Bitcoin reclaims $110K as traders eye $112K breakout, ZEC lead altcoins

0

0

Bitcoin extended its gains today, reclaiming the key support level above $110,000 as easing macroeconomic tensions brought renewed momentum to the market.

The total cryptocurrency market capitalisation rose by over 2% at the time of writing, stabilising above $3.85 trillion alongside a sharp uptick in trading activity.

Bitcoin’s trading volume jumped more than 55% in the past 24 hours, signalling a return of investor confidence after last week’s sell-off.

Market sentiment, however, remained cautious.

The Crypto Fear and Greed Index stayed in the “Fear” zone at 29, though analysts expect a rebound once risk appetite improvement after the US market opened.

Bitcoin’s recovery also helped spark modest rallies across the altcoin sector, with several tokens managing to recoup a portion of the losses sustained over the weekend.

Why is Bitcoin price going up?

Bitcoin hit an intraday high of $111,374 today after recovering from weekend lows around $104,778 triggered by ongoing tensions regarding US–China trade and geopolitical friction.

However, sentiment turned around on Sunday after reports confirmed that senior Chinese officials are set to meet their US counterparts this week to iron out differences ahead of the Trump–Xi Jinping summit at the APEC meeting in South Korea.

The confirmation, relayed by both Chinese state media and US Treasury Secretary Scott Bessent, signalled a potential diplomatic thaw.

That, in turn, helped ease market jitters and lifted risk assets across the board, with Bitcoin among the main beneficiaries.

The renewed dialogue comes at a time when the US and China have issued strong warnings against each other, with Beijing threatening retaliatory action if new tariffs are imposed and even hinting at cutting off rare earth exports.

But markets appear to be pricing in a more constructive path, at least in the short term, as hopes build that upcoming talks may defuse the situation.

At the same time, there’s growing optimism around the Federal Reserve’s next policy move.

Several top Fed officials, including Jerome Powell, Michele Bowman, and Christopher Waller, have signalled support for an additional interest rate cut in the upcoming meeting.

If delivered, it would mark the second consecutive cut, further loosening financial conditions.

With the unemployment rate ticking up to 4.2% and the private sector shedding 36,000 jobs in September, the case for monetary easing has strengthened.

Polymarket odds for a rate cut have now surged to 96%.

Expectations are pinned at 3.1% inflation for September, and anything softer could add fuel to the bullish setup for crypto.

Today’s recovery rally has also been supported by opportunistic buying from traders looking to capitalise on oversold conditions, followed by fresh inflows from both institutional and retail participants chasing the bounce.

The backdrop of improving macro conditions and reduced geopolitical overhang has acted as a catalyst for this rotation.

According to data from CoinGlass, total Bitcoin open interest climbed 4.5% over the past 24 hours to $34.5 billion.

Perpetuals saw a 4.62% uptick, while futures rose by 2.54%.

The rise in open interest alongside rising price levels typically points to new long positions being opened, which is a sign that traders are positioning for further upside.

Meanwhile, liquidation data from the past 24 hours paints a clear picture of how the bounce played out in real time.

More than 106,000 traders were liquidated, with total losses amounting to $415.97 million.

Notably, short positions accounted for $260.71 million of that total, far outweighing the $155.26 million in long liquidations.

As such, much of today’s upward pressure likely came from short squeezes, especially as price broke above key technical levels and forced leveraged bears to exit.

Will Bitcoin price go up?

As of press time, Bitcoin’s 24-hour liquidation heatmap showed that the flagship cryptocurrency was trading between two prominent liquidity clusters, with one band of liquidations building around the $110,000 zone and another concentrated near $112,000.

The region just above $110,000 appears to have absorbed a significant portion of recent short liquidations, effectively flipping from resistance into a temporary support.

Meanwhile, the band near $112,000 is showing elevated liquidation leverage density, suggesting it could act as the next hurdle before an upside rally.

This area is where a large number of short positions have likely been stacked, and if breached, could trigger another cascade of forced buybacks that might push the price even higher in a short squeeze scenario.

Conversely, the lower end of the heatmap shows less immediate liquidation pressure below $108,000, indicating that much of the overleveraged long exposure has already been cleared out during the weekend drop.

From a structural standpoint, Bitcoin now finds itself wedged between these two zones, a region often referred to by traders as a “liquidity pocket.”

Price could remain rangebound here in the short term as traders assess macro developments and position ahead of Friday’s CPI print and next week’s Fed decision.

Should Bitcoin convincingly break above $112,000 and absorb the overhead liquidity, the next leg higher may come swiftly.

However, failure to do so could see the price drift back toward $108,000, where bids are likely to re-emerge given the now-cleared liquidation field.

With open interest rising and leverage returning to the system, volatility is likely to stay elevated.

Manay analyst expectations were leaning in favor of an upside rally when writing.

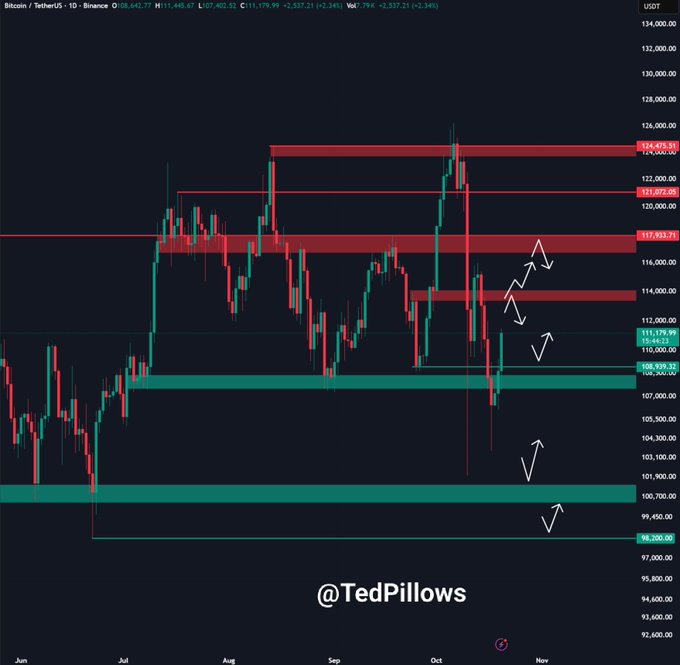

Among them, was well-followed crypto personality Ted Polllows. See below:

Fellow analyst Rekt Capital joined within an equally bullish narrative that supports a bullish trend continuation if BTC price manages to reclaim the 21-week EMA, which currently sits around $112,000 to $112,300, as support.

When writing, Bitcoin price was at $111,125, meaning that level was less than 1% away.

A confirmed weekly close above that zone would likely validate the higher‑low structure highlighted by Rekt Capital and could mark the beginning of a fresh leg upward if momentum holds through the week.

Top altcoin gainers today

In the past 24 hours, the total altcoin market cap initially surged by 5% to hit $1.69 trillion, but later cooled off to around $1.64 trillion at the time of writing.

Ethereum (ETH), the largest altcoin by market share, saw a brief dip from $4,000 to $3,900 earlier in the day.

However, it managed to bounce back, reaching $4,020, up roughly 1.6% for the day.

Other major altcoins, including XRP, Tron (TRX), Dogecoin (DOGE), and Cardano (ADA), also posted minor gains, each rising between 1% and 2%.

Among the top 99 altcoins by market cap, Zcash (ZEC) stood out as the leading gainer, being the only one to post double-digit gains, jumping 15.2% in the past day.

Chainlink (LINK) followed closely with a 9.5% uptick, while MemeCore (M) notched a respectable 7.5% gain.

Source: CoinMarketCap

Zcash: ZEC’s rebound comes on the heels of the broader market recovery and dip-buying activity seen since Oct. 17, when the token briefly lost its footing below the $200 support level.

The token’s upswing has also been fueled by renewed speculation in the past few weeks, as growing concerns around blockchain surveillance and increased government oversight have reignited interest in privacy-focused cryptocurrencies.

Chainlink: LINK rallied on news that some of the project’s top execs are set to meet with the pro-crypto senate Democrats on Wednesday.

Gains were also partly fueled by a surge in LINK withdrawals from centralized exchanges by large holders, or whales.

Such outflows typically reduce the number of tokens available on the open market and help build demand.

MemeCore: MemeCore’s gains were supported by a surge in speculative trading, and rally got a slight boost after the project announced the MEMEKATHON, hackathon event that will focus on building projects on the Layer 1 blockchain.

The hackathon’s core purpose is to expand the MemeCore ecosystem by encouraging developers to build and integrate projects with the platform.

It is part of MemeCore’s larger initiative, the LIFT EcoFund, which is a $10 million program to foster innovation within meme coin communities.

The post Bitcoin reclaims $110K as traders eye $112K breakout, ZEC lead altcoins appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.