Sunday Review 30/03/2025

0

0

Happy Sunday, Observers!

This week, the crude reality of how challenging it is to build on-chain came to the fore as Hyperliquid faced its major crisis so far.

The decentralized exchange which had been gaining market share at a much faster pace than its centralized counterparts witnessed a major whale manipulation attempt in which a trader exploited the protocol to make a million dollar profit with the $JELLY token.

To avoid losses, the protocol responded by immediately liquidating the token at a much lower price and then force-delisting it—a strategy that saved it from losing $12 million but nonetheless tanked its popularity and cast a shadow of doubt over its decentralized status.

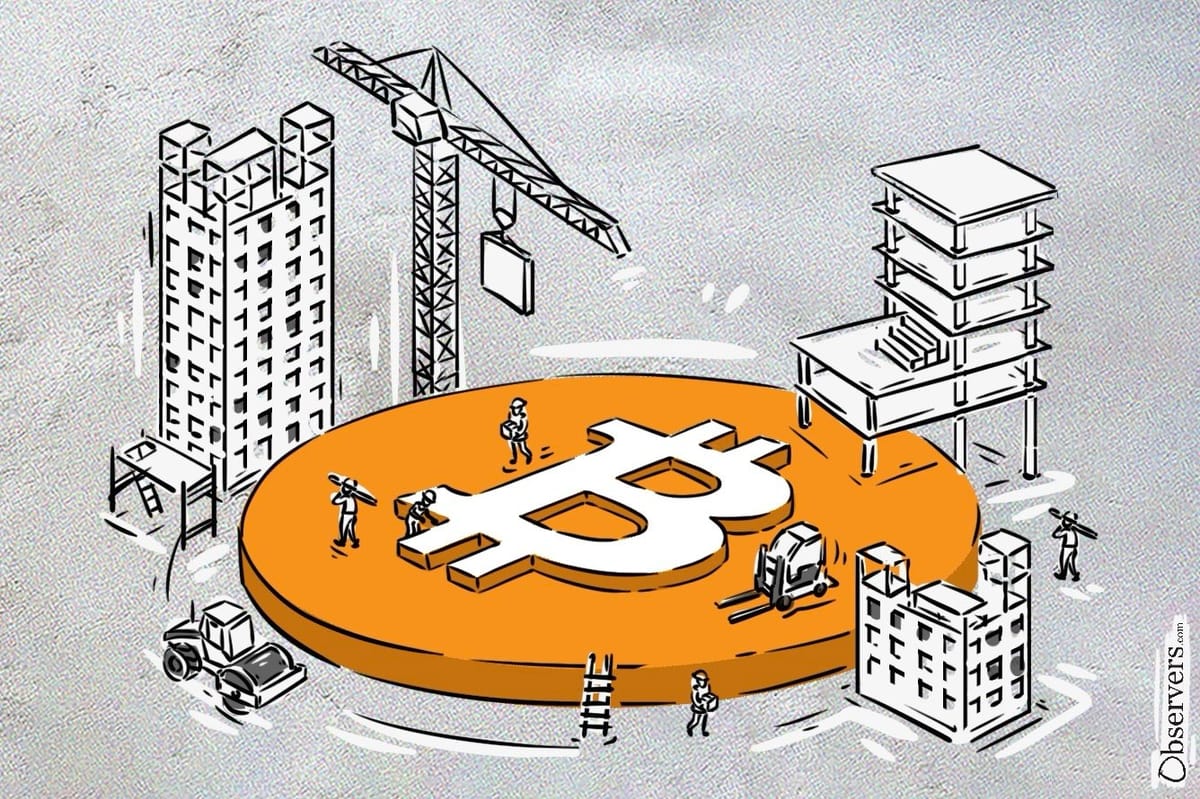

Despite setbacks and regular crisis events, DeFi’s momentum continues strong, especially on Bitcoin, where TVL has grown from $300 million to $8 billion within a year.

While still less than 1% of Bitcoin is being used for DeFi, Bitcoin L2s, staking protocols, and wrapped versions of the token are increasingly changing how people use the network.

🔥 Highlights Of The Week

- Animoca Brands partners with Sony’s Soneium blockchain to launch identity layer Anime ID;

- World Liberty Financial and Fidelity announce stablecoins;

- BpiFrance has launched a $27 million fund to support French crypto tokens.

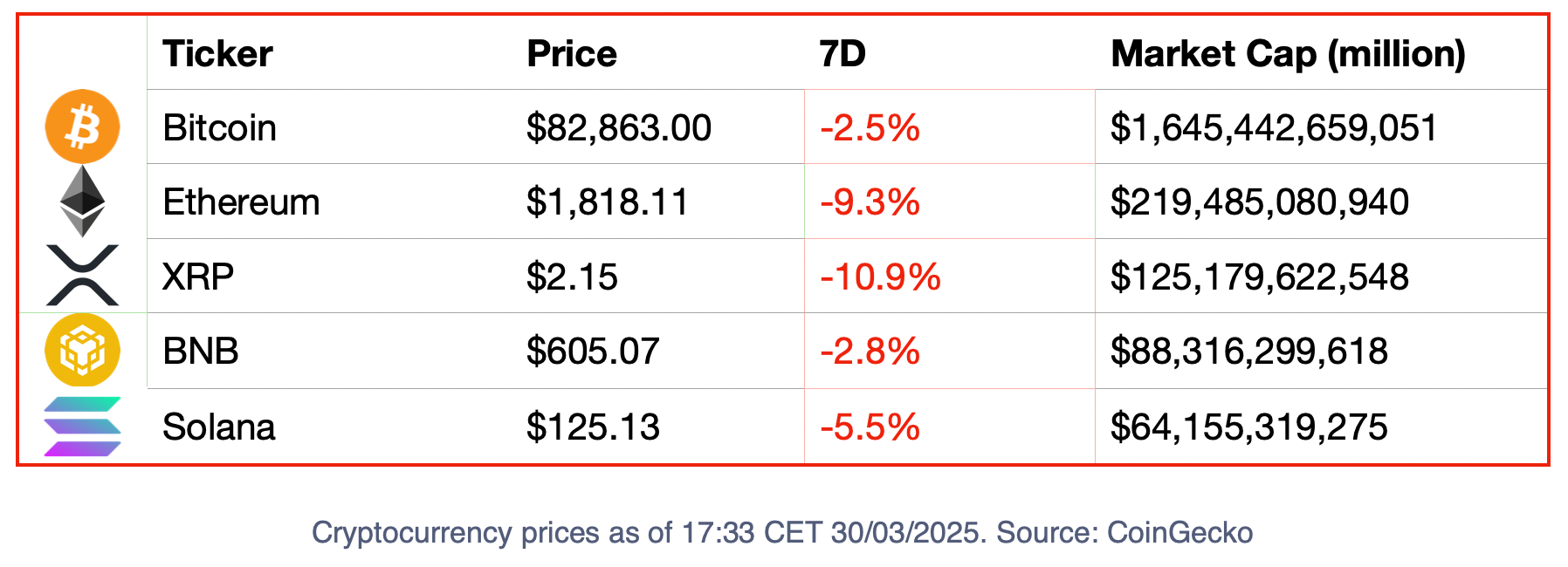

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- Sam Altman’s identity network World (previously known as Worldcoin) is in talks with Visa to create a stablecoin-powered digital wallet aimed at mainstream crypto payments. While the project has fallen behind its ambitious adoption goals, this partnership might spur a positive change in the course of events.

Project Of The Week: Euler

Over the last year, the lending platform Euler saw a fivefold increase in its total value locked, from $100 to $500 million, and a threefold increase in active loan portfolio, now at around $290 million.

Since the V2 upgrade six months ago, a growing number of builders have been using the Euler Vault Kit (EVK) and the Ethereum Vault Connector (EVC), which has contributed to an increase in activity and revenue from protocol fees.

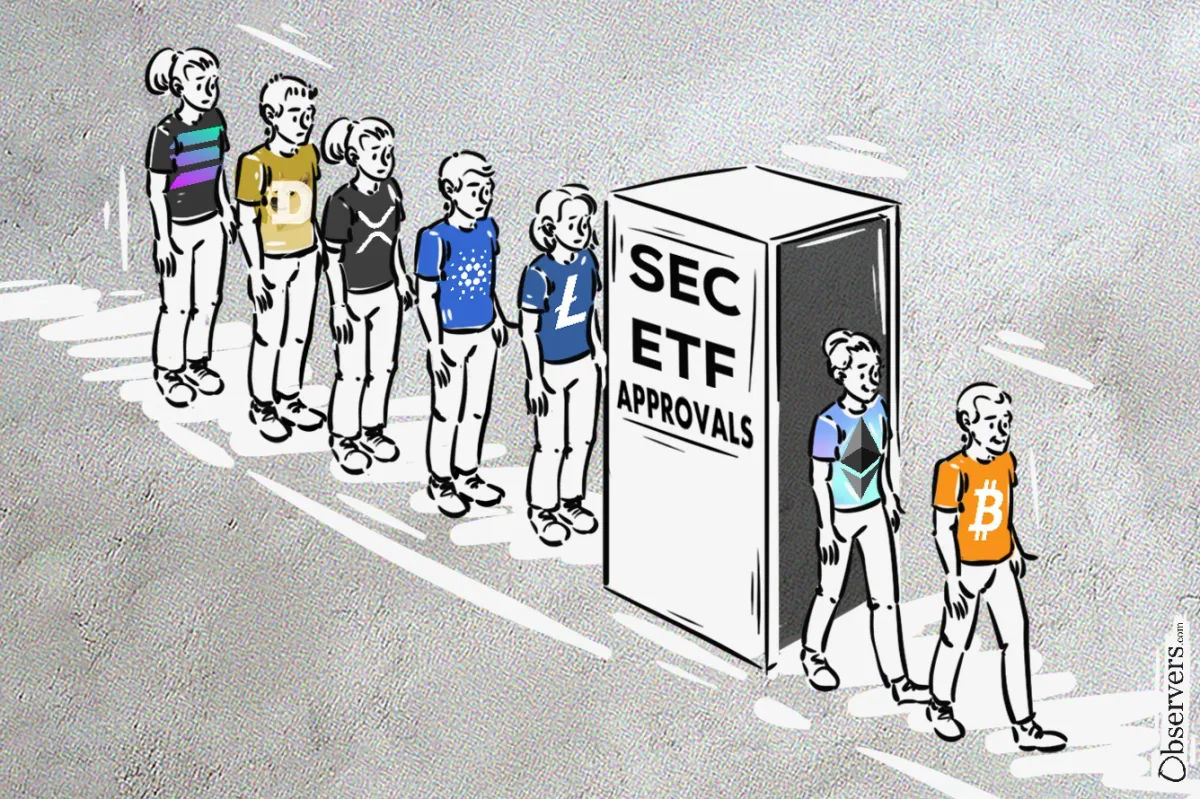

ETFs For Everybody

Since Trump was sworn into office, the legislative risk perception of institutions regarding cryptocurrencies in the United States has changed considerably.

One way in which this has become evident is by the filing of ETFs (Exchange Traded Funds).

Multiple applications have been filed for large altcoins, including Ripple (XRP), Solana (SOL), Cardano (ADA), Litecoin (LTC), Dogecoin (DOGE), Polkadot (DOT), Hedera (HBAR), SUI (SUI), and others – most expected to be approved in the last quarter of 2025.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.