0

0

The crypto market saw a sharp pullback overnight. Total crypto market cap shed about $176.6 billion, falling 5.7% from yesterday’s high before stabilizing near $2.9 trillion. Even after the bounce, the market remains down roughly 4% over the past 24 hours.

The weakness has been led by Bitcoin (BTC), which is down around 4.1%, dragging sentiment across major tokens. Ethereum (ETH) has slipped even harder, down 6.5%, while losses are widespread across the top 100. Among large movers, Hyperliquid (HYPE) stands out as one of the biggest laggards, dropping nearly 9.4% as risk appetite fades.

In the news today:-

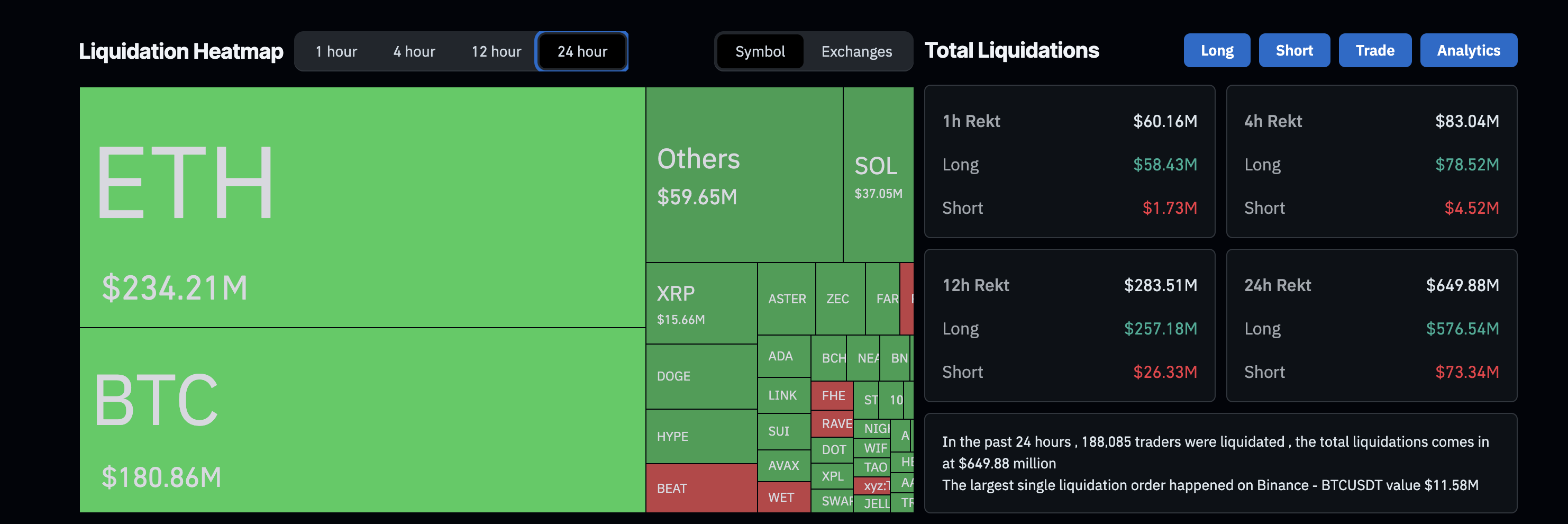

Beyond the headlines, the crypto market downturn shows clear signs of leverage-driven stress. Over the past 24 hours, more than $576 million in long positions were liquidated across major exchanges. Ethereum and Bitcoin accounted for the bulk of these forced exits, confirming that leveraged long exposure was crowded before the selloff began.

Liquidation data suggests this move was not driven by fresh bearish conviction, but by cascading stop-outs. As prices slipped below key intraday levels, long liquidations accelerated, pushing prices lower in a feedback loop. This explains why losses were sharp and broad, even in the absence of new negative crypto-specific news.

Crypto Liquidations: Coinglass

Crypto Liquidations: Coinglass

Macro risk added pressure. Markets remain cautious ahead of the upcoming Bank of Japan policy signals, where speculation around tighter financial conditions has weighed on global risk assets. Crypto, still trading as a high-beta asset, reacted accordingly. The combination of macro uncertainty and high leverage left the market vulnerable.

From a structure perspective, total crypto market capitalization (TOTAL) is now down roughly 32% from its October peak, reinforcing a corrective phase. The $3 trillion level has turned into a key psychological pivot. A reclaim above $3.00 trillion, followed by $3.25 trillion, would be needed to stabilize sentiment and reopen upside toward $3.59 trillion and $3.94 trillion.

TOTAL Price Analysis: TradingView

TOTAL Price Analysis: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the downside, the market is currently holding above the $2.81 trillion to $2.73 trillion support band. A sustained break below this zone would increase downside risk and signal that deleveraging is not yet complete.

Bitcoin is down just over 4% on the day, but it continues to defend an important support level at $85,200. That area has absorbed repeated sell pressure and remains the line separating a controlled pullback from a deeper correction.

If this support fails, downside risk opens toward $83,500, followed by $80,400 if market stress intensifies and liquidations accelerate further. However, one constructive sign is that long-side leverage is thinning out as price falls, which reduces forced selling risk.

BTC Price Analysis: TradingView

BTC Price Analysis: TradingView

For Bitcoin to regain strength, it must reclaim $90,700. That would represent roughly a 5.5% recovery from current levels and signal that buyers are stepping back in. A move toward $94,500 could follow, though that level remains a major decision zone rather than a confirmed upside target for now.

For the moment, Bitcoin’s ability to hold the $85,200 support will continue to dictate broader market direction.

Hyperliquid remains one of the weakest names in this market selloff, extending losses even as broader conditions stabilize. The HYPE token is down over 9% in the past 24 hours and nearly 12% from yesterday’s peak, making it one of the biggest laggards among large-cap altcoins.

Price action is still trending lower, but the daily chart is starting to show early signs of exhaustion. Between November 22 and December 16, the HYPE price printed a lower low while the Relative Strength Index (RSI), a momentum tool, formed a higher low. This standard bullish divergence suggests selling pressure may be fading, though confirmation is still missing.

For any rebound to gain credibility, Hyperliquid must reclaim $29.68 on a daily close. A move above that level opens upside toward $36.78. Until then, rebounds risk remaining short-lived.

HYPE Price Analysis: TradingView

HYPE Price Analysis: TradingView

On the downside, $26.01 is critical support. A daily close below it exposes $20.39, keeping downside risks firmly in play.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.