Tariff-Driven Inflation: Powell’s Crucial Insights on Temporary Price Pressures

0

0

BitcoinWorld

Tariff-Driven Inflation: Powell’s Crucial Insights on Temporary Price Pressures

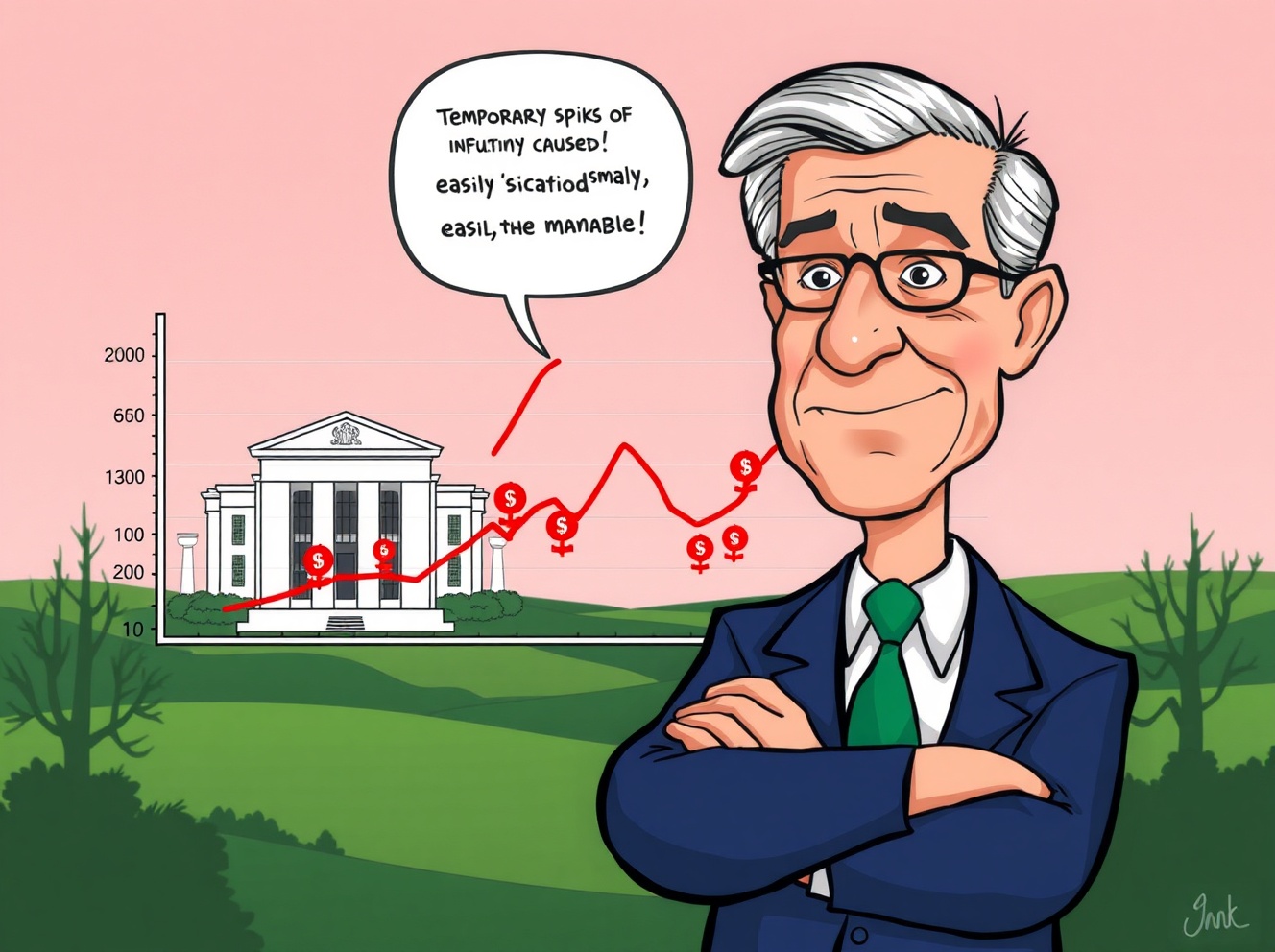

The financial world often buzzes with complex terms, and lately, the phrase ‘tariff-driven inflation‘ has been making headlines. For many, understanding its true impact can feel daunting. However, recent insights from Federal Reserve Chair Jerome Powell offer a clearer, more reassuring perspective. He believes that any price pressures we see due to tariffs are likely to be temporary, a crucial distinction for both businesses and everyday consumers.

What Exactly is Tariff-Driven Inflation?

Before diving deeper into Powell’s remarks, let’s quickly clarify what we mean by tariff-driven inflation. Simply put, tariffs are taxes imposed on imported goods. When these taxes are applied, the cost of bringing those goods into a country increases. Businesses often pass these higher costs onto consumers through increased prices. This ripple effect across various sectors is what we refer to as tariff-driven inflation.

- Key takeaway: Tariffs raise import costs, leading to higher consumer prices.

- This kind of inflation differs from other forms, like demand-pull or cost-push inflation, as its root cause is a specific government policy on trade.

- Understanding this distinction is vital for accurately assessing its potential duration and severity.

Why Does Powell See Tariff-Driven Inflation as Temporary?

Federal Reserve Chair Jerome Powell recently shared his outlook during an economic discussion in Warwick, Rhode Island. He acknowledged that while inflation remains slightly elevated, any specific price pressure stemming from tariffs is unlikely to persist. Powell’s confidence comes from a comprehensive analysis of the economic data and the nature of these specific price hikes.

- The Fed’s economists monitor a wide range of indicators. They distinguish between broad, systemic inflation and more localized, temporary price spikes.

- Often, the impact of tariffs can be absorbed or mitigated over time as supply chains adjust, or as trade negotiations progress.

- Powell’s statement suggests that the underlying economic fundamentals are strong enough to prevent these tariff effects from becoming deeply entrenched in the broader economy.

The Fed’s Favorable Position: A Strategic Advantage?

Adding to his optimistic view, Powell highlighted the Federal Reserve’s current ‘favorable position.’ This strong stance follows the Fed’s proactive decision to cut interest rates in September. Such moves are not made lightly; they reflect a careful assessment of economic conditions and a strategic effort to support sustainable growth.

- Interest rate adjustments are a powerful tool for the Fed. A rate cut can stimulate borrowing and spending, counteracting potential economic slowdowns.

- This flexibility allows the Fed to respond effectively to various economic challenges, including temporary inflationary pressures.

- Being in a ‘favorable position’ means the Fed has ample room to maneuver, should economic circumstances require further action, reinforcing confidence in its ability to manage the economy.

What This Means for Your Finances and the Economy

Powell’s remarks about tariff-driven inflation being temporary carry significant weight. For individuals, it suggests that while some prices might see short-term increases, a prolonged, widespread surge in living costs due to tariffs is not the primary concern. For businesses, this outlook can help in planning and investment decisions, reducing uncertainty.

- For consumers: Keep an eye on specific product categories affected by tariffs, but don’t panic about overall inflation spiraling out of control.

- For investors: A temporary inflation outlook might alleviate fears of aggressive rate hikes, potentially stabilizing markets.

- The overall message is one of measured optimism, suggesting that the economy has resilience to absorb and adapt to trade-related challenges.

Federal Reserve Chair Jerome Powell’s recent statements provide a calming perspective on tariff-driven inflation. By categorizing these price pressures as likely temporary, he underscores the Fed’s analytical depth and strategic readiness. The Fed’s favorable position, bolstered by recent interest rate cuts, further reinforces confidence in its ability to navigate economic shifts. This outlook suggests that while economic vigilance is always wise, the specific challenges posed by tariffs are not expected to derail broader economic stability. It’s a powerful reminder that even amidst global trade tensions, the underlying economic picture remains robust.

Frequently Asked Questions (FAQs)

Q: What exactly are tariffs?

A: Tariffs are taxes imposed by a government on imported goods and services. They are typically used to protect domestic industries or to generate revenue.

Q: How do tariffs lead to inflation?

A: When tariffs are applied, the cost for importers to bring goods into a country increases. These higher costs are often passed on to consumers through higher retail prices, leading to inflation.

Q: Why does the Federal Reserve believe tariff-driven inflation will be temporary?

A: Federal Reserve Chair Jerome Powell suggests that the economic system can absorb or adapt to these specific price pressures over time. Factors like supply chain adjustments or the limited scope of affected goods contribute to this temporary outlook, rather than a broad, sustained inflationary trend.

Q: What is the Fed’s “favorable position” mentioned by Powell?

A: The Fed’s “favorable position” refers to its flexibility and capacity to respond to economic conditions. Following its September interest rate cut, the Fed has more tools and policy space to manage economic shifts and support growth if needed.

Q: How might temporary tariff-driven inflation affect consumers?

A: Consumers might experience short-term price increases on specific imported goods. However, if the inflation is indeed temporary, it is less likely to lead to a widespread, prolonged increase in the cost of living or significantly erode purchasing power over the long term.

Did this article help you understand Jerome Powell’s outlook on tariff-driven inflation? Share these crucial insights with your friends, family, and colleagues on social media to help them stay informed about the economic landscape!

To learn more about the latest economic outlook and inflation trends, explore our article on key developments shaping the economic outlook and inflation trends.

This post Tariff-Driven Inflation: Powell’s Crucial Insights on Temporary Price Pressures first appeared on BitcoinWorld.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.