Bitwise SOL ETF Tops Inflows With $417 Million, Strengthening Solana Price Prediction

0

0

This article was first published on The Bit Journal. Wall Street’s appetite for Solana (SOL) is growing fast. In a major show of confidence, investors have poured $417 million into the newly launched Bitwise SOL Staking ETF (BSOL), marking one of the strongest ETF debuts in the digital asset space this year. Analysts suggest that this surge in institutional exposure could significantly strengthen the Solana price prediction for the coming months.

Wall Street Demand Boosts Solana Price Prediction Trends

Bloomberg ETF analyst Eric Balchunas reported that BSOL became the largest exchange-traded product (ETP) inflow of the week, even outpacing Bitcoin and Ethereum spot ETFs. The good performance at the beginning highlights an increasing institutional belief that Solana is becoming a formidable competitor in the blockchain market and that optimistic Solana price prediction are not too distant.

The U.S. investors at BSOL will have regulated access to Solana staking rewards, which was previously accessible only to on-chain users. This innovation has successfully demolished the institutional capital floodgates, providing funds and wealth managers with a permissive means to get SOL staking yields without holding or operating tokens directly. The relocation is largely seen as a good catalyst to Solana price prediction patterns on a long-run basis.

What a week for $BSOL, besides the big volume, it led all crypto ETPs by a country mile in weekly flows with +$417m ($IBIT had a rare off week, it'll be back). It also ranked it 16th in overall flows for the week. Big time debut. pic.twitter.com/HpKUTdq1J5

— Eric Balchunas (@EricBalchunas) November 1, 2025

Spot Solana ETF Approval Anticipated Soon

According to market analysts, this may become a turning point in institutional adoption of Solana. Grayscale Investments estimates that Solana ETPs may hold as much as 5 percent of all SOL in two years worth over 5 billion dollars at present-day value. These inflows have the potential to give a solid tailwind to any positive Solana price prediction.

The inflows of ETFs have increased as the market is looking forward to the regulatory authorisation of a spot Solana ETF, which may happen as early as this month. According to analysts, this sidelined demand may result in a breakout of the seven months rising channel of Solana, with prices entering new grounds, a critical event in short/ medium term Solana price prediction framework.

Technical Indicators Show Mixed Market Signals

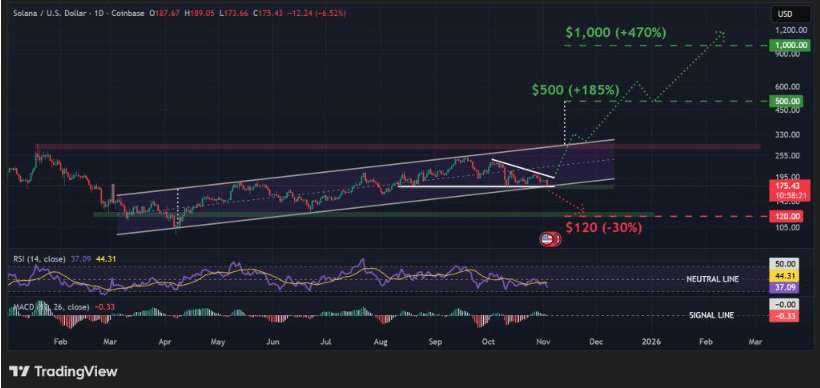

Currently, SOL is being tested at a major support area of approximately 175 where the technical indicators are both a warning and an opportunity. The MACD has fallen below its signal line, which is an early bearish indicator, but the RSI is close to a historical low of 33, which means that the pressure to the downside can soon end. These are consistent with analysts, who believe that the Solana price prediction would be optimistic though cautiously so in case of support.

A convincing price under $175 would lead to a further correction down to $120 which would be a possible 30% deterioration. But when bulls manage to defend this point analysts reckon that Solana might make another breakout run at $300, the ultimate resistance level that divides consolidation and a new uptrend.

BSOL Success Reinforces Solana Market Confidence

A successful recovery of above $300 and holding would open the way to a rebound of up to $500, a 185 percent increase. More aggressive Solana price predictions with increasing the ETF coverage and corporate usage indicate that the price may be long-term around 1,000, which indicates a 470 percent gain over current levels.

Institutional momentum is evidently moving towards Solana because of the asset managers and hedge funds. The success of BSOL does not only signify a novel investment product, but a wider confirmation of the Solana role in the next era of the blockchain expansion.

Institutional investors love ETFs, and they love revenue. Solana has the most revenue of any blockchain. Therefore, institutional investors love Solana ETFs.

I have a feeling the Bitwise Solana Staking ETF, $BSOL, is gonna be huge.

This material must be accompanied by a…

— Matt Hougan (@Matt_Hougan) October 28, 2025

Having Wall Street in the mix, Solana price prediction models within the industry are becoming more bullish indicating that the next big upward movement of Solana may only be beginning to show itself.

Conclusion

Solana’s growing institutional traction, highlighted by Wall Street’s $417 million bet on the Bitwise SOL Staking ETF, underscores a pivotal shift in market sentiment. As analysts eye imminent spot ETF approvals, sustained inflows and expanding adoption could propel Solana into its next major bullish phase.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- Wall Street invested $417 million in the new Bitwise SOL Staking ETF, showing strong institutional confidence.

- BSOL outperformed Bitcoin and Ethereum ETFs, giving U.S. investors regulated access to Solana yields.

- Grayscale expects Solana ETPs to capture 5% of all SOL tokens within two years.

- Analysts see spot Solana ETF approvals as a trigger for a breakout toward $1,000.

Glossary of Key Terms

Solana (SOL): A fast, low-cost blockchain for decentralized apps and crypto projects.

Bitwise SOL Staking ETF (BSOL): A fund giving investors regulated access to Solana staking rewards.

Exchange-Traded Product (ETP): A market-traded investment tracking assets like cryptocurrencies.

Exchange-Traded Fund (ETF): A tradable fund offering exposure to assets without direct ownership.

Spot Solana ETF: A proposed ETF holding actual Solana tokens for direct exposure.

Institutional Investors: Large entities like hedge funds or banks investing big capital.

Staking Yields: Rewards earned for locking SOL to support the blockchain.

Grayscale Investments: A major digital asset manager offering crypto-based funds.

Wall Street: Represents major U.S. financial markets and institutions.

Frequently Asked Questions about Solana price prediction

1. Why is Solana’s price prediction rising?

Because Wall Street invested $417 million in the Bitwise SOL Staking ETF, showing strong institutional demand.

2. What is the Bitwise SOL Staking ETF?

It’s a fund giving regulated access to Solana staking rewards for U.S. investors.

3. Will there be a spot Solana ETF soon?

Analysts expect possible approval within weeks, which could boost Solana’s price.

4. How high can Solana go in 2025?

Analysts predict a breakout toward $1,000 if institutional inflows continue.

Read More: Bitwise SOL ETF Tops Inflows With $417 Million, Strengthening Solana Price Prediction">Bitwise SOL ETF Tops Inflows With $417 Million, Strengthening Solana Price Prediction

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.