XRP Crash Alert: Lower Highs, Weak Volume, and a Potential Meltdown Ahead

0

0

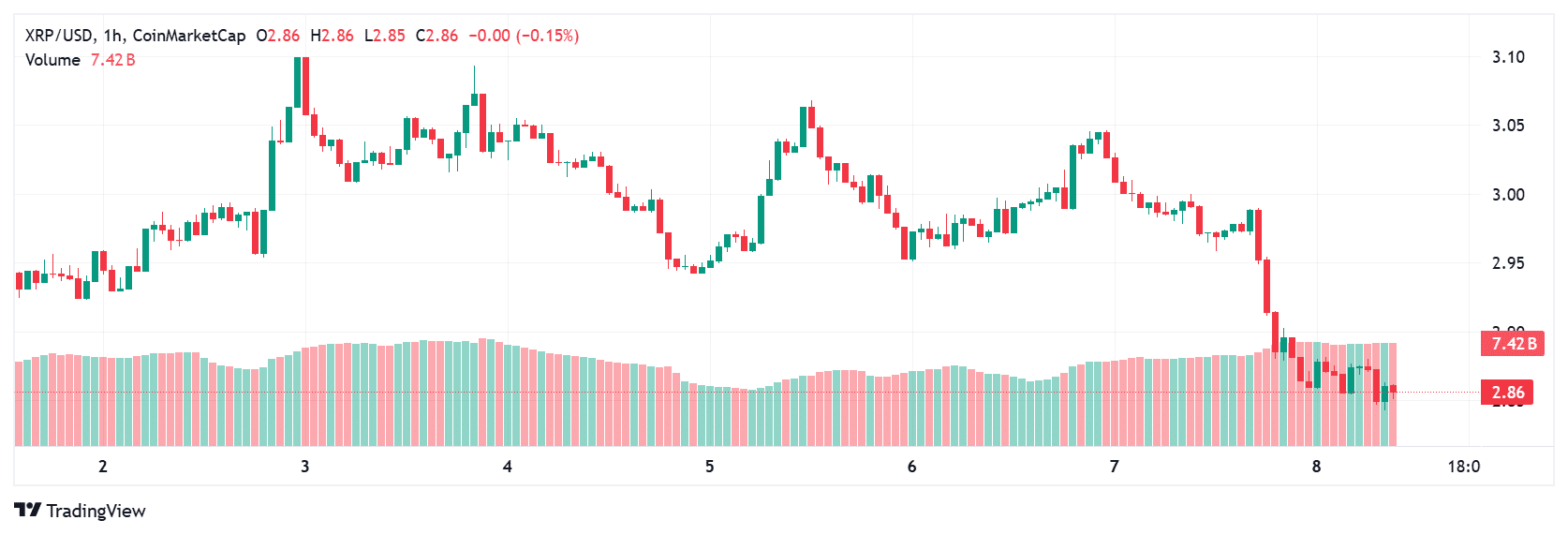

XRP is once again in the eye of a storm. Social chatter has turned gloomy, with panic among small traders reaching its highest level since the U.S. tariff turmoil under Donald Trump. Analysts warn this surge in fear could trigger a classic setup, one that sometimes leads to what many call an XRP crash, yet also carries the seeds of recovery.

Retail Panic Meets Whale Calm

According to on-chain data, bearish mentions now outnumber bullish ones for XRP, signaling widespread fear among retail traders. That emotional shift often precedes volatility. In April, a similar pattern ended with XRP falling over 25%, only to rebound by more than 120%.

Market analysts say the same playbook may repeat. “Retail traders are bailing near the lows, but the whales are quietly absorbing that pressure,” Santiment data analysts wrote on X. In simpler terms, large investors are taking advantage of emotional selling, a recurring theme before major reversals.

On-Chain Signals Defy Sentiment

While retail conversations scream caution, blockchain data tells a calmer story. Wallets holding over 100 XRP have grown steadily over the past few months, indicating accumulation during price stagnation. This move undercuts the XRP crash narrative by showing that deeper liquidity players aren’t fleeing.

Additionally, optimism around potential exchange-traded fund (ETF) approvals has helped offset fear. Institutional desks see XRP’s legal clarity as a competitive edge, positioning it as a viable candidate for broader exposure once regulatory frameworks mature.

Technical Picture: Breakout or Breakdown?

From a technical standpoint, XRP recently broke above a symmetrical triangle, a setup that often precedes large moves. The asset is now retesting that breakout zone. If it bounces cleanly, analysts see room for a rally toward $4.29, about 45% higher than current levels.

But the other side of that coin still looms. A failure to hold above the upper boundary could invite another XRP crash, possibly dragging prices back toward $2.33. Traders watching this level know it’s a psychological pivot: resilience could spark a fresh leg up, while a breakdown might confirm the bearish case.

Macro Tailwinds and Market Psychology

Beyond charts, macro sentiment also plays its role. The weakening U.S. dollar and uncertainty around the ongoing government shutdown have lifted risk assets broadly. Yet, that hasn’t fully translated into confidence for XRP.

“Fear is often the final ingredient before a trend reversal,” one analyst noted on X. Still, timing that pivot remains a challenge. Emotional overreactions, herd exits, and short-term liquidity crunches can easily magnify an XRP crash, even when the fundamentals look supportive.

Conclusion

The narrative surrounding XRP is split in two: emotional retail panic versus calculated whale confidence. History shows that periods of extreme pessimism sometimes birth unexpected rebounds. Whether this turns into another XRP crash or a sharp reversal will depend on how well the market holds its key support levels in the coming days.

Until proven otherwise, XRP stands at a crossroads, shaken but not broken.

Frequently Asked Questions

1. Why is there growing talk of an XRP crash?

Because retail traders are showing extreme fear, technical charts are mixed, and the token has failed to sustain key breakouts.

2. Are whales buying or selling XRP now?

Data indicates whales are accumulating, suggesting confidence in long-term potential despite short-term panic.

3. What could trigger a sharp XRP crash from here?

A decisive drop below the $2.60–$2.70 support area could accelerate selling pressure and panic liquidations.

4. Can ETF approval prevent a crash?

While it might not stop short-term volatility, ETF optimism could restore investor confidence over time.

Glossary

Retail FUD: Fear, uncertainty, and doubt among small traders that often leads to emotional selling.

Whales: Large crypto holders capable of influencing market trends through high-volume trades.

Symmetrical Triangle: A chart pattern signaling potential for a breakout or breakdown.

Retest: When a price revisits a previous resistance or support level to confirm its strength.

Read More: XRP Crash Alert: Lower Highs, Weak Volume, and a Potential Meltdown Ahead">XRP Crash Alert: Lower Highs, Weak Volume, and a Potential Meltdown Ahead

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.