Bitcoin Futures Hit $72B, Is $110K Price Breakout Imminent?

0

0

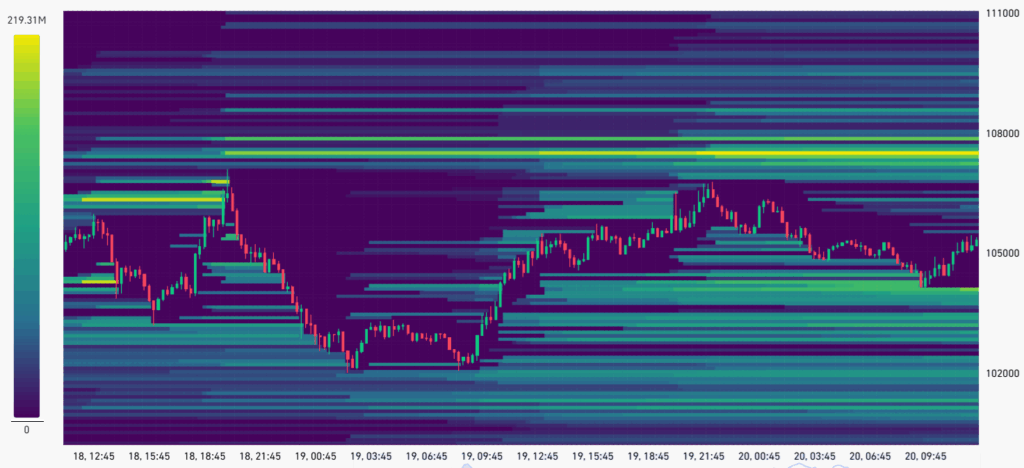

Bitcoin futures markets recorded a historic surge in open interest on May 20, sparking new speculation over a potential price breakout. The data pointed to heightened institutional activity and elevated leverage, setting the stage for a possible short squeeze above the $107,000 level.

Bitcoin Records $72B in Open Interest Signaling Bullish Sentiment

Bitcoin’s open interest across major exchanges rose to $72 billion on May 20, according to CoinGlass data. That marked an 8% weekly jump from $66.6 billion.

Institutional platforms led the surge, with the Chicago Mercantile Exchange (CME) hitting $16.9 billion, followed by Binance at $12 billion.

Traders have increasingly turned to leverage, signaling rising conviction around a bullish continuation. Yet, the flagship crypto has failed to hold above $107,000 since May 18. This BTC price zone has become critical for leveraged short sellers now facing liquidation risk.

CoinGlass estimated that $1.2 billion worth of short positions would be between $107,000 and $108,000. If Bitcoin breaks above that range, a wave of liquidations could follow, driving BTC into price discovery.

Fiscal Tensions Fuel Bitcoin Hedging Narrative

Beyond leveraging data, macro factors have added fuel to Bitcoin’s bullish bias. Concerns about U.S. fiscal policy and political gridlock have weighed on investor sentiment. The 20-year Treasury yield hovered near 5%—up from 4.82% two weeks earlier—highlighting weak demand for long-duration U.S. debt.

With economic uncertainty rising, some market watchers expect the U.S. Federal Reserve may be forced to resume bond purchases. That shift would reverse a 26-month trend and may pressure the U.S. dollar. BTC, often pitched as a hedge against monetary debasement, has benefited from these shifting dynamics.

Jelle, a crypto trader, noted that Bitcoin is just “inches away” from entering a price discovery phase. He cited the lack of resistance above $110,000 and the potential for a cascading move once BTC breaks past its all-time high.

Compression Patterns and Short Liquidation Skew Add Support

Axel Adler Jr. highlighted Bitcoin’s ongoing “compression” phase, which was marked by narrowing trading ranges. His analysis pointed to three major periods of compression in the asset’s recent history. Each preceded explosive breakouts, including the 2017 rally from $1,000 to $20,000. Adler wrote,

“The current compression mirrors historical setups that led to violent upward breakouts.”

That view aligns with technical analyst Gert van Lagen, who warned that a “liquidation magnet” above $107K could trigger billions in short covering. He explained that BTC first climbed “on fear,” but the next leg could come from liquidations.

Coinglass data showed over $3 billion in leveraged short positions could be wiped out if Bitcoin hits $110,000. By contrast, it would require a drop to $94,612 to trigger a similar amount in long liquidations. This liquidation skew underscores a market tilted toward upward momentum.

Bitcoin Price’s Monthly Close Above $102K Could Set Stage for New Highs

Bitcoin also approached a record monthly candle close, with the current May price action tracking above $106,000. A close above $102,400 by month-end would mark BTC’s highest monthly close in history.

The daily chart shows BTC price holding firm within an ascending channel, with the price consolidating just below $107,000. Both the 50-day EMA ($95,808) and 200-day EMA ($88,671) sit well below current levels, reinforcing bullish momentum.

The Relative Strength Index (RSI) stands at 70.28, indicating overbought conditions, yet suggesting continued strength unless sharp rejection follows. A confirmed breakout above the upper trendline could activate the $110,000 liquidity zone, while failure may see a retest toward the $95,000 region.

The flagship crypto’s potential to outperform traditional hedges also drew attention. While gold remains dominant with a $22 trillion market cap and 24% gains in 2025, its size deters further institutional inflows. Bitcoin, with a $2.1 trillion market cap, still presents room for upside.

Even a modest 5% reallocation from global gold reserves to BTC could translate into a $105 billion inflow. That would represent roughly 1 million BTC at current prices, pushing the asset deeper into price discovery territory.

Institutions Still in Control as Market Eyes Bitcoin Price Rally To $110K

MicroStrategy’s Bitcoin holdings—currently at 576,230 BTC—reflect how institutional conviction remains central to BTC’s current trajectory. The firm’s strategy mirrors broader shifts in capital toward digital assets amid global macro instability.

BTC traded around $106,375 at press time, up 3.1% in May. A monthly close above $110,000 would deliver a 17% gain, the strongest May performance since 2019.

With leverage building and macro uncertainty growing, Bitcoin remains on the edge of a major move. Short sellers now face the risk of forced liquidation, and the broader market may soon watch BTC establish a new price range above all-time highs.

The post Bitcoin Futures Hit $72B, Is $110K Price Breakout Imminent? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.