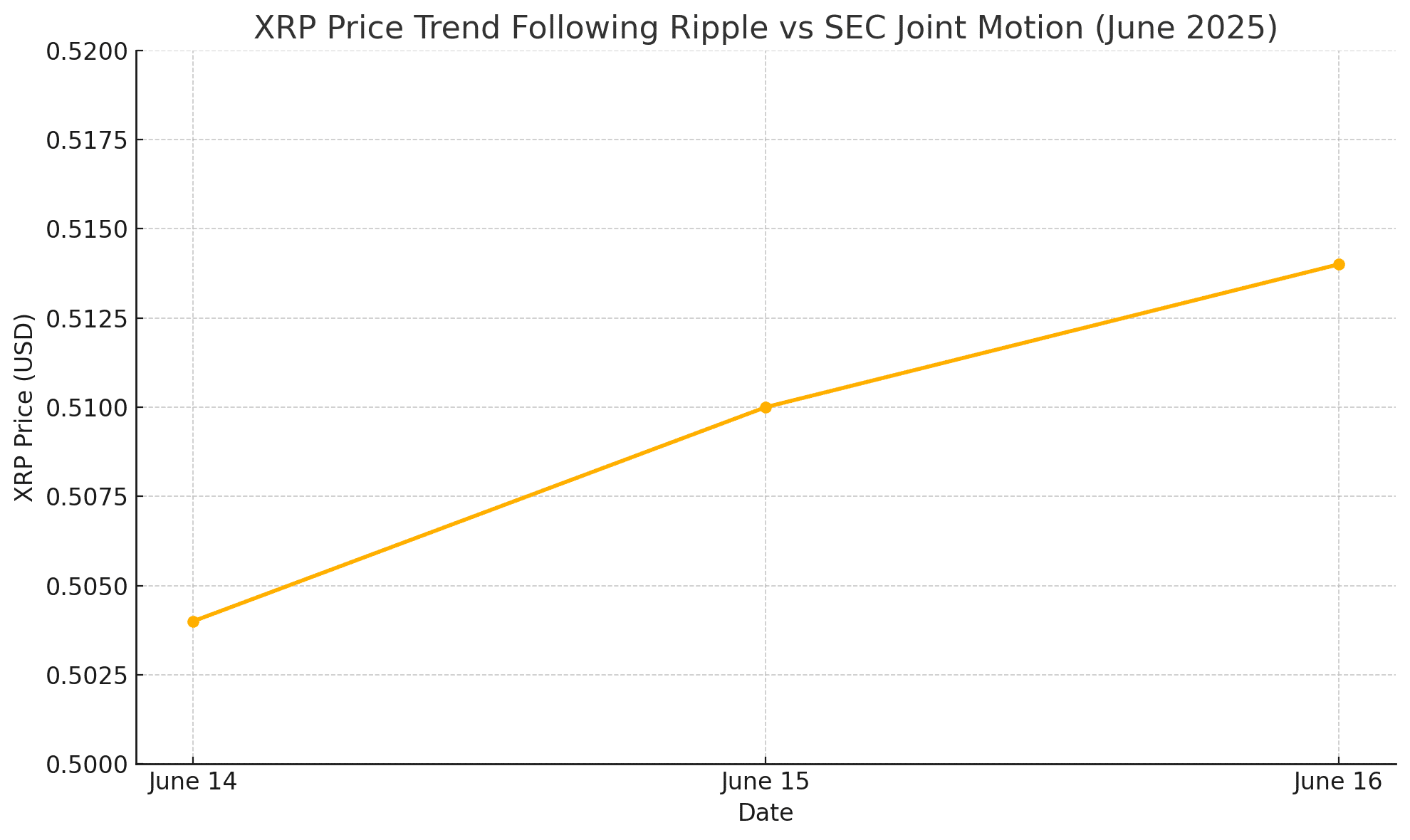

Market Reaction: Ripple XRP Price Climbs Modestly on Optimism

Following the motion, XRP’s price rose by approximately 1.18%, with analysts pointing to renewed investor confidence in a favorable ruling. While the price bump was modest, it reflects cautious optimism from traders hoping the lawsuit’s end is in sight.

| Date | XRP Price (USD) | Price Movement |

|---|---|---|

| June 14, 2025 | $0.504 | +0.92% |

| June 15, 2025 | $0.510 | +1.18% |

| June 16, 2025* | $0.514 (projected) | +0.78% (est.) |

*As per trend estimates; subject to market updates.

However, some analysts caution that any negative ruling could reverse recent gains and introduce renewed volatility. The broader altcoin market remains sensitive to regulatory decisions, especially those tied to landmark cases like Ripple vs SEC.

Why This Motion Matters for the Crypto Industry

The Ripple vs SEC case has become a litmus test for how regulators approach digital assets in the United States. If Judge Torres approves the motion:

-

It sets a precedent for collaborative settlements in crypto enforcement.

-

Institutional investors may return to XRP, boosting liquidity and adoption.

-

Other token issuers may pursue similar negotiation strategies with the SEC.

If rejected, however, it could prolong regulatory uncertainty—not just for Ripple, but for the broader crypto ecosystem struggling with legal clarity.

Timeline: What Happens Next?

-

June 16, 2025: The SEC is scheduled to file a status update.

-

June 17–24, 2025: Judge Torres is expected to respond within 7–10 days based on prior rulings.

-

Post-approval: The settlement would proceed to the appellate stage for final distribution and case closure.

Conclusion On Ripple vs SEC: A Legal Milestone in Sight

The latest joint motion marks a pivotal moment in the long-running Ripple vs SEC lawsuit. With a reduced fine and a potential lifting of XRP restrictions on the table, optimism is brewing across both legal and market circles. Still, history shows that the court’s approval is far from guaranteed.

Judge Torres now holds the key to one of crypto’s most anticipated decisions. If she approves the motion, XRP’s path forward becomes much clearer. But if she doesn’t, the legal saga continues—with broader implications for crypto regulation in the U.S.

FAQs

What is the Ripple vs SEC joint motion about?

It’s a proposal to reduce Ripple’s fine from $125M to $50M and lift XRP’s institutional sales restrictions.

Will the judge approve the motion?

Legal experts say it’s possible, but not guaranteed. A previous similar motion was denied quickly.

How has XRP price reacted to the update?

XRP rose around 1.18% as traders speculated on a favorable outcome to the settlement motion.

Glossary of Key Terms

Joint Motion

A legal request filed by both parties—in this case, Ripple and the SEC—seeking court approval for a settlement or action.

Institutional Sales Restrictions

Limits placed on Ripple’s ability to sell XRP directly to institutional investors due to SEC enforcement.

Judge Analisa Torres

The U.S. District Judge presiding over the Ripple vs SEC lawsuit in the Southern District of New York.

Settlement Agreement

A resolution between two legal parties without continuing trial, often involving a financial penalty and future compliance.

XRP

The native cryptocurrency of the Ripple network, used for cross-border payments and liquidity provisioning.

SEC (Securities and Exchange Commission)

The U.S. regulatory body overseeing securities markets and protecting investors.

Sources and References

Read More: Ripple vs SEC Lawsuit Update: Judge Likely to Approve, But Big Legal Hurdles Remain">Ripple vs SEC Lawsuit Update: Judge Likely to Approve, But Big Legal Hurdles Remain

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.