Vitalik Buterin’s New Gas Cap Proposal Fuels ETH Momentum Toward $2,800

0

0

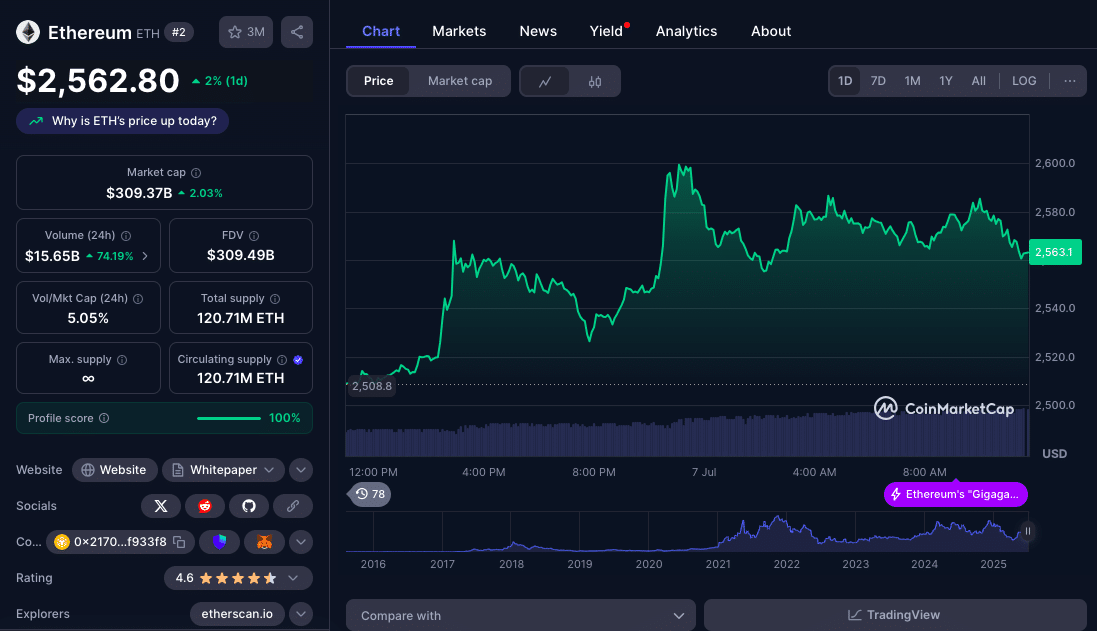

Ethereum’s resilience is being scrutinized this week on two fronts: co-founder Vitalik Buterin’s technical proposal to limit transaction gas usage and a surge that’s pushing ETH price rally toward the $2,600 resistance. These intersecting developments highlight the network’s ongoing efforts to balance security, scalability, and investor confidence.

EIP‑7983: Capping Gas to Reinforce Security & zkVM Compatibility

Ethereum Improvement Proposal EIP‑7983, introduced by Vitalik Buterin and researcher Toni Wahrstätter, intends to place a 16.77 million gas cap on all transactions. This measure, half the previously suggested 30 million units, sets a firm upper bound regardless of block limits.

Based on reports, by implementing this limit, Ethereum can enhance its resilience against certain DoS vectors, improve network stability, and provide more predictability to transaction processing costs.

Removing the ability for a single transaction to monopolize block gas addresses denial-of-service vulnerabilities, ensures even gas distribution, and simplifies protocol predictability. A cap will invalidate any transaction request exceeding 16.77 million gas at both the mempool and block validation phases.

The proposal also supports zkVM compatibility, encouraging developers to split large processes into smaller chunks, streamlining distributed proving systems.

As Toni Wahrstätter notes,

“This value enables most current use cases, including contract deployments and advanced DeFi interactions, while ensuring consistent performance characteristics”.

Why This Gas Cap Matters for Ethereum Resilience

Currently, transactions can consume entire block gas limits, exposing Ethereum to potential spam-based DoS attacks and unpredictable performance. Capping gas per transaction: Reduces risk of abuse by limiting large, block-filling operations; Enhances predictability for gas costs and execution time; Improves zkVM circuit design, enabling smoother scaling paths

As officials briefing summarized, this adjustment is expected to have minimal impact on everyday users, but contributes significantly to network stability.

Price Dynamics: ETH Tests $2,600 After Clearing $2,550 Resistance

On the market side, Ethereum has made a sharp move above the $2,550 resistance, currently trading around $2,562, verifying technical strength and consumer interest.

Key momentum indicators include: A decisive break above the hourly bearish trendline at $2,520; Price holding above the 100‑hour Simple Moving Average (SMA); Technical oscillators (MACD and RSI) trending bullish, with RSI above 50.

| Level | Value (USD) | Significance |

| Immediate Support | $2,550 | Post-breakout consolidation |

| Critical Support | $2,520 | Trendline base and SMA-100 |

| Resistance 1 | $2,600 | Fib level & psychological |

| Resistance 2 | $2,620 | Near-term target |

| Resistance 3 | $2,650 – $2,720 | Bullish continuation zone |

| Long-term Target | $2,800 | Round milestone |

Upside targets align with $2,600 (76.4% Fib), followed by $2,620–$2,650, then $2,720 and $2,800 if momentum extends .

Gas Cap Meets Market Momentum

The juxtaposition of EIP‑7983 and this current ETH price rally reinforces Ethereum’s resilience narrative. Stabilizing transaction execution and avoiding protocol failures increases investor confidence, fueling bullish sentiment.

Analysts have highlighted how a capped gas limit brings predictable block times and smoother fee structures, which often translate into stronger technical setups like this week’s rally.

Conclusion: What Happens If Price Stalls?

Failure of this ETH price rally to break past $2,600 could open the door to a return to $2,520 support. Should that level break, further downside could target the $2,475 and $2,420 levels. But unless broader macro conditions shift such as a sharp U.S. CPI surprise or BTC correction, the path for ETH appears slanted toward bullish consolidation.

Meanwhile, the gas cap must clear community testing phases and reach consensus before activation. Developers and node operators are expected to review on testnets over coming months, with final implementation conditional on robust security analysis and ecosystem feedback .

As Ethereum works toward scaling in a sustainable and secure manner, market momentum and protocol evolution appear to be in rare alignment.

Summary

Ethereum is spotlighted today by a dual show of resilience, with Buterin’s EIP‑7983 gas cap proposal targeting network security and zkVM alignment, and ETH price rally pushing past $2,600 resistance. The 16.77 million gas cap helps prevent DoS risks and ensures stable execution, while the technical breakout combined with bullish indicators hints at sustained momentum. Still, execution risks remain: a failure to breach $2,600 could see a pullback, and protocol upgrades require careful protocol vetting.

FAQs

What is EIP‑7983 and its goal?

EIP-7983 proposes capping each transaction at 16.77 million gas to prevent DoS attacks, stabilize execution, and improve zkVM compatibility.

Why is the gas cap important for zkVMs?

It encourages splitting large transactions into smaller blocks, which simplifies circuit design and reduces proving overhead.

What price level is Ethereum targeting?

ETH is aiming for resistance near $2,600, with further upside possible toward $2,620–$2,650, then $2,720–$2,800 .

What if ETH fails at $2,600?

Key support lies at $2,565, $2,550, and $2,520. A drop below $2,520 could test $2,500 or lower.

When could the gas cap go live?

EIP‑7983 must go through community testing and develop consensus. It could take several months before the upgrade is implemented.

Glossary

Gas – A measure of computational cost for executing Ethereum transactions.

zkVM – Zero-knowledge virtual machines for scalable and privacy-enhanced smart contracts.

MACD / RSI / SMA – Technical indicators used to assess market momentum and trends.

Fibonacci retracement – A tool to identify support/resistance levels based on price history.

Sources

Read More: Vitalik Buterin’s New Gas Cap Proposal Fuels ETH Momentum Toward $2,800">Vitalik Buterin’s New Gas Cap Proposal Fuels ETH Momentum Toward $2,800

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.