Analysis: how sanctions on Venezuelan oil could disrupt global supply and impact crude prices

0

0

It seems as if the oil market can’t catch a break from tariffs and increasing uncertainty about global supply.

The recent announcement by the US President Donald Trump to impose 25% tariffs on countries buying oil and gas from Venezuela has already shaken up the crude market.

Market participants are concerned about the impact of the new sanctions, while refineries that rely heavily on Venezuelan crude may have to look at other options.

Meanwhile, the prospect of restricting supply could push crude oil prices higher, putting further pressure on economies around the world.

“Oil prices are finding some upward momentum this week as US tariffs on Venezuelan crude cast fresh doubt over the reliability of global supply,” Mukesh Sahdev, Rystad Energy’s global head of commodity markets, said in an emailed commentary.

“If these tariffs last into the northern hemisphere’s summer when crude demand surges, that will provide a stronger bullish signal than current market conditions,” Sahdev added.

Impact on prices

Global oil prices have been stuck in a range of $70-$75 per barrel over the last couple of months. Brent prices had briefly risen over $80 per barrel in January, but has struggled to sustain the gains ever since.

The reason behind the subdued price environment is the fear of an oversupply in the market this year.

Experts believe that even with the fresh sanctions on Venezuelan oil, the supply loss may be offset by increasing production by the Organization of the Petroleum Exporting Countries and allies from April.

Sahdev added:

We project that the price rise will stay modest with OPEC+ ready to add barrels to compensate (for) losses.

OPEC+ is scheduled to unwind some of its voluntary oil production cuts of 2.2 million barrels per day from April, and raise output by around 140,000 barrels a day.

In a different scenario, OPEC could slow the production increase in favour of higher oil prices.

“If the US policy of sanctions on buyers and sellers of crude stretches into the summer, or if OPEC+ exercises restraint on returning its barrels to the market, the stage will be set for oil prices in the $85 to $90 range,” Sahdev said.

However, Sahdev believes that OPEC understands that higher oil prices could subdue demand and prompt cartel members towards non-compliance with output quotas.

“The most likely outcome is that OPEC+ will carefully unwind its production cuts to keep prices near the $75 sweet spot.”

Supply

According to Carsten Fritsch, commodity analyst at Commerzbank AG, the announcement about Venezuela was the most serious sanction threat Trump has made on the oil market to date.

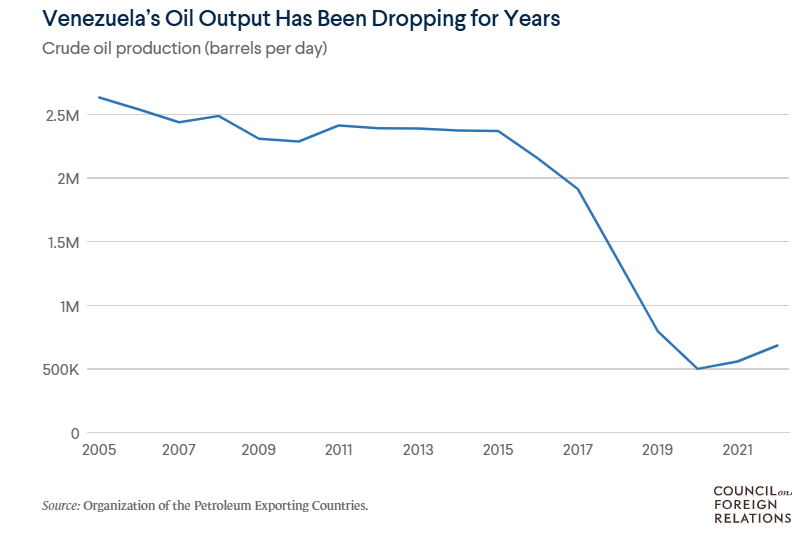

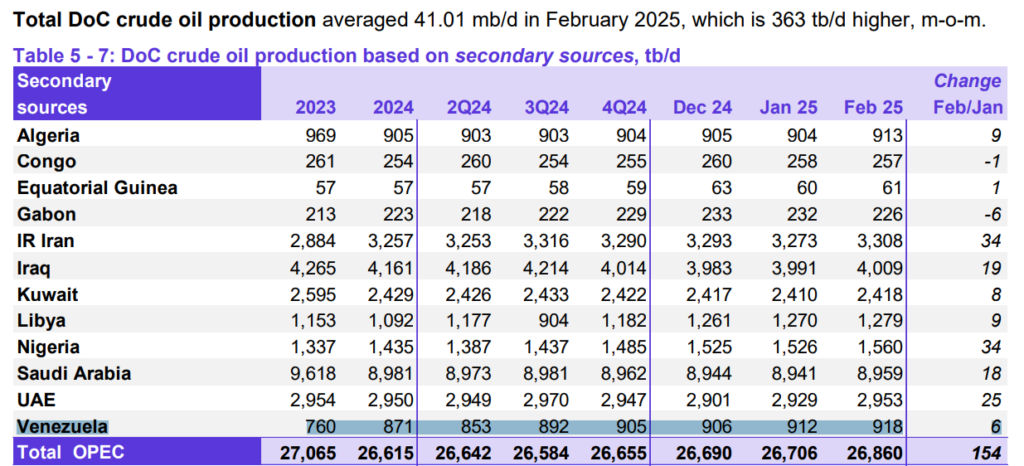

“Venezuela recently produced a good 900 thousand to just under 1 million barrels per day, depending on the data source, meaning that Venezuela’s oil production has doubled since the end of 2020,” Fritsch said.

The last time it was higher was six years ago.

According to Bloomberg data, Venezuela’s oil exports rose to just under 760,000 barrels per day in February.

“If Venezuelan oil exports are successfully reduced significantly, the tariff threat could also be a blueprint for a further tightening of sanctions against Iran if the previous Iran sanctions prove ineffective,” Fritsch added.

The US government also tightened oil sanctions against Iran last week, including an independent Chinese refinery on the sanctions list for the first time.

“This could also deter other potential buyers of Iranian oil,” Fritsch noted.

Leverage

The American multinational energy corporation, Chevron had to cease operations in Venezuela within 30 days, starting from March 4 as directed by Trump.

However, the company’s license to produce oil in Venezuela was extended till May 27.

“This provides some further negotiating leverage to the US in dealing with secondary tariffs with other countries,” Sahdev said.

The US sanctions on Venezuela’s oil and gas are an indirect method to cripple the South American country’s supply capability and hurt China’s teapot refining system.

It is from the same playbook as sanctions on Chinese refinery dealing in Iran crude given this may be most cost effective to deal (with) the challenge at sink vs. source.

The US is strategically using the current market conditions to secure deals before the summer season, according to Rystad Energy.

Other countries at risk

According to Rystad’s estimates, if Chevron leaves Venezuela, it could impact about 230,000 barrels per day of oil out of a total output of 1 million barrels per day.

The Norway-based energy intelligence company forecasts that Venezuelan oil output could fall to between 700,000-750,000 barrels a day by the end of this year.

“With new tariffs on buyers, total Venezuelan production could fall to much lower levels.” Sahdev said.

The countries that will be affected include India and Spain, in addition to China. Venezuela also lacks a robust refining system to divert crude oil for its own use.

However, India’s oil refiners have been issuing fewer spot tenders for crude purchases as Russian supply has stabilised following disruptions from western sanctions.

Meanwhile, Venezuela’s oil production will undoubtedly be significantly impacted by the tariffs, given that domestic refineries can only process approximately 250,000 barrels per day.

“However, the impact on supply and demand balances will be muted, as China’s imports of Venezuelan crude has been much lower in the first two months of 2025,” Sahdev said.

The US, also a buyer of Venezuelan crude, may seek alternative suppliers of heavy sour crude from OPEC+ nations, such as Iraq.

Sahdev said:

This news could have had positive repercussions for the other major heavy sour producers like Mexico, Iran, Russia and Canada, but all of these countries are facing their own tariffs challenges.

The post Analysis: how sanctions on Venezuelan oil could disrupt global supply and impact crude prices appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.