Debt Worries Drive Investors Toward Bitcoin Hedge Against Dollar Weakness

0

0

According to recent economic warnings, the Bitcoin hedge concept is gaining traction among investors who fear a weakening of the U.S. dollar. Rising government debt and record interest burdens have shaken confidence in traditional assets.

Many now look toward Bitcoin and gold as alternatives to protect value during turbulent financial cycles.

Debt Risks Fuel Search for Alternatives

Economists point out that the U.S. government spends more than $1 trillion annually on interest payments. With trillions in debt due for refinancing, market watchers believe the dollar could face severe pressure. This backdrop has made the Bitcoin hedge against dollar strategy a vital talking point.

Gold, often regarded as a traditional haven, continues to draw demand. Yet, digital assets are now part of the conversation. Bitcoin, with its limited supply of 21 million coins, offers a clear contrast to unlimited money printing.

Also read: Bitcoin Smashes All-Time High as JPMorgan and Hedge Funds Rush In

Expert Views on the Bitcoin Hedge

“Every empire in history has faced decline once its debt cycle reached the breaking point,” Ray Dalio noted in a recent interview.

In this environment, a Bitcoin shield appears more than speculation; it is part of a long-term risk management strategy.

Market strategists also see Bitcoin and gold moving in the same direction when confidence in the dollar falls. A Bitcoin hedge against dollar weakness not only protects wealth but also opens growth opportunities.

Allocation and Market Impact

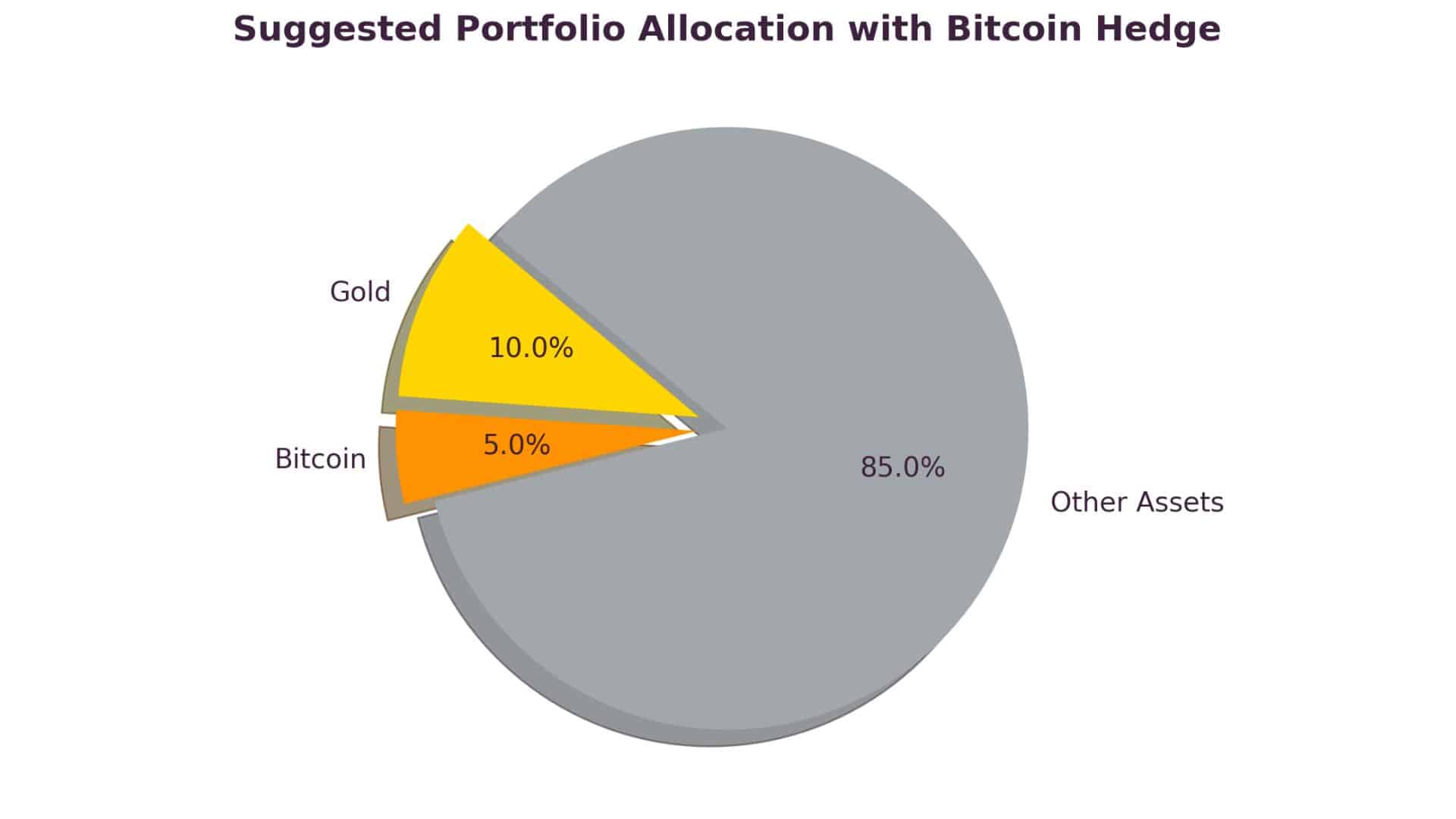

Experts suggest placing up to 15% of a portfolio in gold and Bitcoin to balance risks. Bitcoin often rises in tandem with global liquidity shifts, lending weight to its role as a hedge.

Over the past five years, both gold and Bitcoin have proven resilient, though Bitcoin is more volatile. The concept of a Bitcoin hedge against dollar weakness remains attractive to investors seeking diversification.

Conclusion

Based on the latest research, Bitcoin hedge strategies are no longer fringe ideas but central to portfolio discussions. Rising debt, political division, and weaker trust in fiat currencies have set the stage for digital and traditional hard assets to play a bigger role.

While gold remains a reliable anchor, Bitcoin offers a modern tool for protection. The concept of a Bitcoin safe haven against a decline in the dollar may shape the way investors think about wealth for years to come.

Also read: Ray Dalio Warns Dollar Crisis, Urges 15% in Crypto and Gold.

Summary

As investor concerns mount due to U.S. debt and the depreciation of the dollar, the concept of a Bitcoin hedge has gained traction. Experts suggest that a portfolio of gold and Bitcoin, with a maximum allocation of 15%, hedges against inflation more effectively. A Bitcoin safe haven against the dollar drop offers diversification and long-term sustenance by providing stability and growth.

Glossary of Key Terms

Bitcoin hedge: Using Bitcoin as protection against currency or market risks.

Dollar decline: A drop in the value or global confidence in the U.S. dollar.

Haven asset: An investment that holds or increases value in times of uncertainty.

Liquidity: The availability of cash or assets that can quickly be turned into cash.

Portfolio allocation: The percentage of money placed in different assets.

FAQs for Bitcoin Hedge

Q1. What does Bitcoin hedge mean?

It refers to using Bitcoin as a protective asset when traditional currencies like the dollar lose value.

Q2. Is Bitcoin safe haven against dollar effective?

Yes, Bitcoin has shown strong performance when the dollar weakens, though it remains more volatile than gold.

Q3. How much should investors allocate to a Bitcoin shield?

Many experts suggest allocating up to 15% of one’s portfolio to gold and Bitcoin combined.

Q4. Why is the dollar under pressure?

The U.S. faces high debt, rising interest costs, and political division, all of which reduce global confidence.

Read More: Debt Worries Drive Investors Toward Bitcoin Hedge Against Dollar Weakness">Debt Worries Drive Investors Toward Bitcoin Hedge Against Dollar Weakness

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.