Solana Price Analysis – SOL Likely to Rally to $200 as Fundamentals Strengthen

0

0

Highlights:

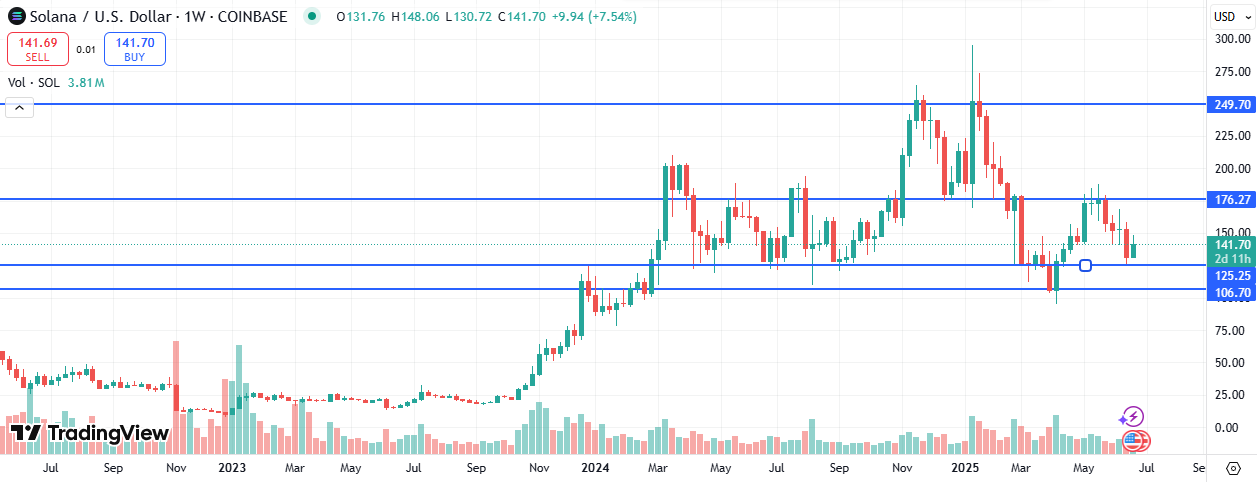

- Solana is range-bound between the $176.27 resistance and $125.25 support

- A bullish breakout through $176.27 could trigger a rally to $200

- Institutional adoption of Solana is likely to trigger a bullish breakout

Solana (SOL) shows price action similar to Bitcoin and other top altcoins intraday. When going to press, there was only a marginal change in its price, declining by 0.46% to stand at $142.73. However, even as the price has dropped slightly intraday, Solana trading volumes, unlike those of Ethereum and Bitcoin, have declined slightly.

This could indicate that short-term traders may liquidate their holdings before the weekend. Such could be driven by the fact that price weakness on Friday usually hints at a possible correction over the weekend. That said, Solana’s trajectory is likely upside going into the future.

Institutions Are Adding SOL to Their Balance Sheets

One of the indicators that the future is bright for Solana is that institutions are adding it to their balance sheets. Most institutional investments in cryptocurrencies have mostly gone into Bitcoin and Ethereum. However, this is changing, and companies are becoming more confident in adding other altcoins to their balance sheets. Solana is one altcoin that is particularly gaining favor amongst corporate buyers. The latest corporate buyers moving into Solana is Aurora Mobile, a Fortune 500 company.

Aurora Mobile has announced that it is allocating 20% of its reserves to cryptocurrencies, and Solana is one of the cryptocurrencies they are buying. Several other companies have made the same move, which has two significant implications for Solana. The first is that institutions’ tremendous amount of money invested in SOL could trigger a parabolic move up. Then there is the likelihood of retail FOMO as the average investor gains confidence to invest now that major institutions are choosing Solana. These factors could trigger a SOL rally to new all-time highs in the short term.

UPDATE

Nasdaq-listed Aurora Mobile to allocate up to 20% of cash reserves into digital assets, including $BTC, $ETH, $SOL, and more.

pic.twitter.com/BVhEysjT5W

— Moby Media (@mobymedia) June 25, 2025

Solana Gaining Adoption In Asset Tokenization

Besides institutions adding Solana to their balance sheets, Solana is also getting adopted in the fast-growing RWA market. Ethereum currently dominates the RWA with a 59% share of the market. However, Solana is coming into organizations choosing to tokenize, opting for it thanks to its scalability and low transaction costs. One of the companies that is choosing Solana for tokenization is Upexi, a Nasdaq-listed organization.

UPEXI TO TOKENIZE SEC-REGISTERED SHARES ON SOLANA VIA SUPERSTATE’S OPENING BELL

Upexi (NASDAQ: UPXI) is set to tokenize its SEC-registered shares on the Solana blockchain using Superstate's "Opening Bell" platform.

This move aims to modernize equity trading by leveraging… pic.twitter.com/omqWaVUzPB

— Crypto Town Hall (@Crypto_TownHall) June 26, 2025

The company has announced tokenizing all its listed shares on the Solana network. As more organizations make the same move, especially now that asset tokenization is gaining traction, Solana could experience a surge in demand. This factor could see SOL rally through its all-time highs in the foreseeable future.

Anticipation Growing for Solana ETFs In 2025

Solana is also likely to continue drawing speculative investors who are anticipating a Solana ETF within the year. While the SEC recently postponed the approval of Solana and several other ETFs, confidence is rising that this will change. The current SEC is increasingly pro-crypto, and it is only a matter of time before approval. The money flow into Solana in anticipation of the ETF could support Solana in the short to medium term. This will especially be the case if Bitcoin, the overall market determinant, keeps pushing higher, and uplifting the broader market.

July 2025 is huge for #Solana! $SOL eyes ETF-driven breakout!

#Blockchain #DeFi

• Solana ETFs Nearing Approval! 90% odds for spot ETFs by July, led by Fidelity & Grayscale. Staking boosts yields!

#CryptoInvesting

• $SOL Targets $200+! 65K TPS &… pic.twitter.com/UAZlv3kDsu

— Crosswalk Ecosystem (@crosswalkeco) June 26, 2025

Technical Analysis – SOL In A Multi-Week Consolidation

From the charts, Solana is still stuck in a multi-week consolidation between the $176.27 resistance and $125.25 support. If bulls take control and push Solana through the $176.27 resistance, a rally to $200 could follow in the short term.

However, if bears take control and breach the $125.25 support, the key level to watch would be the second support level at $106.70. A breach of $106.70 support could see Solana drop below $100. Of these two scenarios, the odds are higher for a rally through $176.27 resistance. The rising adoption of SOL and an improving macro environment make a bullish breakout more probable.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.