Solana’s ‘Death Cross’ is Looming as SOL Struggles in the $150 Range

0

0

Since April 23, Solana’s price has oscillated within a tight trading range, facing resistance near $153.67 and finding support around $145.68.

A growing wave of bearish pressure threatens to break this range to the downside, with a key technical indicator on the verge of confirming a major sell signal.

Solana Faces Breakdown Risk as Sellers Tighten Grip

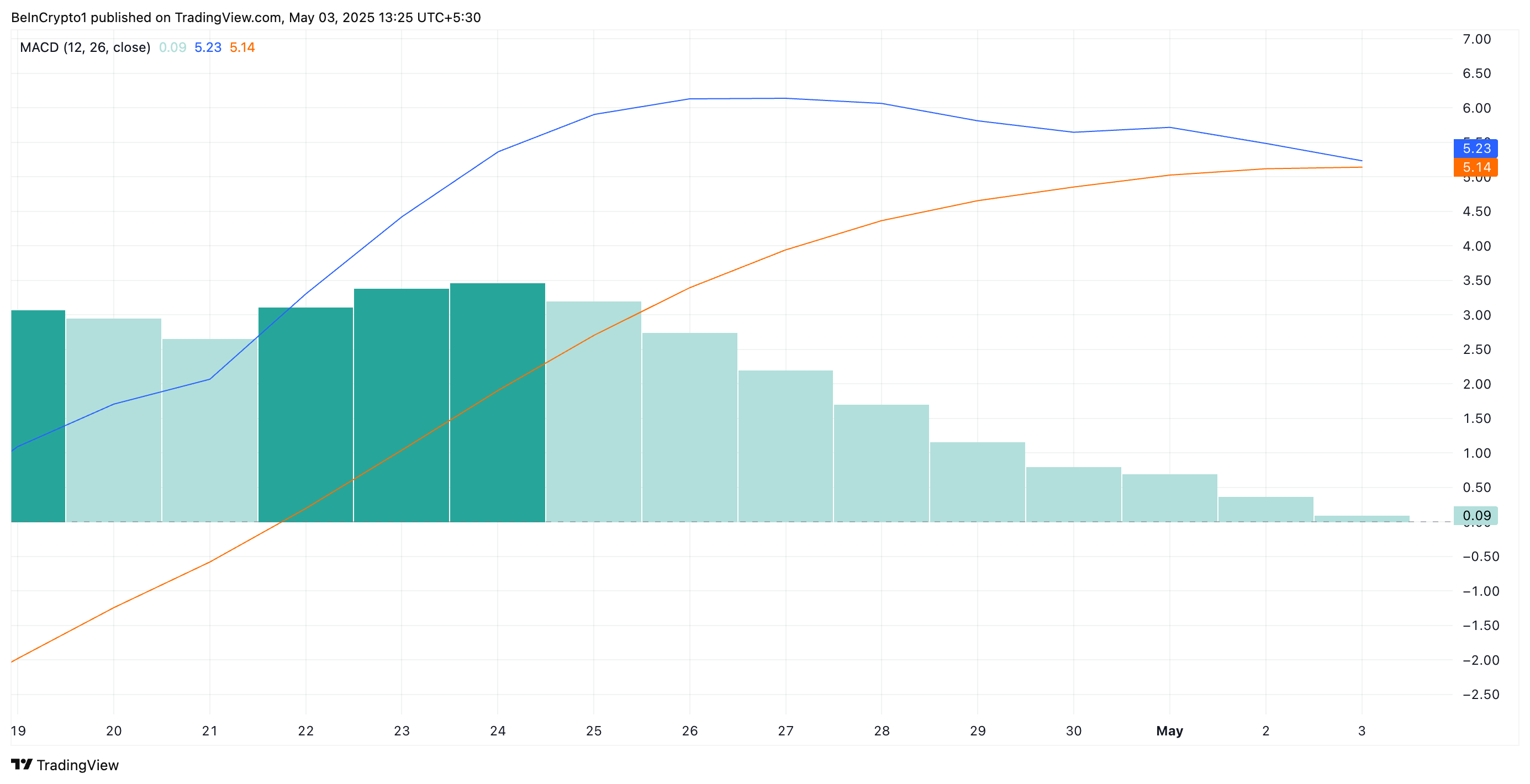

SOL’s Moving Average Convergence Divergence (MACD) indicator is poised to form a death cross, a bearish crossover where the MACD line dips below the signal line.

SOL MACD. Source: TradingView

SOL MACD. Source: TradingView

As of this writing, the coin’s MACD line (blue) rests near the signal line (orange), awaiting a catalyst to push it under. This pattern often precedes a sustained downtrend and is widely viewed by traders as a sign of weakening price strength.

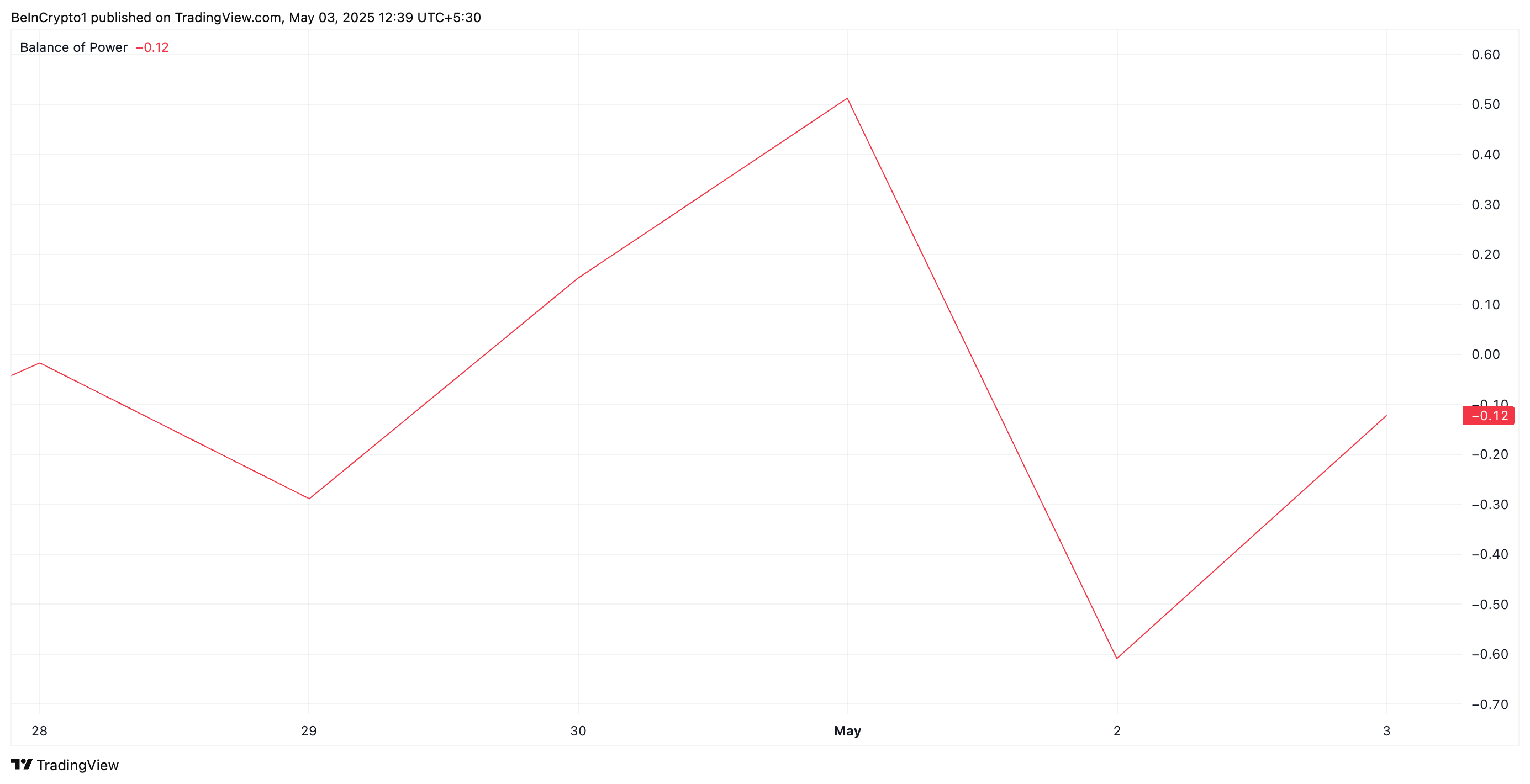

Further, SOL’s Balance of Power (BoP) is currently negative, reinforcing the downtrend. This indicates that sellers have gained market control. At press time, this stands at -0.12.

SOL BoP. Source: TradingView

SOL BoP. Source: TradingView

The BoP indicator measures the strength of buying versus selling pressure by comparing the closing price to the trading range over a given period.

When an asset’s BoP is positive, it signals that buyers are in control, indicating strong upward momentum and potential for continued price gain.

On the other hand, as with SOL, a negative BoP value indicates that sellers dominate the market. It suggests an increase in downward pressure on SOL and hints at the potential commencement of a new decline phase.

SOL Faces Key Support Test Amid Mounting Sell Pressure

As bearish momentum builds, SOL risks breaking below the support level at $145.68. A decisive break beneath this threshold would confirm a short-term downtrend and potentially trigger a deeper decline toward $142.32.

Should buyers fail to regain control at that point, SOL could slide further to test the lower support at $133.94.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingView

However, this bearish outlook could be invalidated if fresh demand emerges and buying interest strengthens. In that bullish scenario, SOL may overcome resistance at $153.67, opening the door for a rally toward $171.50.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.