Bitcoin ETF Holders Face $7B Loss as BTC Risks Drop to $65K

0

0

This article was first published on The Bit Journal.

Bitcoin ETF losses have climbed to $7 billion as the cryptocurrency slips below important price levels, raising concerns about how US spot Bitcoin ETFs and the broader market will hold up. This decline has put many US spot Bitcoin ETF investors in significant unrealized losses, showing that both institutional and retail participants are feeling the strain.

During the past weekend, Bitcoin (BTC) dropped to $74,609 before recovering and is currently trading at $78,775.77. Market experts note that if demand does not pick up, continued ETF outflows could drive Bitcoin down toward $65,000, adding further pressure on the market.

What Are Bitcoin ETF Outflows and Why Do They Matter?

Bitcoin ETF outflows show the unrealized drop in value for investors holding spot Bitcoin ETFs. Alex Thorn, head of research at Galaxy Digital, noted that this price performance indicates Bitcoin is trading below the average cost basis of US ETFs, which can influence investor behavior and increase market volatility.

Unlike self-custody holders, ETF investors, including advisors and institutional allocators, often adjust their portfolios following strict rules, and falling prices can trigger sell-to-even actions.

Across 12 US spot Bitcoin ETFs, the average purchase price is around $90,200 per Bitcoin, reflecting a paper loss of roughly 15%. Jim Bianco of Bianco Research calculated a combined average purchase price of $85,360 per Bitcoin, implying an average loss of about $8,000 per BTC, totaling roughly $7 billion for ETF holders.

Who Is Most Affected by the Losses?

ETF investors who bought Bitcoin at higher prices are mostly underwater. Jim Bianco of Bianco Research pointed out that the 12 spot Bitcoin ETFs together hold around 1.29 million BTC, valued at more than $115 billion. This represents roughly 6.5% of all Bitcoin in circulation.

When combined with corporate holdings such as Strategy, formerly MicroStrategy, the total reaches about 10% of the Bitcoin supply. Strategy has an unrealized profit of $1.17 billion, with an average purchase price of $76,020 per Bitcoin, while ETF investors, having paid higher prices, are facing losses. James Check of Checkonchain added that 62% of ETF inflows are now underwater, showing the extent of the correction for these funds.

How Are Outflows Driving Bitcoin Price?

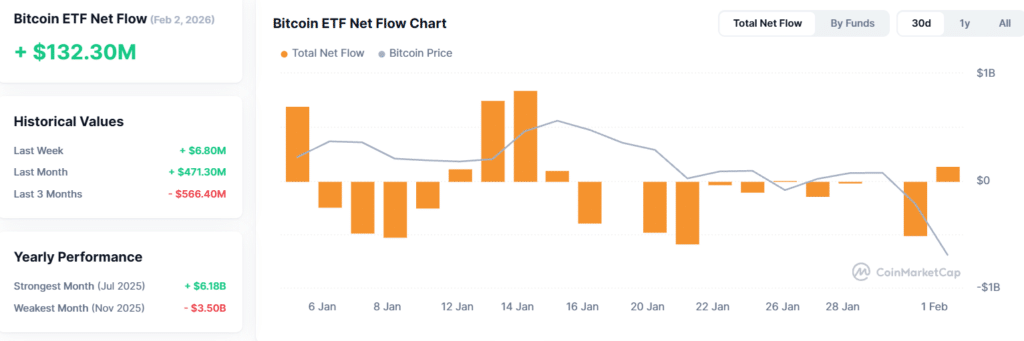

US spot Bitcoin ETFs are seeing significant net outflows, totaling roughly $6.18 billion between November 2025 and January 2026, marking the longest consecutive outflow period since their 2024 launch. Redemptions often happen in large bursts, with net redemptions exceeding $1.3 billion during the last two trading days of January.

The 12 spot ETFs also experienced a nine-day outflow streak, though it was punctuated by a modest inflow of $6.3 million, showing that ETF flows are not entirely one-directional and can vary day to day.

Bianco highlighted that the average trade size for Bitcoin ETFs is just $15,800, much smaller than the SPDR S&P 500 ETF Trust at $111,300 and SPDR Gold Shares at $87,000, indicating that ETF activity is more retail-driven and more sensitive to price swings. If the ETF complex continues to shed more than $6 billion every three months, the implied monthly net outflow is roughly $2 billion, which at a Bitcoin price of $75,000 corresponds to 27,000–28,000 BTC that the market must absorb each month.

K33 Research found that Bitcoin’s price remains closely tied to ETF flows, with an R-squared of 0.80, meaning ETF activity explains around 80% of 30-day BTC price changes. These factors show how Bitcoin ETF losses can amplify selling pressure, create a feedback loop, and increase short-term volatility.

How Could ETF Redemptions Affect Bitcoin’s Price?

Ongoing ETF redemptions put significant pressure on Bitcoin’s price. If net outflows of $2 billion per month continue, the market would need to absorb an extra 27,000 to 28,000 BTC each month at a $75,000 price level. This is much higher than new supply from the 2024 halving, which adds roughly 13,500 BTC per month.

Analysts say that if ETF outflows stay at this pace, it would be like absorbing two months of new supply every month unless other buyers step in. Alphractal CEO Joao Wedson noted that if redemptions keep going, Bitcoin could face strong headwinds and fall toward a key support level of $65,500.

Can ETFs Stabilize the Market?

While Bitcoin ETF losses are substantial, the market could stabilize if flows return to normal. Analysis indicates that mid-$75,000s could act as temporary support.

If investors buy at these levels, ETFs might shift from adding selling pressure to becoming marginal buyers. However, if redemptions continue, the current paper loss trend could persist, leaving Bitcoin ETF investors underwater and keeping downward pressure on BTC.

Conclusion

Bitcoin ETF losses of $7 billion highlight the delicate balance between ETF flows, investor decisions, and Bitcoin pricing. With 12 major US spot ETFs holding a significant portion of BTC, ongoing outflows could push prices down toward $65,000.

Experts stress the importance of closely watching ETF activity, as continued redemptions could shape the market’s direction in the near term. While temporary support levels may provide relief, the interaction between ETFs and Bitcoin price remains a key factor for both institutional and retail investors.

Glossary

Spot Bitcoin ETF: An ETF that holds real Bitcoin and follows its live price.

Paper Loss: A loss on an investment that hasn’t been sold yet.

Underwater: When an investment is worth less than what was paid for it.

Outflows / Redemptions: Money pulled from ETFs, which can trigger Bitcoin sales.

Average Cost Basis: The average price investors paid for their Bitcoin.

Frequently Asked Questions About Bitcoin ETF Outflows

How much have US Bitcoin ETF investors lost?

US Bitcoin ETF investors have lost about $7 billion on paper, which is roughly 15% of their holdings.

Why are ETF investors underwater?

Many ETF investors bought Bitcoin at higher prices, around $90,200 per coin, while the current price is about $78,775.

How much Bitcoin do the 12 US spot ETFs hold?

The 12 US spot ETFs hold about 1.29 million BTC, which is around 6.5% of all Bitcoin in circulation.

Could ETF redemptions push Bitcoin even lower?

Yes, if ETF outflows continue at $2 billion per month, Bitcoin may drop toward $65,500 unless new buyers enter the market.

Which investors are most affected?

ETF investors who bought Bitcoin recently at high prices are most affected, while earlier buyers like corporate holders face smaller losses.

Sources

Read More: Bitcoin ETF Holders Face $7B Loss as BTC Risks Drop to $65K">Bitcoin ETF Holders Face $7B Loss as BTC Risks Drop to $65K

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.