$3.6B Bitcoin Inflow to Accumulation Addresses in a Single Day, Highest Since 2022

0

0

Highlights:

- Bitcoin wallets show confidence with a huge accumulation of BTC.

- Political instability and market shifts spark optimism for Bitcoin’s rise.

- Experts predict Bitcoin could hit $250,000 by the end of 2025.

Bitcoin saw a significant spike in accumulation, with the largest single-day inflow to accumulation addresses in over three years. On April 9, CryptoQuant tracked a significant transfer of 48,575 BTC into accumulation addresses. The numbers show that people have been quietly buying and holding crypto after the recent market ups and downs. This was the biggest amount of Bitcoin added in one day since February 1, 2022, based on the latest data from CryptoQuant.

The move, worth about $3.6 billion, happened during a sharp market drop caused by rising trade tensions after President Trump brought back tariff policies against China. Interestingly, a similar $3.6 billion worth of Bitcoin was added on February 1, 2022, when Bitcoin was around $38,400 — much lower than today’s price of $80,000. In the past, accumulation addresses have shown a habit of buying smartly during tough economic times.

Massive $3.6 Billion Bitcoin Inflow to Accumulation Addresses!

“Bitcoin accumulation addresses received 48,575 BTC — the largest single-day inflow since February 1, 2022. When accumulation addresses move this aggressively, it’s worth paying attention.” – By @burak_kesmeci pic.twitter.com/MVIFUcXKWz

— CryptoQuant.com (@cryptoquant_com) April 10, 2025

Bitcoin Accumulation Surge Signals Confidence from Long-Term Investors

This recent surge shows that institutions or long-term investors are more confident again, as these wallets had been seeing only small, steady growth before. The fact that these two huge inflows are almost the same value in USD, despite being three years apart, suggests a pattern of buying during important market moments. Experts say this is something to keep an eye on.

CryptoQuant also observed increasing demand from wallets holding between 1,000 and 10,000 BTC. These wallets, not usually linked to exchanges or miners, are seen as influential. Their historical impact on market dynamics makes their actions particularly noteworthy. On April 9, the number of such wallets grew faster than their 30-day average, confirming the accumulation trend.

Experts Share Insights on BTC’s Future

Seeing this trend of accumulation, industry leaders are growing even more confident in Bitcoin’s future. This week, Cardano founder Charles Hoskinson said he’s very positive about Bitcoin, predicting it might reach $250,000 by the end of this year.

Bitcoin to hit $250,000 this year and Magnificent 7 to adopt stablecoins, Cardano founder predicts https://t.co/OoHgwxRH4m

— CNBC (@CNBC) April 10, 2025

His positive outlook is based on factors like more people using crypto worldwide, increasing interest from big investors, and changes in regulations. Hoskinson also pointed out that political instability and expected lower interest rates could be key reasons for Bitcoin’s rise.

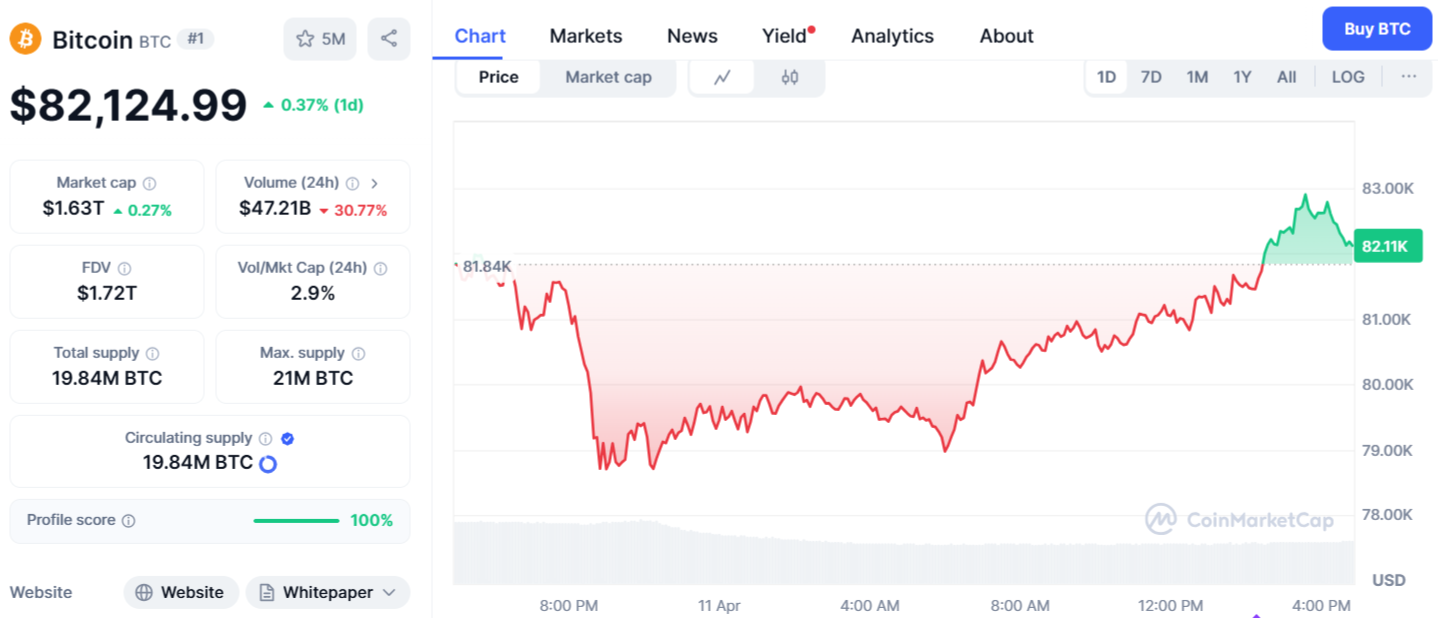

Although he expects a short slowdown in the next few months, he predicts a strong recovery starting around August or September, which could lead to a big rally driven by a better investor mood and changes in the economy. Matt Hougan, Chief Investment Officer at Bitwise, also said that Bitcoin is likely to reach new all-time highs and go even higher once the market becomes more stable. Bitcoin is currently priced at $82,124, down 0.37% in the last 24 hours.

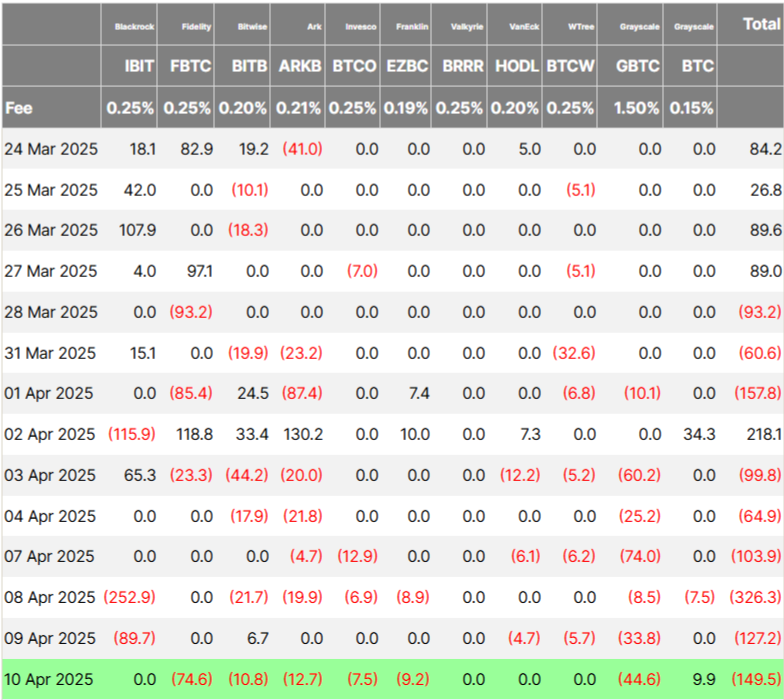

Bitcoin ETFs See $149M in Outflows

Although on-chain metrics appear bullish, institutional interest remains muted. On April 10, U.S. spot Bitcoin ETFs faced net outflows of $149.5 million, continuing a six-day streak of withdrawals. Out of the 12 ETFs, the largest outflow came from Fidelity at $74.6 million. Grayscale’s main trust followed with $44.6 million, while its Mini Bitcoin Trust saw $9.9 million pulled.

ARK 21Shares and Bitwise saw modest outflows of $12.7 million and $10.8 million. Meanwhile, Franklin and Invesco recorded less than $10 million in outflows. The other five ETFs had no net movement.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.