Loopring Price Rallies 14% Amid Trading Volume Surge – Bulls Eye Breakout to $0.15

1

0

Highlights:

- Loopring price flaunts a 14% increase in the past 24 hours to $0.105.

- Its daily trading volume has soared over 2200%, indicating heightened market activity.

- Analyst highlights a potential rally to $0.91 in the medium term, if Loopring price rebounds from the lower boundary of the falling wedge.

The Loopring price is flashing a bullish picture, despite the wobbly cryptocurrency market. The LRC token has skyrocketed 14% in the past 24 hours, as its daily trading volume soars over 2200%. This is a clear indication of heightened market activity in the LRC market.

Meanwhile, a wide scope of the crypto market shows a downtrend as cryptocurrencies drop. Leading the slippage is Bitcoin, which has fallen to the $94K mark. However, with the Fed rate cut expected tomorrow, will crypto prices rebound? Various analysts are optimistic about a potential price surge in LRC if the Bitcoin price bounces back. According to Whale Crypto trading, if LRC rebounds from the falling wedge, it could rally to $0.91 in the medium term.

#lrc/usdt

Loopring is attempting to rebound from the lower border of the falling wedge pattern on the weekly timeframe

If the bounce confirms, we could see $LRC rally towards $0.91 in the medium term

Crypto Traders-join Telegram

https://t.co/4ApYM0WgpD

. pic.twitter.com/SivruuPxCX— Whales_Crypto_Trading

(@WHALES_CRYPTOzz) May 6, 2025

Loopring Price Outlook

The LRC token is showing strength, as it has flipped the 50-day MA at $0.09 into support, igniting some bullish momentum. If the support level in the market holds, the Loopring price could rally toward the $0.13 resistance. Increased buying pressure will ignite further upside, for the bulls to conquer the $0.15 resistance, which aligns with the 200-day MA.

Notably, the Loopring price has pushed into a consolidation channel. This may act as an accumulation period before the bulls ignite a strong upward move. A close above the $0.15 barrier, which aligns with the 200-day MA, will call for further upside in the LRC market.

The LRC Relative Strength Index (RSI) sits at 54.54, indicating that the bulls have the upper hand. Increased buying appetite will cause the RSI to soar towards the 60 level, validating the bullish thesis in the market. Moreover, more room is still available for the upside, before the Loopring price is considered overbought.

The LRC Moving Average Convergence Divergence (MACD) also calls for traders and investors to buy more LTC tokens. This is manifested as the blue MACD has flipped above the orange line, towards the positive region. More upside is imminent in the LRC market unless the MACD changes.

Conversely, if the $0.15 resistance proves too strong for the bulls, the Loopring price could seek support at lower levels. In such a scenario, the $0.09 will be the first safety net against further downside. If the bears breach the 50-day MA, the bullish sentiment would be invalidated, triggering panic selling in the market.

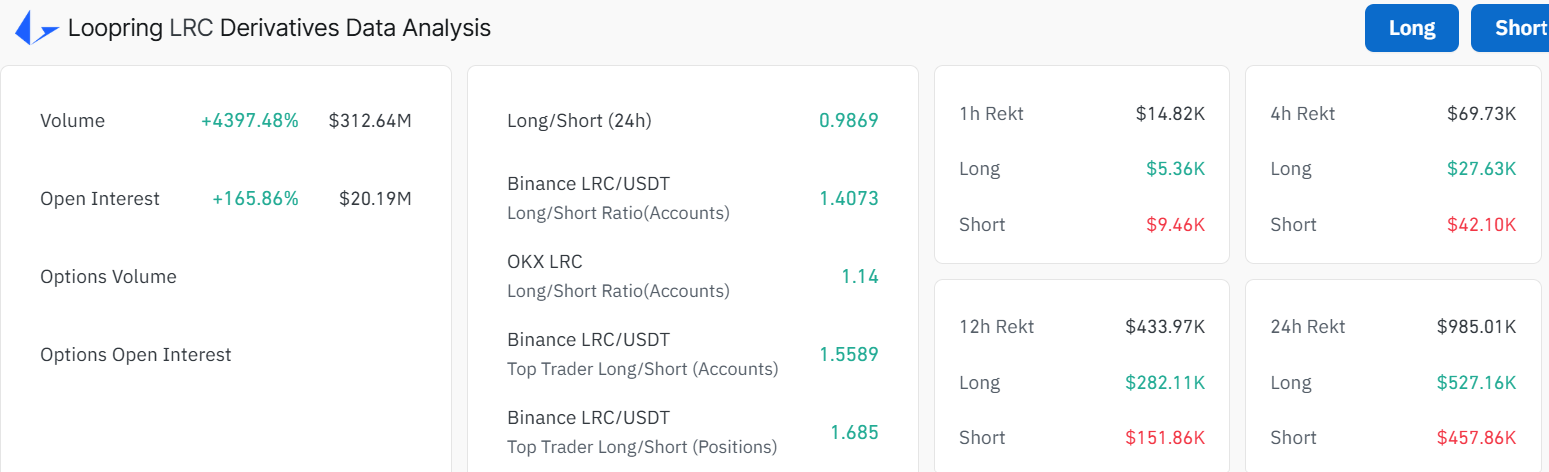

LRC Derivatives Analysis

On the other hand, Coinglass data shows a positive outlook in the Loopring market. The volume has spiked over 4300% to $312.64M, while the open interest flaunts a 165% surge to $20.19M. This indicates heightened market activity, as new money flows into the market. In layman’s language, this may cause a spike in LRC price, reclaiming the $0.15 mark soon.

Moreover, the upward movement potential is building, as the LRC traders have gone long. The long liquidations in the past 24 hours have garnered about $527K, surpassing the shorts. Most traders are betting on a Loopring price increase in the short term. However, monitoring the technical indicators and the wider market sentiment is necessary to determine the next movement in the LRC market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.