Bitcoin vs. Gold in 2025: Sentiment, Safety, and Trust Amid Iran-Israel Crisis

0

0

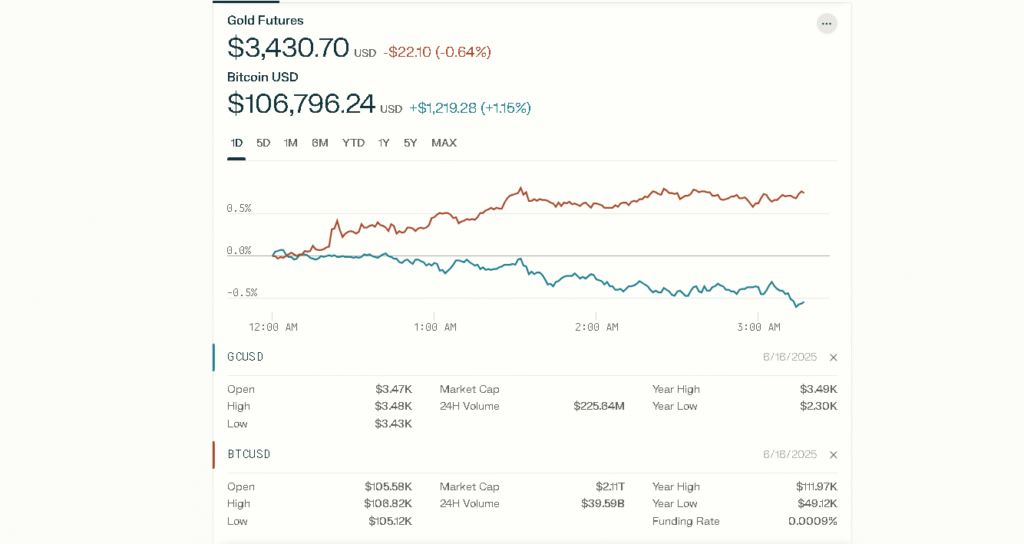

According to Cointelegraph, the Bitcoin price has shown slight gains, while the Gold surge remains strong as more investors see gold as a safer option during the rising tension in the Middle East.

This started a debate among financial experts about what role Bitcoin really plays during global crises. The Bitcoin vs Gold debate is not new, but the recent price action has shown that investors still trust gold more than Bitcoin in uncertain times.

Gold Shines as Safe Haven in Crisis

As fear of broader conflict grew after an Israeli missile strike on Iran, markets reacted quickly. Investors moved to gold, which caused a strong gold surge.

It is currently trading near $3,413 per ounce, just below its historical peak. Experts say this rise happened because of worries about inflation, global tension, and gold’s reputation as a trusted safe-haven asset.

CBS News said the gold price might easily reach a new record if central banks or top officials suggest that inflation might get worse.

Experienced traders agree with this, and one senior expert said Gold is still the top choice when things get rough. People trust it more than they follow the market trends.

Bitcoin Reacts More Like a Risk Asset

On the other hand, the Bitcoin price is still roughly 5% below its all-time high of $111,800 and is now trading around $106,677. Although it has recovered from last week’s drop, experts say that Bitcoin’s performance is more like the stock markets than that of gold.

Tony Sycamore, an analyst at IG Markets, said the Bitcoin vs Gold comparison is not even close right now. Bitcoin is closely following the stock market. In fact, it is acting more like Nasdaq than like gold.

Even after the recent global tensions, Bitcoin quickly bounced back along with the U S. Stock futures. This shows that big investors still don’t fully see it as digital gold.

| Metrics | Value |

| Gold Price | $3,434 |

| Market Cap | $23.128 T |

| Bitcoin Price | $107,215.67 |

| 24 Hour Trading Volume | $41.05B |

| Market Cap | $2.12T |

| All Time High | $111,970.17 |

Market Voices Signal Caution on Bitcoin

Henrik Andersson, chief investment officer at Apollo Crypto, told Cointelegraph that Bitcoin is rising again after its Friday drop, but it is not because people see it as a safe asset. Instead, it is going up like a tech stock.

Nick Ruck of LVRG Research shared a more critical view, saying that the Bitcoin vs Gold debate is losing its strength. He pointed out that during global uncertainty, traders are not rushing to Bitcoin for safety, they are just using it mainly for a quick trade based on price swings and how easily it can be sold or bought.

Many institutional experts agree with this view, pointing out that Bitcoin will become even more closely tied to stock markets in 2025. This makes it harder to believe that Bitcoin’s price should move like gold when there is global trouble.

What Could Change the Narrative?

Analysts believe that the Federal Reserve’s upcoming policy move could boost Bitcoin, particularly if investors start to feel more confident.

Eugene Cheung, chief commercial officer at OSL, said that if the market Sentiment gets better and people start to move their money out of gold, then Bitcoin might get new support.

Still, because most experts believe that interest rates will not change soon, any rise in the Bitcoin price will probably come from investors who are willing to take more risks, and not because they see Bitcoin as a safe place to store their money.

Conclusion

Even though people have compared Bitcoin vs Gold for years, Gold is winning for now. The strong gold surge to $3,450 shows that investors still trust it more during the global troubles.

The Bitcoin price has bounced back, but it is moving more like stocks than a safe asset. Bitcoin staying above $105,000 is a good sign but it is not yet acting like gold. For now, gold remains the top choice when the market is uncertain.

FAQs

1. Why did the gold price rise recently?

Gold rose due to rising tensions in the Middle East and inflation concerns.

2. How did Bitcoin react to the Iran-Israel conflict?

Bitcoin’s price dropped, reacting more like stocks than gold.

3. What is the current gold price?

Gold is trading near $3,413 per ounce.

4. What is Bitcoin’s current price level?

Bitcoin is around $106,677, below its all-time high.

5. Why is gold trusted more in global conflicts?

Because of its long-standing reputation and stability.

Glossary

Inflation Fear – Worry that prices may rise sharply, reducing money’s value.

Safe-Haven Asset – A trusted investment like gold that holds value during global turmoil.

Geo-Political Shock – A global event, like war or conflict, that triggers sudden market moves.

Digital Gold – A term used for Bitcoin when compared to gold as a value store—though still debated.

Correlation Trade – When an asset like Bitcoin moves in sync with another market, like tech stocks.

Sources

Read More: Bitcoin vs. Gold in 2025: Sentiment, Safety, and Trust Amid Iran-Israel Crisis">Bitcoin vs. Gold in 2025: Sentiment, Safety, and Trust Amid Iran-Israel Crisis

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.