Five Spot altcoin ETFs Lunch Mark A New Phase For Crypto

0

0

This article was first published on The Bit Journal.

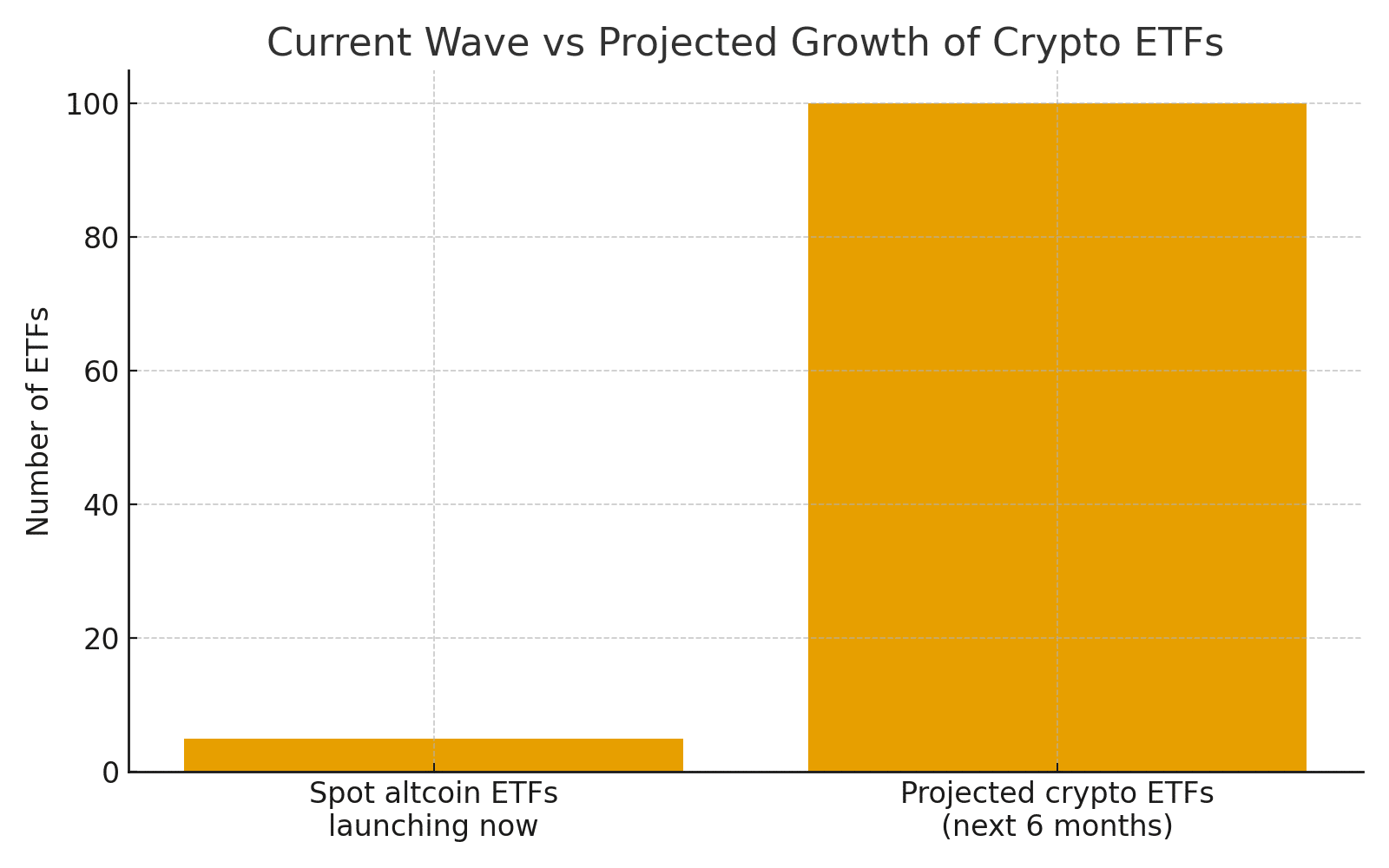

A new wave of regulated crypto funds is lining up at a delicate moment for digital assets. An exchange-traded fund analyst reports that five spot products tied to Dogecoin, XRP, and Chainlink are scheduled to launch within six days on a United States stock exchange. The move follows weeks of heavy outflows from Bitcoin funds and softer trading in Ethereum products, and it suggests that attention is starting to shift toward altcoin ETFs as investors look for fresh opportunities in many regions.

Five Spot Funds In One Week

The structure of the new vehicles is simple. Each fund holds a single coin in custody and issues shares that trade like ordinary stocks. Market watchers expect a Dogecoin fund, more than one XRP product, and at least one Chainlink vehicle in the opening group. The same analyst believes that over the next six months more than one hundred additional crypto funds could arrive if conditions stay calm, many of them created as altcoin ETFs that copy this first batch.

These launches arrive at a time when many traders are reassessing exposure. Spot Bitcoin and Ethereum funds in the United States have seen significant net outflows, which hints at profit taking and fatigue after a long rally. Against that backdrop, altcoin ETFs offer a new angle: targeted access to meme coins, payment tokens, and infrastructure assets without the operational burden of holding the coins directly.

Why altcoin ETFs Matter Now

For large institutions, owning tokens directly still creates operational, legal, and security challenges. Altcoin ETFs reduce that friction. The funds place the underlying coins with regulated custodians while shares move through existing clearing and settlement systems. Portfolio managers can treat positions in Dogecoin, XRP, or Chainlink like any other sector exposure, using familiar order types, risk limits, and compliance checks.

The wrapper also fits neatly into existing mandates. Many investment policies are written around listed securities rather than spot crypto. Altcoin ETFs allow compliance teams to map new positions onto rules that already exist, instead of rewriting those rules around wallets, private keys, and offshore venues. That makes it easier for cautious institutions to experiment with non-Bitcoin assets in controlled size.

Key Signals For The Crypto Market

Several indicators will show whether this moment marks a real shift or a short detour. The first is trading volume and bid ask spreads once the funds open for trading. If altcoin ETFs attract steady turnover with tight spreads, that will point to strong market maker support and real demand. Thin activity and wide spreads would hint that most interest still remains in unregulated spot markets.

Fund flows will be just as important. Analysts are watching to see whether money rotates out of Bitcoin and Ethereum products into altcoin ETFs or whether truly new capital enters the space. Lasting inflows into Dogecoin, XRP, and Chainlink funds would suggest that investors see regulated single asset exposure as a fresh reason to engage with crypto after months of volatility and weak sentiment.

Regulators and market structure watchers will also study who actually buys these funds. A strong mix of institutional accounts and long-only investors would signal confidence in altcoin ETFs as part of a diversified portfolio. A market dominated by very short term flows would point to a more speculative cycle driven by fast money rather than a genuine broadening of adoption.

Conclusion

The arrival of five spot funds in six days is more than a scheduling quirk. It marks a turning point in how investors can reach beyond Bitcoin and Ethereum. Altcoin ETFs now stand at the center of that change, linking speculative digital cultures to capital that prefers rules, filings, and tickers. Whether this wave brings lasting depth or a short burst of excitement, it will deliver a clear signal on investor appetite for altcoins inside a regulated framework.

Frequently Asked Questions

What is a spot altcoin ETF?

A spot altcoin ETF is an exchange traded fund that holds a single cryptocurrency directly rather than using futures, and its shares trade on a stock exchange.

How do these funds change crypto access?

These funds let investors gain exposure to coins such as Dogecoin, XRP, or Chainlink through regular brokerage accounts without handling wallets or private keys.

What risks should investors consider?

Investors must weigh volatility, liquidity, regulation, tracking error, and the chance that large fund flows may amplify sharp moves in the underlying coin.

Glossary Of Key Terms

Exchange traded fund

An investment vehicle that trades on an exchange like a stock and holds a basket of assets or a single asset.

Spot market

A market where assets are bought and sold for near immediate delivery at the current observable price.

Custodian

A regulated firm that holds assets for investors or funds and is responsible for safekeeping and settlement.

Liquidity

The ability to buy or sell an asset quickly in meaningful size without causing a large change in its market price.

References

Read More: Five Spot altcoin ETFs Lunch Mark A New Phase For Crypto">Five Spot altcoin ETFs Lunch Mark A New Phase For Crypto

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.