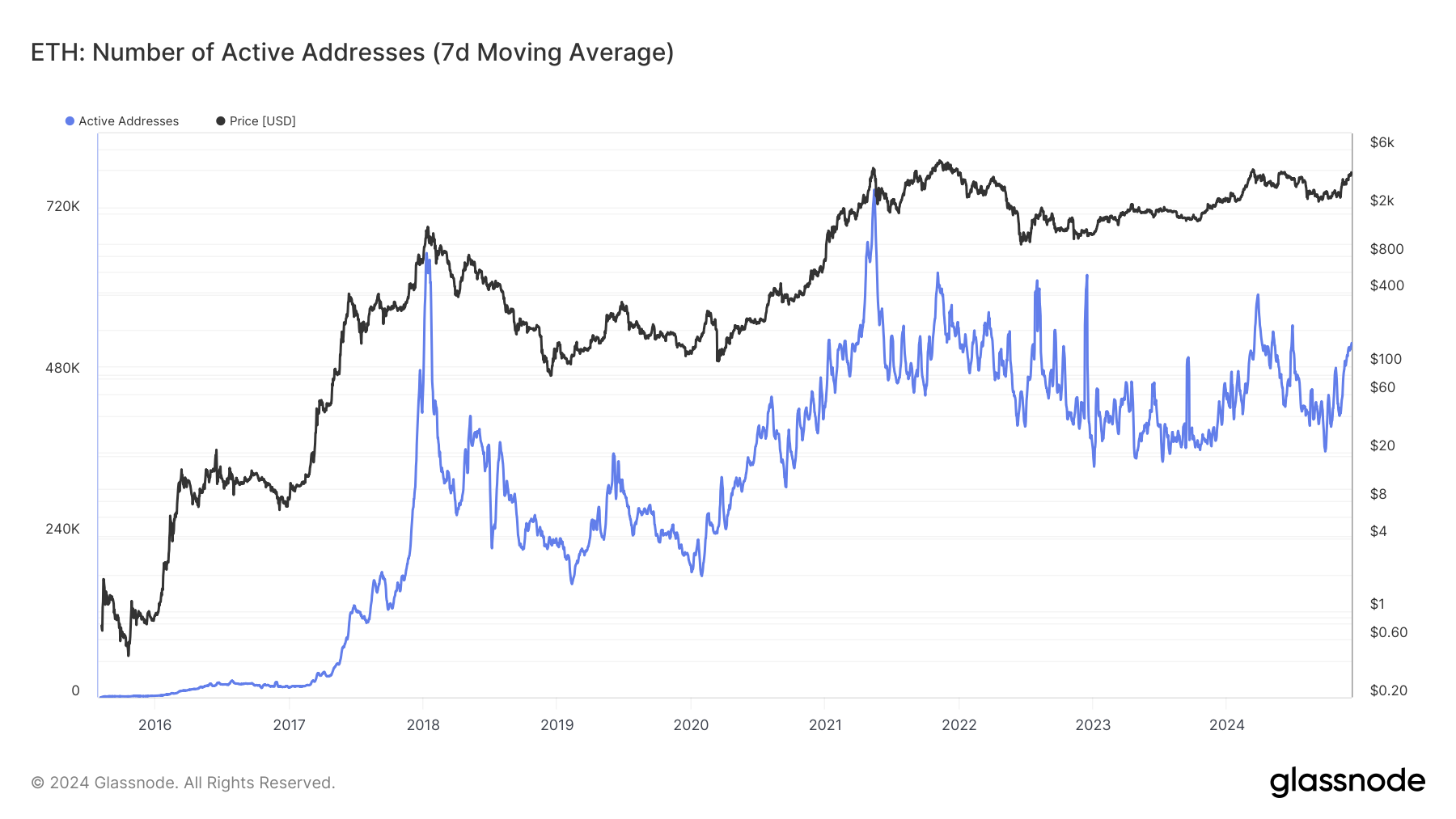

Ether Hits $4,000 as Coinbase Premium and Ethereum Active Addresses Surge

1

0

The price of Ethereum's ether (ETH) broke above the $4,000 mark on Friday for the first time since March.

The second-largest cryptocurrency is up 2.4% in the last 24 hours and 8.4% in the last seven days, outperforming bitcoin (BTC) in both timeframes. The move comes as spot ether exchange-traded funds saw record inflows on Thursday.

As of writing, ether is trading for $4,033, just 2% away from setting a fresh 2024 high. It's also a mere 20% away from its all-time high of $4,868. The ETH/BTC ratio, which has been getting hammered since September 2022, has reached 0.04 again — a level that marked a brief top for ether in relation to bitcoin on Nov. 10.

The Coinbase premium on ether also continues to expand — meaning that ether is trading for a higher price on the exchange than on the most liquid crypto exchange, Binance. Coinbase premiums are generally seen as a sign of demand among U.S. institutional investors as well as retail participants. TradingView data shows a slight increase in ether's price on Coinbase relative to Binance, suggesting the market is driven by activity from the U.S,., which coincided with the U.S. market opening around an hour ago.

That's not all. Glassnode data shows that active addresses on Ethereum have shot up on a 7-day moving average from 368,000 to 523,000 from Sept. 24 to Dec. 5, indicating an expansion of on-chain activity, which in turn ends up benefitting ether by constraining its the token’s supply through the "burn" mechanism.

Meanwhile, the CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization excluding memecoins, stablecoins and exchange coins — is down 1.4%, with its worst performers consisting of stellar (XLM) and litecoin (LTC), which have dropped 3.1% and 5% respectively in the last 24 hours. Uniswap (UNI) and render token (RDNR), however, are up 11.7% and 6.4% in the same period of time.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.