Price Predictions 2/10: BTC, ETH, XRP, BNB, SOL, DOGE, ADA

0

1

SOL registered a doji on Monday, following its rebound from a slight retracement; not a strong start to the week. However, the situation is worse at the time of writing.

SOL is trading almost 3% lower than its opening price. It also edged closer to retesting the previous day’s low a few hours ago.

Nonetheless, recent data from CoinMarketCap show healthy trading volume amid the decline. Evidently, current price action suggests that most of the 4% increase in volume is from sellers.

The global cryptocurrency market cap has shed almost 2% on Tuesday as bearish sentiment spread. However, the 4-hour chart shows a slight pullback as the first green of the day appears. Its current movement mimics that seen on Monday, suggesting that Tuesday may end with no notable changes.

Nonetheless, indicators hint at further declines in the coming days. For example, the moving average convergence divergence is close to a negative crossover in the coming days. Additionally, the bollinger bands are contracting.

Away from the chart, there are economic data reports for Wednesday. It remains to be seen how they unfold. However, the forecasts are slightly bullish. These releases could trigger a massive uptrend in the coming days.

Let’s see how some of the assets in the top 10 will perform in the coming days.

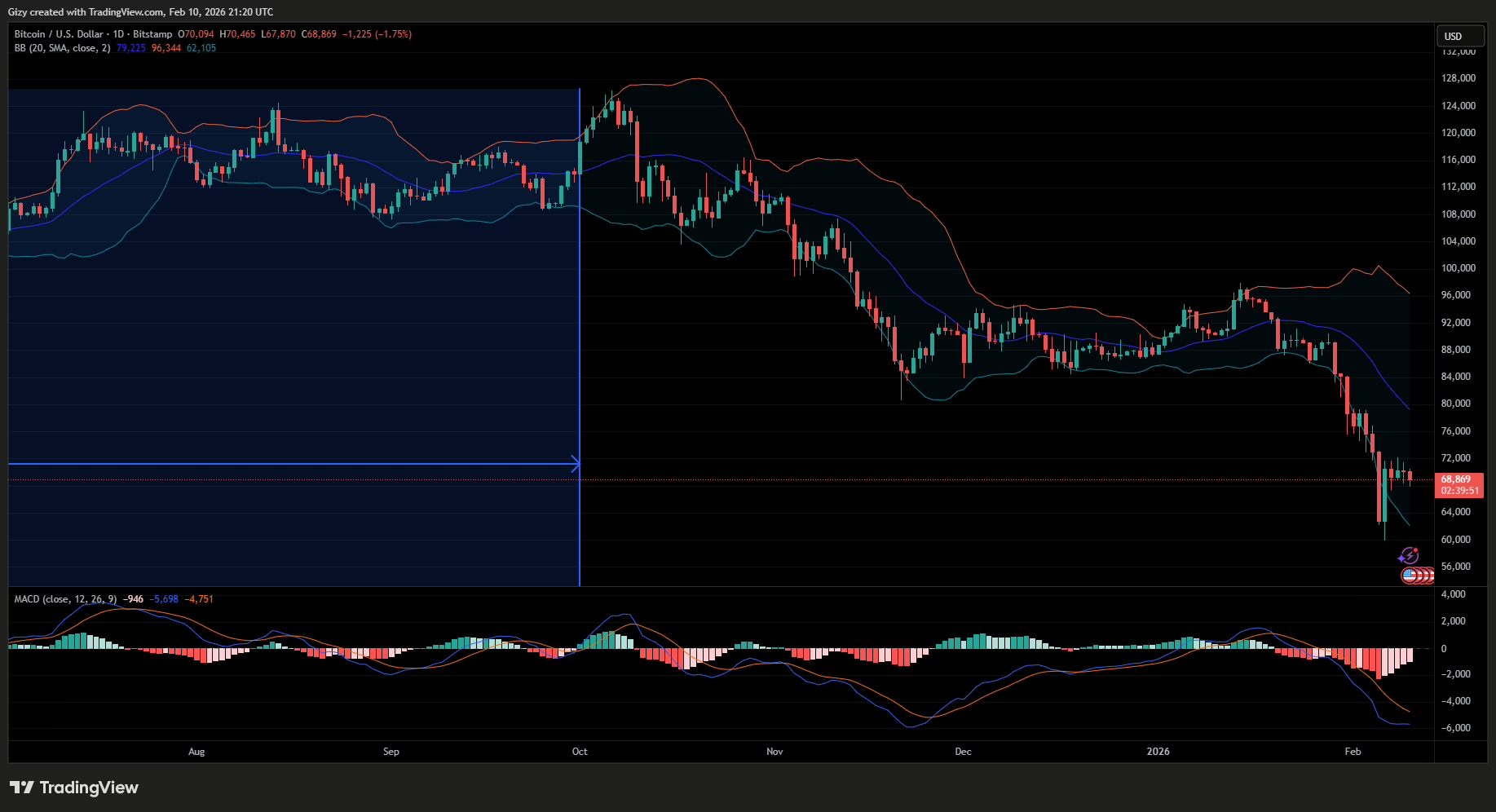

BTC/USD

Bitcoin has been on the decline for most of Tuesday, dropping below the previous day’s low. Following its shaky start to the week, the asset has grappled with notable selling pressure amid rising trading volume.

Nonetheless, the 4-hour shows a slight pullback. BTC prints its first green candle of the day following its recent rebound. However, at the time of writing, the bounce lacks sufficient volume to drive a significant price rally.

Additionally, indicators are currently negative. For example, MACD is close to completing its bearish crossover. A full interception will signal further decline in the coming hours. If the bears resume selling, previous price movements suggest a decline to $66k.

Nonetheless, BTC recently bounced off bollinger’s lower band. If bulls sustain the current upward momentum, it may retest $72k.

ETH/USD

Ethereum is on the verge of registering its first red candle on the 1-day chart. It began printing green candles on Friday and has since struggled to remain afloat.

However, it failed to register any notable increase over the weekend. The trend extended into Monday, and ETH retraced to a low of $2,006 but rebounded. As a result, it printed a doji.

The altcoin broke below its previous day’s low a few hours ago and is currently down by almost 4%. Indicators on the 4-hour chart suggest that this may be the beginning of a deeper correction.

The moving average convergence divergence had a bearish crossover a few hours ago, signalling further decline ahead. If this plays out, ETH will break below $1,900 in the coming hours.

Nonetheless, previous price movements reveal a short-term support at $1,988. It held the mark over the last three days, bouncing off it more than once. If the bulls defend the mark, the altcoin may retest $2,160.

XRP/USD

XRP has been in decline over the past 20 hours. As a result, it has yet to register a red candle on the 4-hour chart. However, its last two candles offer a glimmer of hope. They were dojis, indicating an ongoing effort to stage buybacks.

A closer look at the chart shows several rebounds at $1.38. If the altcoin maintains this level, it would serve as the launchpad for a move toward $1.55. Interestingly, XRP is also trading close to bollinger’s lower band, increasing the likelihood of a rebound.

Nonetheless, MACD recently displayed a negative divergence. Prices may retrace in the coming hours in response to the reading. If the bulls fail to defend $1.38, a slip to $1.30 is likely.

BNB/USD

Like SOL, BNB had a shaky start to the week, registering a doji on Monday. It retraced to a low of $615 but rebounded and ended the session slightly below its opening price.

Tuesday’s price action shows the situation has worsened. It broke below the previous day’s low and is currently down by more than 3%. However, MACD suggests that the asset is gearing up for further decline.

The metric’s recent bearish divergence indicates an impending slip below $615 (a short-term barrier). Losing this key level may send BNB below $600.

SOL/USD

SOL is trading at $82.7, its lowest value since Friday’s recovery. It has been on a decline since the start of the day, breaking below its previous low.

SOL is down by almost 5% on the 1-day scale and has shown no significant recovery push. If trading conditions remain unchanged, it will retrace to below $78 in the coming days.

Interestingly, the moving average convergence divergence supports this assertion, printing sell signals at the time of writing. However, the altcoin is trading below the bollinger bands on the 4-hour chart, suggesting a slim chance of a rebound.

If SOL bounces off $82, it may retest $88 if the bulls sustain the upward momentum.

DOGE/USD

DOGE dropped to a low of $0.092 on Monday but rebounded and ended the session slightly lower than its opening price.

The asset is currently trading below its previous day’s low after resuming its downtrend on Tuesday. It retraced to a low of $0.091 a few hours but rebounded. However, a drop below $0.090 is almost inevitable.

MACD recently printed a bearish divergence, indicating further decline ahead. DOGE may retrace below $0.088 if the bulls fail to defend $0.090. Conversely, if the buyback resumes, the altcoin will attempt $0.096 in the coming hours.

ADA/USD

The 4-hour chart shows that Cardano has traded above $0.26 for the last 4 days. Its consistent rebound at the mark suggests growing demand concentration there. However, it remains to be seen how long the support will hold.

Nonetheless, the bollinger bands hint at an impending rebound in the coming hours. If that happens, the coin will retest $0.275.

While previous price movements suggest that the altcoin will likely surge, MACD says otherwise. It had a bearish crossover a few hours ago, signalling impending corrections. Currently down by almost 3%, the downtrend may extend into Wednesday, leading to a plummet below $0.25.

The post Price Predictions 2/10: BTC, ETH, XRP, BNB, SOL, DOGE, ADA appeared first on CoinTab News.

0

1

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.