Why Solana and XRP Are Thriving While Ethereum Bleeds $912M

0

0

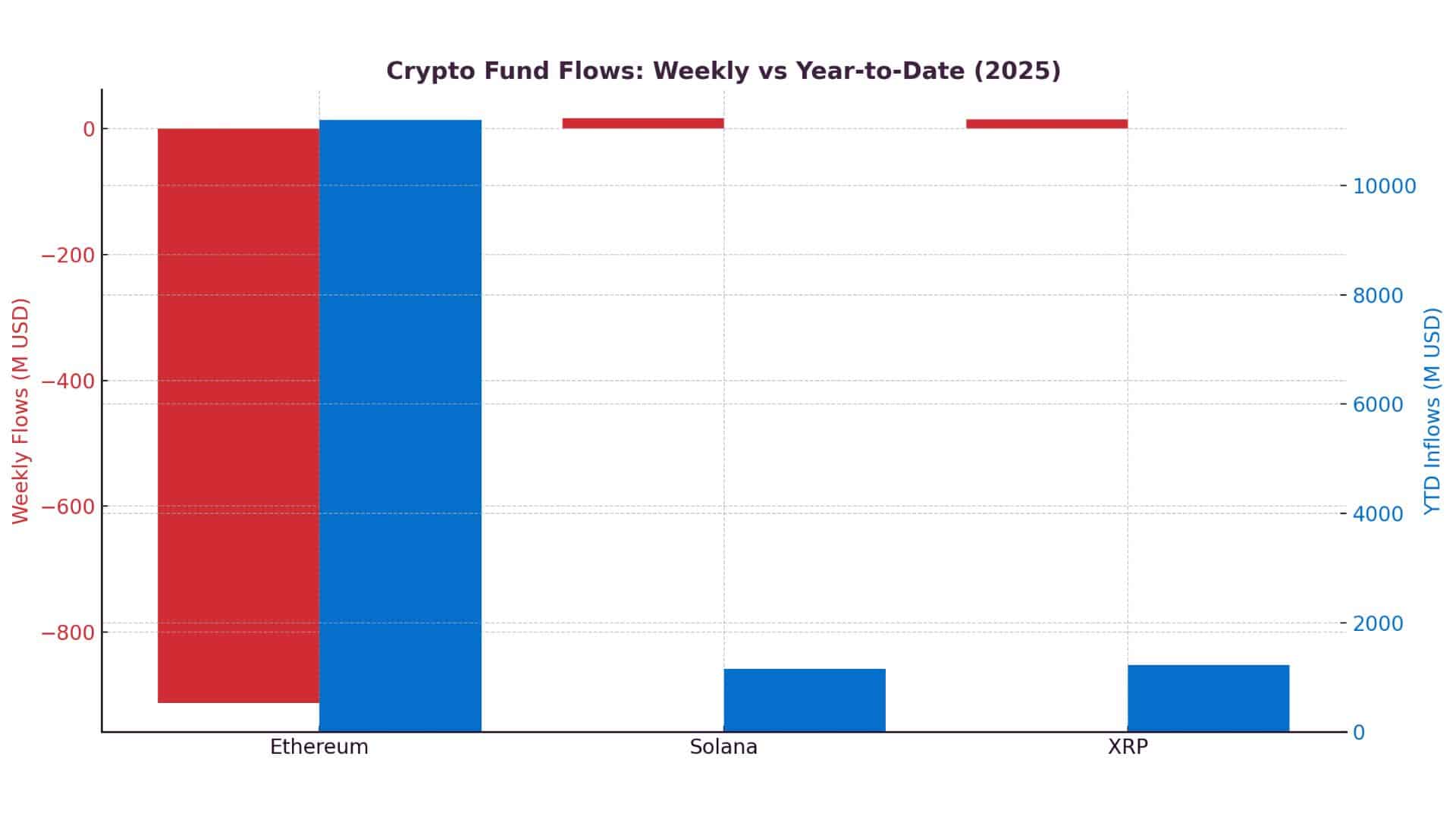

As per the latest market update, crypto fund flows highlight a sharp turn for Ethereum with heavy outflows, while Solana and XRP continue to attract investor interest. The figures underline a shifting mood in digital assets where one network struggles to hold ground, and others gather steady traction.

Ethereum Faces Pressure

Ethereum recorded weekly outflows of more than $900 million, raising eyebrows among analysts. Some point to investor caution ahead of expected policy changes in the United States. Others say that concerns around network scaling and fee pressures keep some funds from increasing exposure.

Despite this setback, Ethereum still holds over $11 billion in net inflows this year. That shows confidence has not disappeared entirely. Yet the latest swing in crypto fund flows illustrates how quickly sentiment can shift when market signals appear uncertain.

Read more: Crypto Price Prediction Today: BTC, ETH, and XRP Hold Key Levels

Solana’s Steady Climb

In contrast, Solana continues to record consistent inflows. With $16 million added in the past week, this marks its 21st consecutive week of positive movement. Many see this as an early sign of institutional interest, possibly tied to long-term expectations around exchange-traded products.

“Solana is beginning to show staying power as an asset with broad appeal,” noted a market strategist.

The persistent green numbers in crypto fund flows suggest that investors are seeking alternatives to Ethereum’s dominance.

XRP Keeps Its Pace

XRP also posted $14 million in weekly inflows, bringing its yearly total to more than $1.2 billion. Legal clarity and growing usage in payment networks may be key drivers. Unlike Ethereum, XRP’s market base shows resilience even during broader sell-offs.

These inflows reinforce the idea that XRP is cementing its role in remittance and settlement sectors. For investors tracking crypto fund flows, XRP has become a reliable barometer of institutional sentiment.

Regional Trends

The United States led the week with $440 million in redemptions, but Europe and Asia told a different story. Germany recorded inflows above $85 million, while Hong Kong and Brazil showed modest positive numbers. This split indicates regional differences in how investors approach digital assets, a factor worth watching in future crypto fund flows.

Table: Weekly Fund Flows Snapshot

| Asset | Weekly Flow | Year-to-Date 2025 |

|---|---|---|

| Ethereum | –$912M outflow | +$11.2B inflow |

| Solana | +$16M inflow | +$1.16B inflow |

| XRP | +$14M inflow | +$1.22B inflow |

| Market | –$352M total | — |

Conclusion

Based on the latest research, crypto fund flows show Ethereum under short-term pressure while Solana and XRP attract steady inflows. The market remains divided, with U.S. investors pulling back and other regions leaning in.

For traders and institutions, these movements serve as reminders that diversification across multiple assets may prove more rewarding than leaning on a single chain.

Read more: BlackRock Sparks Panic: $664M in Bitcoin and Ethereum Moved as ETF Outflows Surge

Summary

Crypto fund flows reveal a mixed week across digital assets. Ethereum saw $912 million in outflows, raising concerns about sentiment, while Solana posted its 21st consecutive week of inflows and XRP added $14 million. Regional data showed the U.S. leading withdrawals, while Germany and Asia added funds. The data suggest that diversification across assets is becoming more important as global crypto investors weigh new risks and opportunities.

Glossary of Key Terms

Crypto fund flows: The movement of money into and out of cryptocurrency funds.

Inflows: Funds moving into an asset or market.

Outflows: Funds withdrawn from an asset or market.

ETF (Exchange-Traded Fund): A fund that tracks an index or asset and trades on exchanges like a stock.

FAQs for Crypto Fund Flows

Q1: What are crypto fund flows?

They track the net movement of money into or out of cryptocurrency investment products.

Q2: Why did Ethereum see such large outflows?

Analysts suggest investor caution linked to U.S. policy changes and network scaling issues.

Q3: Why are Solana inflows consistent?

Institutional demand and optimism around future ETF approvals keep Solana attractive.

Q4: How does XRP benefit from inflows?

XRP’s legal clarity and growing role in payments help sustain investor confidence.

Read More: Why Solana and XRP Are Thriving While Ethereum Bleeds $912M">Why Solana and XRP Are Thriving While Ethereum Bleeds $912M

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.