The DYOR-Ready Playbook: How to Earn Trust Faster and Cheaper Than Paid Hype

0

0

A new Web3 project launches with a large marketing budget, paying influencers and flooding social media with hype. However, in a market marked by scepticism, the most likely outcome will be inundating your community with short-term speculators, who will leave the project within a week without any positive price movement.

Every project founder must ask themselves a fundamental question: “What kind of community do we actually want to build?” If you’re reading this, it’s clear you’re not looking to attract short-term gamblers just to launch and exit. You’re aiming higher: to build a lasting crypto project with a core community of crypto-fluent, long-term believers who will actively support it.

For that specific goal, the traditional “hype-first” approach is one of the most expensive and inefficient strategies a project can take.

In this case, instead of preparing a marketing campaign in the pre-seed stages, Hacken recommends that Web3 builders initially focus on becoming ready for thorough community fundamental research.

The DYOR-Ready Framework: The 5 Pillars of Transparency

The most powerful strategy for building a lasting trust doesn’t hide in social media hype; it lies in proving that you have nothing to hide. Being “DYOR-ready” from day one builds a community of brand advocates more effectively and cheaply than any paid promotion. This playbook provides a framework for doing exactly that.

1. Documentation: Does the Project’s Story Make Sense?

After a quick look at a project’s website, the deep dive always starts with the documentation. Some might think that the whitepaper is a place where you include every concept trending right now and hope it will be successful when reviewed. But in reality, it must simply describe your business, its economy, and its technology. The perfect whitepaper example is Ethereum.

Next is the roadmap, which should be treated just as your map for project development, not a wishlist of “would be nice to do” points.

Crucially, it should have a verifiable track record of past milestones that can be checked against on-chain data or market calendars. A history of shipping on time is one of the strongest signals a project can have.

Finally, there’s technical transparency. This means a clean, well-commented GitHub and, most importantly, a clear, easy-to-find list of all core smart contract addresses. If these contracts are difficult to find, it’s usually assumed there’s something to hide.

It all comes down to this: if the story a project tells in its documentation isn’t clear, credible, and verifiable, it will be dismissed before getting a real look.

2. Tokenomics: Show Me the Vesting

When it comes to tokenomics, the real story is found on-chain. Marketing narratives can say anything, but the blockchain data is the only immutable source of information.

The analysis begins with a simple question: why does this token exist? Is it essential for the protocol to function, or is it primarily a fundraising tool for insiders? A token without a clear, sustainable purpose is just exit liquidity waiting to happen.

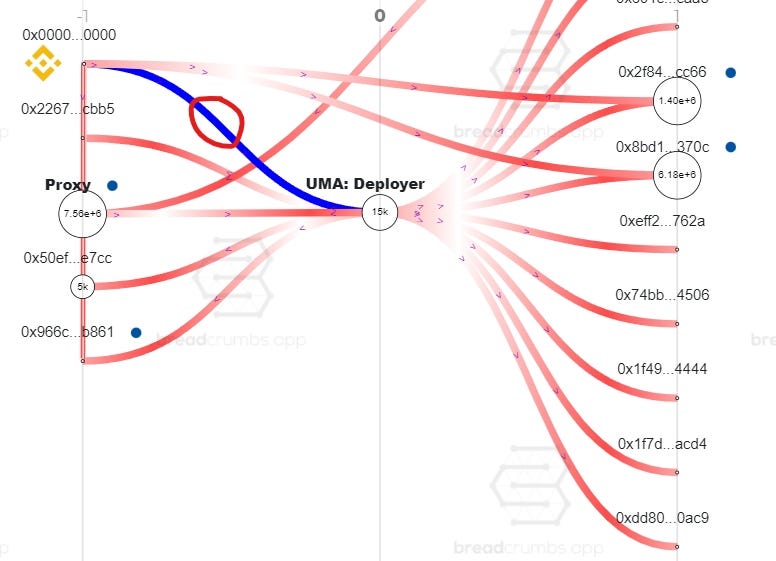

After establishing purpose, the due diligence moves to the money trail. A simple pie chart doesn’t cut it. A proper analysis involves tracing the token from its creation at the Token Generation Event, following it to the primary multisigs, and then to every single allocation wallet — team, VCs, treasury, and so on. The best projects facilitate this by providing a clear map with block explorer links.

The most critical part of this on-chain verification is the vesting. The cliff period, the unlock schedule, and the distribution logic must all be examined. Any difference between the promises made in a whitepaper and what the vesting contract actually enforces is an absolute deal-breaker.

The investors’ goal here is to calculate future sell pressure from every unlocked token and to verify every promise made.

3. Security: Audits, Bounties, and Who Can Rug You?

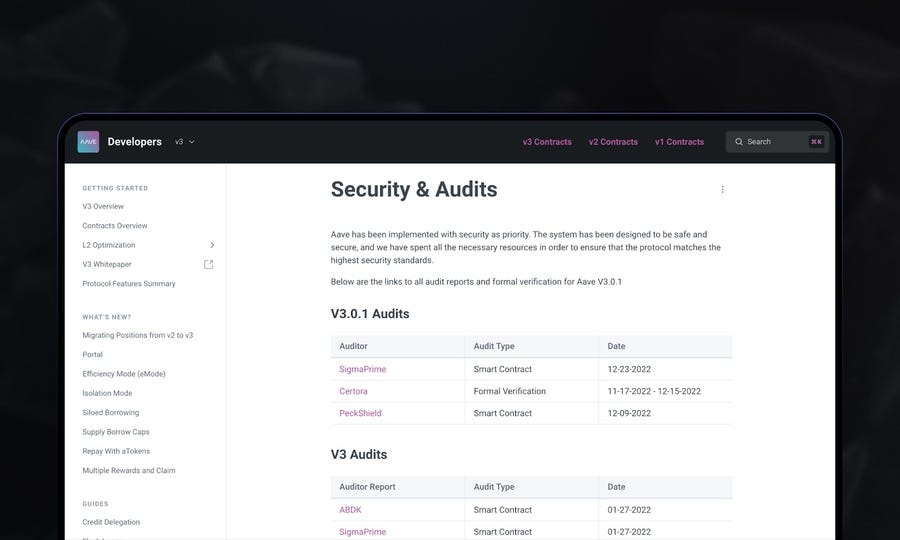

Having the “Audited By ✅” badge on a project’s website is a plus, but that’s just the beginning of the conversation. The key thing to understand is that an audit is not a one-time event; it’s a reflection of an ongoing security culture.

A single token audit from a year ago might appear satisfactory, but what about the core smart contracts? The scope of the reports falls under the field of research. If the contracts have been revised, a new security audit is necessary. Savvy investors are not lazy, as their money is at stake — they will certainly verify whether the deployed code matches the audited code.

Being “DYOR-ready” also means having a running bug bounty. Even the greatest auditor might miss something that a 15-year-old white-hat hacker will find. A project doesn’t need a million-dollar prize pool to get started. Launching even a small bounty shows a real commitment to user security.

4. On-Chain Integrity: Does the Project Practice What It Preaches?

Who will track the flow of tokens from the project’s mint smart contract to the burn addresses to prove the tokens are really burned? Actually, any engaged enough investor will do that.

Their first check is basic hygiene: are all core protocol smart contracts verified on a block explorer?

From there, the forensic analysis of a project’s finances begins, tracing the entire on-chain history from the Token Generation Event.

This is why transparent projects make this process easy. They label their primary wallets using services like ENS — treasury.eth, team-vesting.eth, etc. — and provide direct links in their docs to the TGE and initial distribution transactions.

Most importantly, their treasury is managed professionally. Every transaction is public, and large, unexplained transfers to new anonymous wallets are one of the biggest red flags there is.

5. Team & Governance: Who is Truly in Control?

Ultimately, every investment in a decentralized project is a bet on the people behind it. A brilliant idea is worthless without a credible and responsible team to execute it, making the assessment of this human element crucial.

The due diligence process looks beyond simply checking if a team is “doxxed” and delves into their actual history. For example, a team of marketing professionals claiming to develop a new ZK protocol will face intense critique. A public track record on LinkedIn or GitHub relevant to the project mission is, on the other hand, a big plus. Past projects will also be examined — a record of success is highly valuable, while any links to failed or questionable projects are immediate red flags.

It all hinges on the human element. A public, credible team with transparent governance offers the strongest defence a project can have against failure. It demonstrates that real people with reputations on the line are dedicated to creating something lasting.

The ROI of Transparency

It’s easy to look at the crypto market and see a casino, but that’s only a snapshot. Even speculative traders learn to look closer at fundamentals, and a new wave of capital is arriving from Web2 demanding transparency and a clear future of the projects they invest in — they are used to playing the long game and to profit on it.

But the current situation looks more like a chaotic market, where it’s almost impossible for a new user to separate the real builders from scams because everyone appears the same.

In just Q1 2025, $2B was lost in DeFi, which is 96% higher than in Q1 2024. Think of the newcomer who trusts the hype behind a new project, invests their savings, and gets rugged. They wake up to a dead token and a deleted Discord. They lose both the money and all the faith in Web3 and become its newest, loudest critic. This is what kills mass adoption.

Hacken’s solution to this problem is to train a new generation of DYOR experts through our Trust Army initiative. When you combine this newly DYOR-certified group with existing smart money, you get the highest-quality community a project could ever attract — the long-term believers and powerful advocates.

And you can’t win this audience with paid hype. You win them by being “DYOR-ready” — having a project that advocates for its real value, transparency, and openness. And that’s where transparency becomes the best marketing tool.

At the same time, being transparent and DYOR-ready makes B2B life of the project easier, as they have tons of ready data to show to VCs, launchpads, CEXs, grants and others.

In a Market of Cults, Verifiable Truth Wins

The playbook for launching a Web3 project is changing. In a maturing market, the old strategy of building trust with a massive marketing budget will no longer be effective.

The projects that will survive and define the next era of crypto will be those with the most verifiable integrity. This shift doesn’t just benefit investors; it raises the standard for the entire industry. If we want to onboard the next wave of retail users instead of creating more crypto horror stories that scare them away, this level of transparency is the only path forward. When projects are built for scrutiny from day one, they create a market where capital flows to substance, not just speculation — and that is how we build the trust needed for mass adoption.

Preparing for rigorous, community-led due diligence isn’t the easy path, but it’s the only one that leads to lasting trust.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.