Senator Lummis Proposes Crypto Tax Bill Aims to Shield Staking and Mining Rewards

0

0

U.S. Senator Cynthia Lummis (R-WY) introduced a sweeping digital-asset tax reform package, seeking to bring the Internal Revenue Code in step with everyday crypto usage. The crypto tax bill revives language that never made it into President Trump’s budget plan and aims to lift burdens on small transactions while ending what Lummis calls the “double taxation” of network validators.

Crypto Tax Bill: Key Provisions

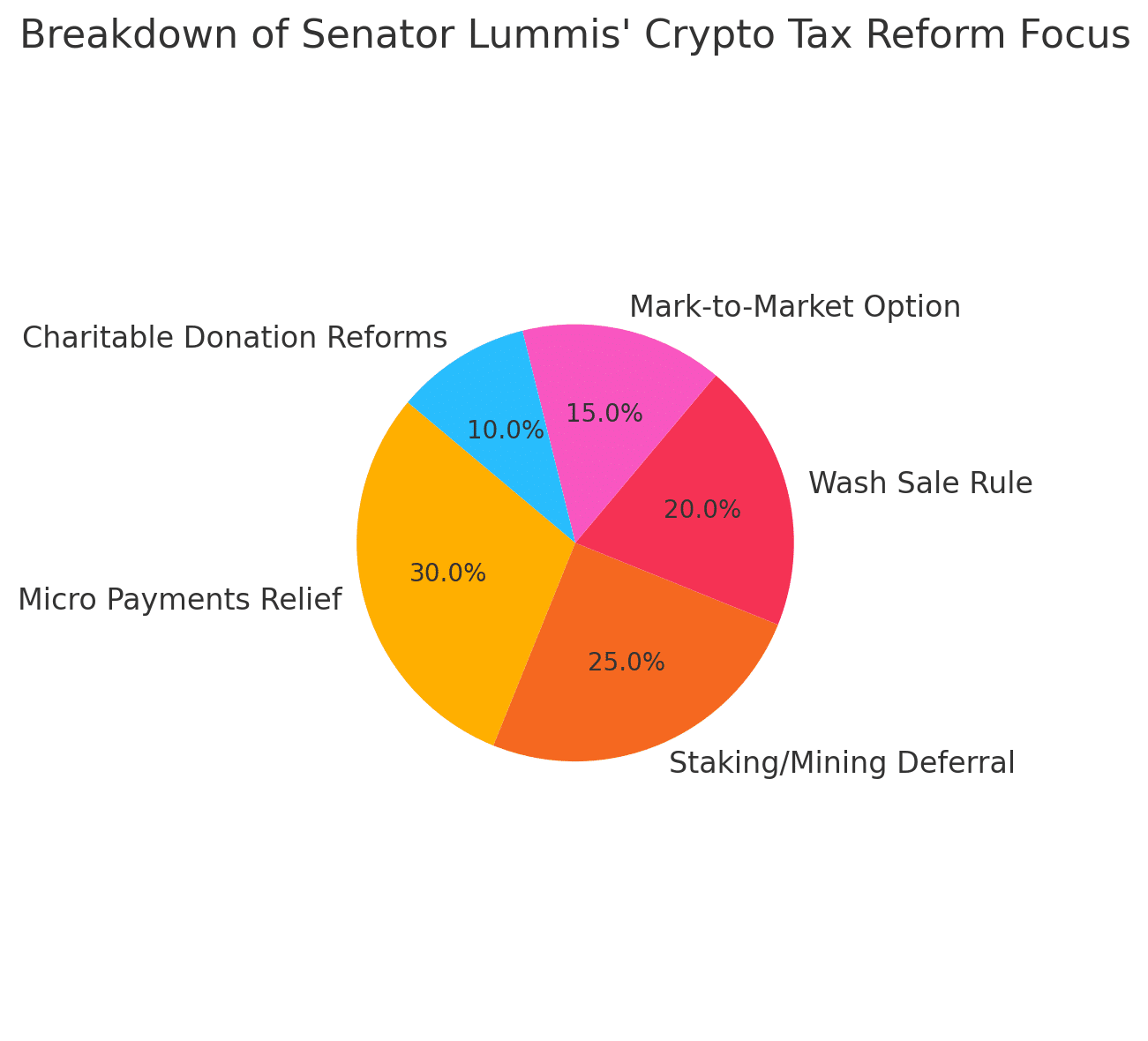

At the heart of the proposal is a $300 de minimis exemption for capital gains on crypto transactions, capped at $5,000 per taxpayer per year and indexed to inflation after 2026. The change would let Americans buy coffee or pay for streaming services with Bitcoin without calculating gains on every swipe.

Beyond everyday spending, the crypto tax bill would defer income recognition on mining and staking rewards until the assets are actually sold, mirroring the treatment of commodities pulled from the ground. It also extends securities-lending rules to crypto loans, applies the 30-day wash-sale rule to digital assets, lets dealers elect mark-to-market accounting, and removes costly appraisal requirements when donors give actively traded tokens to charity.

Why a Stand-Alone Measure Now?

Most of these tax fixes were floated as amendments to the administration’s spending crypto tax bill but were cut in late-stage negotiations. Lummis, who leads the Senate’s Digital Assets Subcommittee, opted to repackage them in a single vehicle that can move through the Finance Committee on its own timetable.

Fiscal Impact and Political Outlook

According to a Joint Committee on Taxation analysis, the reforms are projected to raise roughly $600 million in net revenue between 2025 and 2034, largely through tighter wash-sale enforcement and mark-to-market elections.

Supporters, including industry groups such as the Chamber of Digital Commerce, say the bill strikes a pragmatic balance between innovation and compliance, though some policy analysts argue the $300 threshold is still too low to spur mass retail adoption. The measure now awaits a hearing; lawmakers could fold it into a larger tax package or fast-track it ahead of the next budget cycle.

Next Steps

Lobbyists for exchanges and wallet providers are pushing for the exemption to rise to $600, while anti-tax-evasion advocates want tighter aggregation rules. If the Finance Committee advances the text unchanged, a floor vote could follow as early as September. Either way, Lummis’ crypto tax bill initiative has reignited the debate over how U.S. tax policy can keep pace with the rapid evolution of blockchain technology.

FAQs:

1. What does Senator Lummis’ crypto tax bill propose?

It introduces a $300 exemption for small crypto transactions and defers taxes on staking and mining rewards until assets are sold.

2. Who benefits from the new crypto tax rules?

Everyday crypto users, miners, stakers, and donors of digital assets would benefit from reduced tax complexity and improved treatment.

3. When could the crypto tax bill become law?

If advanced by the Senate Finance Committee, the bill could reach the floor for a vote by September 2025 or be added to a broader tax package.

Glossary of Key Terms:

De Minimis Exemption: A rule allowing small transactions (under $300) to be excluded from capital gains tax reporting.

Staking Rewards: Earnings received by participating in blockchain validation via proof-of-stake mechanisms.

Mining Rewards: Compensation for validating transactions on a proof-of-work blockchain like Bitcoin.

Wash-Sale Rule: A tax regulation that disallows claiming a loss on a security sold and repurchased within 30 days, now proposed for crypto.

Mark-to-Market Accounting: A method allowing crypto dealers to report gains/losses based on fair market value at year-end.

Capital Gains: The profit made from selling an asset for more than its purchase price, which is typically subject to tax.

Securities Lending: The practice of loaning crypto or other assets in exchange for collateral and interest, now potentially covered by IRS rules.

Sources/References

Read More: Senator Lummis Proposes Crypto Tax Bill Aims to Shield Staking and Mining Rewards">Senator Lummis Proposes Crypto Tax Bill Aims to Shield Staking and Mining Rewards

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.