Stellar Price Poised for a Breakout Towards $0.40 Amid Rising TVL

0

0

Highlights:

- The Stellar price is showing signs of a rebound towards $0.40, as the trading volume rallies 34%.

- Growing Defi TVL and positive on-chain metrics indicate positive momentum in the market.

- Technical indicators signal a fading bearish momentum, as bulls target $0.45-$0.50 in the medium term.

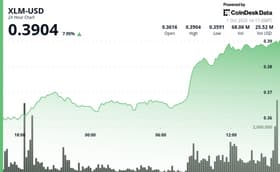

The Stellar price has edged slightly lower at the falling wedge, trading at $0.36. Its daily trading volume has surged 34% to $250 million, indicating growing investor confidence. If the falling wedge pattern continues, bull traders will benefit, as they may strike a leg up. The optimists are buoyed by the increasing Total Value Locked (TVL) and rising bullish bets from traders. Additionally, an XLM upside breakout can be expected due to fading bearish pressure, as indicated by momentum indicator signals.

XLM DeFi TVL and Derivatives Data

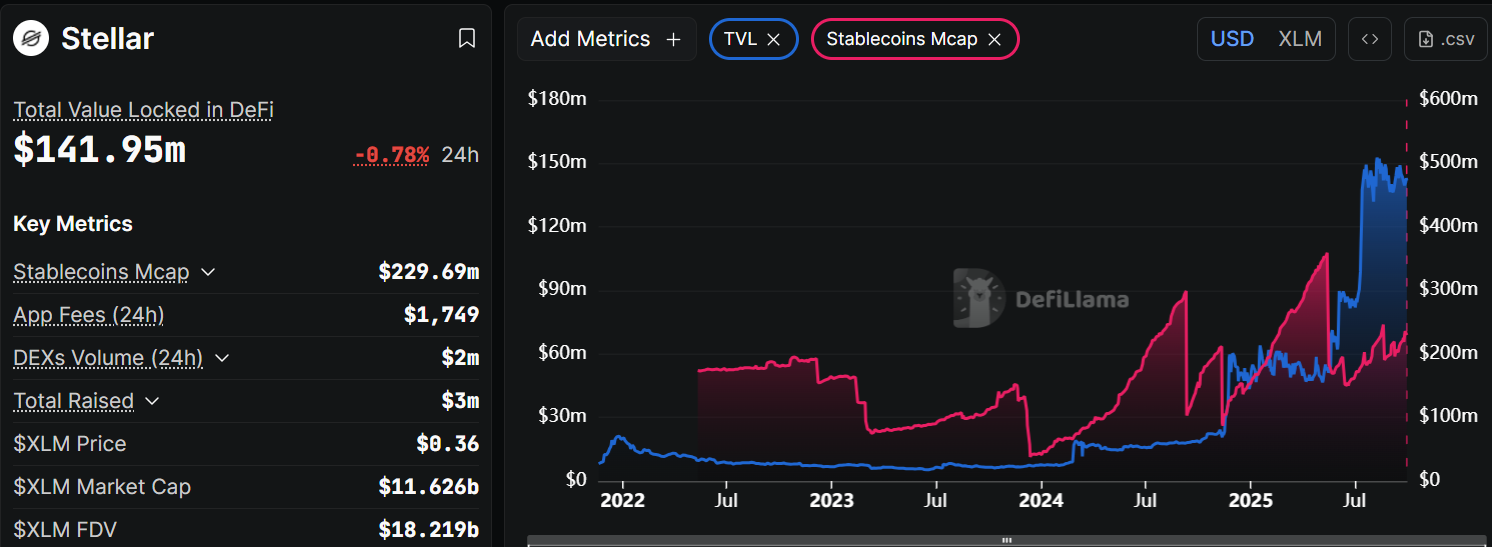

As Stellar continues to improve its ecosystem, crypto users have kept a close eye on the altcoin project recently. The project appears to be experiencing considerable growth. According to DeFiLama data, the TVL of Stellar’s DeFi has risen to $141.95 million, from $139.12 million, recorded on Saturday.

Notably, the Stellar network has a stablecoin market capitalization of $229.69 million. The increase in TVL means that more people are depositing or using their assets in protocols built on the XLM blockchain.

Furthermore, the market cap is $11.63 billion. Similarly, the fully diluted valuation (FDV) is $18.21 billion. These numbers underscore solid investor confidence and robust tokenomics, as Stellar has been garnering attention through partnerships, the tokenization of real-world assets, and payment rail integrations.

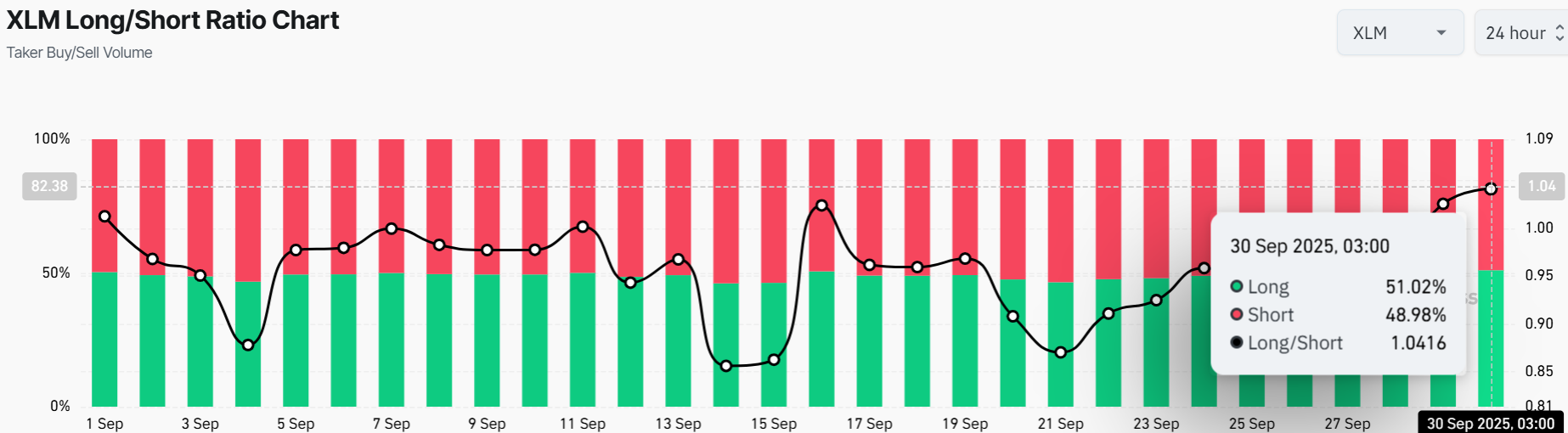

Meanwhile, the market sentiment for the Stellar price is delicately balanced. According to Coinglass’ long/short ratio chart as of September 30, the long positions, at 51.02%, have maintained a slight lead over the shorts, at 48.98%. This slight advantage suggests a bullish stance for now. Moreover, the long/short ratio stands at 1.0416.

Stellar Price Outlook: Bulls Target a Break Above $0.40

The Stellar price is currently trading well within a falling wedge pattern, which seems to be favouring the bulls. The token is exchanging hands at $0.36, with bulls eye to overcome the key resistance around $0.38. Often, the falling wedge pattern is viewed as a bullish pattern, as it suggests that buyers are entering the market. Moreover, the key support around $0.32 gives the bulls strength to push further to the upside.

The Relative Strength Index (RSI) of 46.89 indicates a neutral position. The MACD is indicating a bearish divergence with its values moving towards zero. If the histogram turns positive(green bars), it could mean there will be some bullish momentum in early October.

Looking ahead, if the Stellar price holds above the $ 0.32 support, we could see it test the $0.40 mark if the resistance at $0.38 gives way. On the other hand, if the $0.38 resistance proves too strong, a solid ground at $0.32 will act as the safety net for the bulls.

In the midterm, the Stellar price could break out of the falling wedge pattern, reinforced by positive on-chain metrics. In such a case, a rally to $0.45-$0.50 seems likely. However, bulls first need to overcome the resistance zone.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.