BTC Nears Record High as $1.9B in Shorts Liquidated: Rally Just Beginning?

0

0

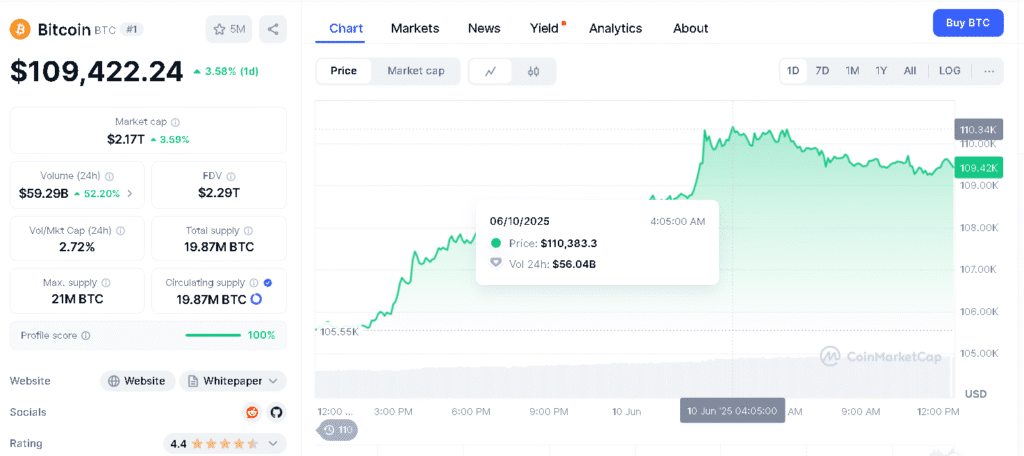

According to market analysis, recently the Bitcoin price went above $110,000, showing a strong recovery after falling last week, and brought it close to its all-time high, just 2% away.

This rise has brought back interest from traders and big investors, particularly after a large number of short trades were closed, which pushed the price higher.

Experts now believe that the Bitcoin price is at an important point, where it might either go up further or slow down, depending on the signals from the broader economy.

Bitcoin is at a key level, say top analysts. If it holds above the $112K–$113K resistance level , it could climb to $120K or higher this month.

A Calm Rally with Powerful Undercurrents

The current rally in the Bitcoin price has surprised many people. Just a few days ago, Bitcoin had dropped close to $100,000, but it strongly bounced back and rose above $109,000.

Bitcoin even crossed the $110,000 level for a short time. Currently, it is trading around $109,434.70. Analysts at Bitfinex said that this rise happened because of a recent “leverage flush,” where $1.9 billion in crypto derivatives were wiped out.

This cleared the way for a more stable and healthier upward trend. Jake O, an OTC trader at Wintermute, pointed out that the rise in the Bitcoin price happened even though the traditional markets didn’t move much, which shows that Bitcoin has its own strong momentum.

He said that investors around the world are now watching macroeconomic factors, like new inflation data and updates on the U.S.-China trade.

Technical Signals Suggest Strength

Market indicators are showing support for the current rise. The Bitcoin price is still just below its highest level ever, and technical indicators are not showing any sign of an overheating market.

The relative strength index (RSI) is in a healthy zone, and the widening Bollinger Bands point to growing volatility. Caleb Franzen, founder of Cubic Analytics, said that a “peaceful rally” is the best way to describe the current price movement.

He noted that the Bitcoin price is steadily forming higher highs and higher lows, and whenever there’s a slight dip, buyers quickly come in to support the trend.

This slowdown and steady rise in the Bitcoin price is making traders more confident, as it looks like a strong recovery rather than just a short-term bounce.

| Metrics | Value | Source |

| Current Price | $109,404.80 | CoinMarketCap |

| 24 Hour Trading Volume | $58.33B | CoinMarketCap |

| 24 Hour High Price | $110,561.42 | CoinMarketCap |

| Resistance Level | $112,000–$112,500 | Binance Square |

| All Time High | $111,970.17 | CoinMarketCap |

| Market Cap | $2.17T | CoinMarketCap |

Liquidations Add Fuel to the Climb

Data from CoinGlass shows that more than $110 million in short positions were liquidated within just one hour during the recent spike in the Bitcoin price.

This forced exit by traders who were betting against the price rise added extra buying pressure, which helped to push the Bitcoin price even higher.

Across the crypto market, more than $330 million worth of short positions were cleared out, which is the highest single-day total in more than a month.

Usually, Such aggressive market reaction creates a lot of volatility. But this time, the outcome has been a steady and controlled climb, which stands out in comparison to previous price surges that were chaotic and filled with panic-driven buying.

Analysts Split on What Comes Next

While some analysts think the recent Bitcoin price movement could push the token to new highs soon, others are more cautious. Several analysts, including PlanB, predict Bitcoin could hit $130K by June 2025 if RSI climbs back to 75.

Experts at Bitfinex say that the Cryptocurrency has strong underlying support, but it also faces challenges from uncertain global economic conditions and selling pressure from long-term holders.

Institutional investors are reportedly entering the market again because of clearer regulations and the launch of new crypto ETF products. However, there are still doubts whether this renewed buying interest can last in the long run.

Conclusion

Bitcoin’s strong rise above $110,000 has made traders more hopeful, and many investors are now wondering if it can reach $130,000 soon.

But experts are still not sure, since the overall economy and selling by long-term holders might affect what happens next. Everyone is now closely watching to see if Bitcoin will keep rising or take a break.

FAQs

1. What is Bitcoin’s current price level?

Trading around $109,434.70

2. How close is Bitcoin to its all-time high?

Just over 2% below its all-time high.

3. How much crypto was liquidated recently?

$1.9 billion in derivatives.

4. How much short interest was wiped out in one hour?

Over $110 million.

5. What are analysts watching next?

Inflation data and U.S.-China trade news.

Glossary

Leverage Flush – Strategic clearing of over-leveraged trades, restoring market balance.

Short Squeeze – Rapid price spike driven by forced exits of bearish positions.

Peaceful Rally – Gradual, low-volatility price rise backed by consistent buyer support.

Macro Signals – Key economic cues influencing crypto sentiment and capital flow.

Volatility Pockets – Localized bursts of price movement amid broader market calm.

Sources

Read More: BTC Nears Record High as $1.9B in Shorts Liquidated: Rally Just Beginning?">BTC Nears Record High as $1.9B in Shorts Liquidated: Rally Just Beginning?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.