Time to Buy MRK? Whale Positions in Maker, Acquire $4 Million MRK Tokens

0

0

Maker (MKR) appears to be strengthening its market rally and is currently experiencing increasing investor attention and bullish market sentiment. Whales are showing robust interest in the asset as reported by Lookonchain today.

Whale adds 2,827 MKR

Today, a whale spent $4 million in DAI stablecoin to purchase 2,827 Maker at an average price of $1,415. This significant acquisition of MKR tokens shows the interest and optimism of savvy investors.

The transaction activity suggests that whales and long-term holders may seize the opportunity to amass MKR tokens. It signifies that MKR is facing increased demand. Such massive purchases often decrease selling pressure, hint at likely upward momentum, and suggest an ideal buying opportunity.

Maker price updates

Maker has recently displayed an outstanding recovery after witnessing a downtrend over the past two weeks. As of today, April 10, 2025, the asset stands at $1,321, representing an incredible 6.6% surge in the last 24 hours. Its trading volume also recorded an increase of 43.60% over the period, indicating that investors and traders are showing increased interest in the asset. Besides today’s increase, its price has been up 2.4% over the past week. These green figures suggest a possibility of a bullish momentum continuation.

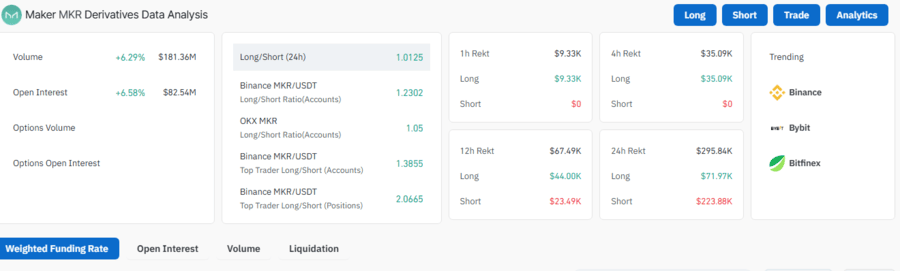

Another on-chain indicator that helped to determine Maker’s next movement is Open Interest (IO). Metrics from Coinglass show that Maker’s IO rose by 6.58% from yesterday. This surge in IO suggests that derivatives traders are buying premiums to maintain their positions. This signals market confidence in MKR and signifies that traders are enthusiastic about its future price movements.

Furthermore, transaction volume rose by 6.29% from yesterday, indicating a significant outflow of MKR tokens from exchanges. This means buyers are in control as investors are increasingly accumulating Maker and moving tokens to their cold wallets.

From a technical outlook, Maker is moving inside an ascending channel pattern (a bullish pattern), suggesting an uptrend continuation. The lower channel border support is holding firm. An upswing potential toward the resistance levels of $1,359 and $1,404 is expected if the asset maintains bullish momentum. However, a risk of fall toward support levels of $1,301 and $1,294 is also anticipated if the asset loses strength.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.