Metaplanet Trades Below 1x mNAV for First Time Since Starting Bitcoin Treasury Plan

0

0

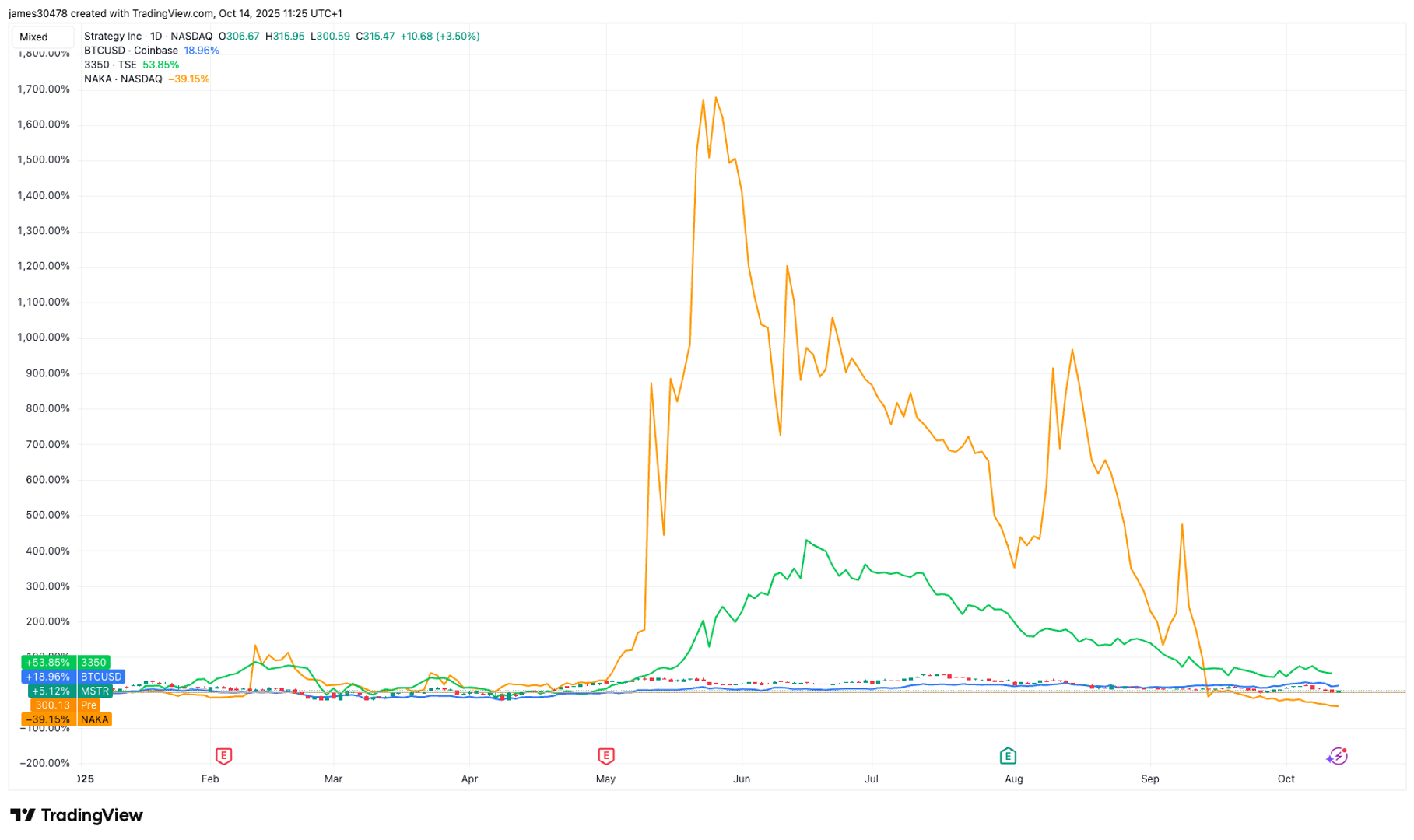

Metaplanet (3350) is now trading below a 1.0x multiple to net asset value (mNAV) for the first time since launching its bitcoin treasury strategy back in 2024.

mNAV can be defined as a metric that measures the market capitalization of a company relative to the value of the crypto assets it holds on its balance sheet.

According to the company’s website, its currently valued at 0.99x mNAV. Metaplanet’s definition of mNAV includes total debt, which stands at $24.68 million, representing its aggregate outstanding debt. Metaplanet is the fourth-largest bitcoin treasury holder globally, with 30,823 BTC, representing a treasury worth $3.5 billion.

The company’s share price fell 12% on Tuesday, closing at 482 yen. While, its share price is up 35% year-to-date.

Similarly, KindlyMD (NAKA) is also trading below a 1.0x mNAV. Its website shows that shares are currently valued at 0.959x mNAV. NAKA holds 5,765 BTC worth at current prices of $646 million. Its current share price is trading at $0.85, down over 95% from its all-time high.

Meanwhile, the largest bitcoin treasury holder, Strategy (MSTR), continues to command one of the highest premiums in the industry with an mNAV multiple of 1.48x. This figure includes the enterprise value, incorporating perpetual preferred shares and convertible debt.

Strategy holds 640,250 BTC, valued at roughly $72 billion at current prices. Despite this massive treasury, and accumulating 193,850 BTC in 2025, the company’s stock has underperformed, gaining only 5% year-to-date compared to bitcoin’s 19% rise over the same period.

According to Forbes, more than 228 publicly traded companies announced a digital asset treasury (DAT) in 2025, collectively investing $148 billion into crypto. The report also notes that 15% of these DATs are trading below a 1.0x mNAV,.

0

0

Gestisci cripto, NFT e DeFi in un unico luogo

Gestisci cripto, NFT e DeFi in un unico luogoConnetti in sicurezza il portafoglio che usi per iniziare.