Ethereum (ETH) Price Eyes $3K Amid ETF & Whale Surge

0

0

Ethereum (ETH) price is finally getting its ATH moment. While Bitcoin (BTC) price made headlines by briefly crossing its all-time high, the ETH price has been quietly building pressure.

And now, the signs are showing. With whales pulling liquidity off exchanges, ETH ETF flows accelerating, and a short squeeze underway, the ETH price may be gearing up for a catch-up rally of its own.

Whale Outflows and Supply Crunch Deepen

Over 46,000 ETH, worth $126.5 million, was withdrawn from Kraken in the past 12 hours, according to Onchain Lens.

One newly created wallet alone pulled $69.9M in ETH in under 8 hours. Such outflows aren’t random. They’re accumulation signals, and they’re making a dent.

CryptoQuant’s exchange reserve data confirms this: Ethereum’s supply on centralized platforms has dropped to just 18.9 million, closing in on the lowest level since mid-2022.

When supply on exchanges shrinks like this, it often means one thing: investors are preparing to hold, not sell.

ETF Inflows Keep Surging

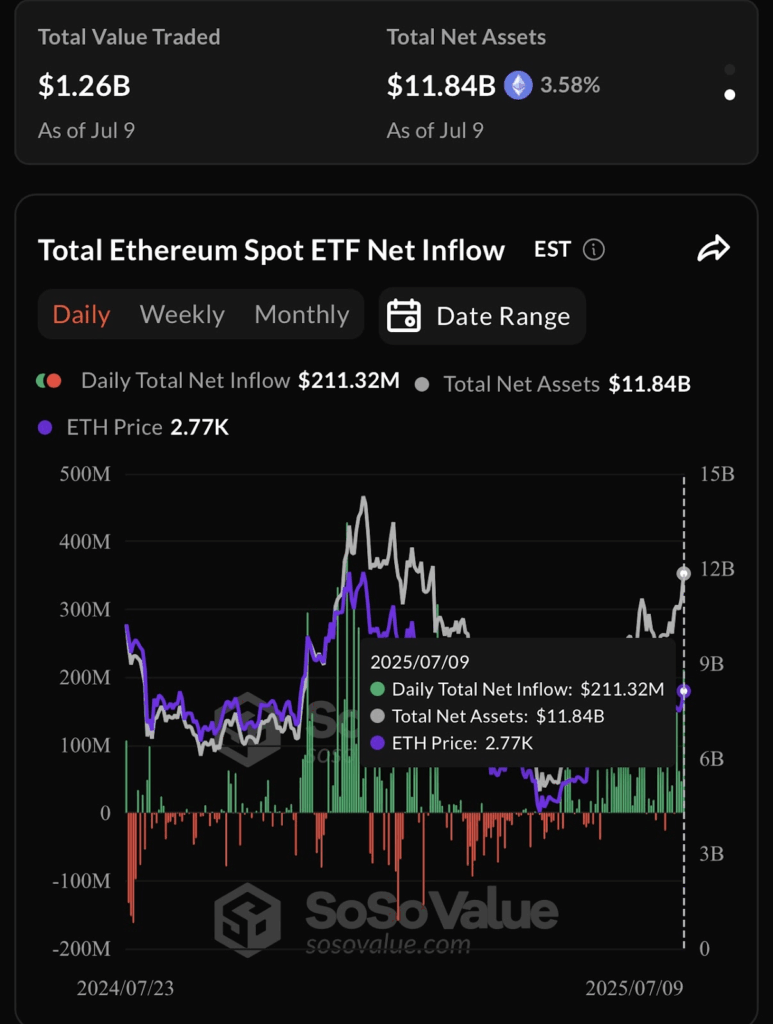

Spot Ethereum ETFs are beginning to live up to the hype. According to SoSoValue, ETH products recorded $211 million in net inflows on July 9 alone.

The last four days have seen green inflows, and this marks the eighth straight week of sustained buying.

Glassnode’s data backs this up.

The trend is clear: institutions are stepping in more aggressively, and ETH is starting to look like Bitcoin’s slower, but just-as-serious sibling.

As of July 9, total net assets in ETH ETFs stood at $11.84 billion, a 3.58% jump.

Short Squeeze and Key Support Levels Unlocked

Per @TedPillows’ data, the $2,775 zone was home to a massive liquidation cluster. ETH has now pushed above that level, meaning thousands of short positions are underwater.

This creates auto-buying pressure as positions get forcefully closed; a textbook short squeeze setup.

The logic here is simple. When enough shorts get liquidated at once, it fuels upward momentum. We’re watching that exact scenario play out.

This could accelerate moves above $3,000 and toward higher resistance levels.

Historical MACD Cross And Ethereum (ETH) Price Breakouts

Crypto YouTuber @CryptoRover pointed out a 2-week bullish MACD crossover; a signal that has previously foreshadowed every major Ethereum rally since 2020.

This isn’t just a “nice-to-see” indicator; it’s backed by price action. Every time this crossover flashed, ETH went vertical.

The difference this time? It’s happening with ETF inflows, exchange supply drying up, and whales accumulating.

The stage might be set for Ethereum to follow Bitcoin’s footsteps toward price discovery.

ETH Price Prediction: ATH Looks Possible?

At press time, the Ethereum price traded around $2,789. The last major resistance zone at $2,863 (Fib 0.5 level) is being tested.

If bulls hold this push, the next upside levels lie at $3,040 (0.618 Fib), $3,291 (0.786), and $3,610 (1.0 extension).

A breakout beyond these levels could trigger a full price discovery leg toward $4,534; the 1.618 extension from the $1,382 swing low to the $2,876 high.

Invalidation of this bullish setup comes if ETH falls back under $2,515, which would break the rising structure and confirm a failed breakout.

That level also aligns with the previous demand zone, making it a clear watch point for bulls.

The post Ethereum (ETH) Price Eyes $3K Amid ETF & Whale Surge appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.