Bitcoin Inflows to Binance Spike Ahead of CPI — Sell Pressure Building or Strategic Positioning?

0

0

Bitcoin reserves on Binance increased by 22,106 BTC as investors moved funds amid market uncertainty and the upcoming CPI announcement.

Derivatives trading activity is rising with higher volume, open interest, and options trading, showing strong market participation.

Bitcoin’s exchange reserves on Binance have witnessed a significant surge, rising by 22,106 BTC between March 28 and April 9, according to the latest report from CryptoQuant. The reserves increased from 568,768 BTC to 590,874, signifying a massive addition to the biggest crypto exchange in the world.

This rising trend shows increased caution among investors due to macroeconomic risks before releasing the Consumer Price Index (CPI). In the past, the increase in the exchange reserves hinted that traders were placing their funds on exchanges for either the purposes of selling or accessing other derivatives.

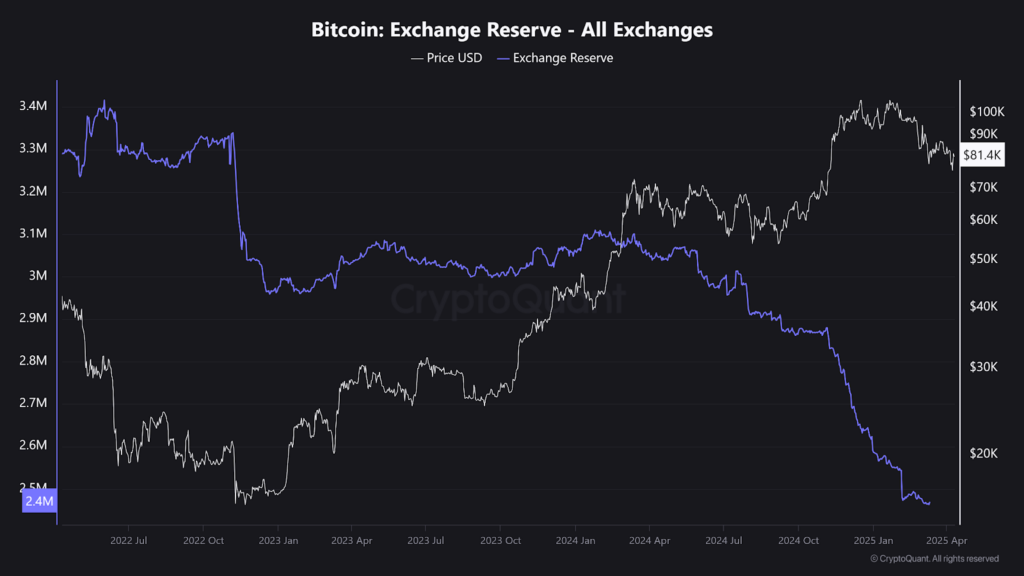

However, the exchange reserves of Bitcoin to Binance went up as the overall exchange reserves shrank across all other platforms worldwide. According to CryptoQuant, current BTC reserves for all exchanges are at 2.4 million BTC, a level not seen since 2018. While accumulation and self-custody are evident across the broader market, Binance’s expanding reserves might point to short-term speculative interest and trading activity.

Derivatives Market Signals Rising Trading Activity

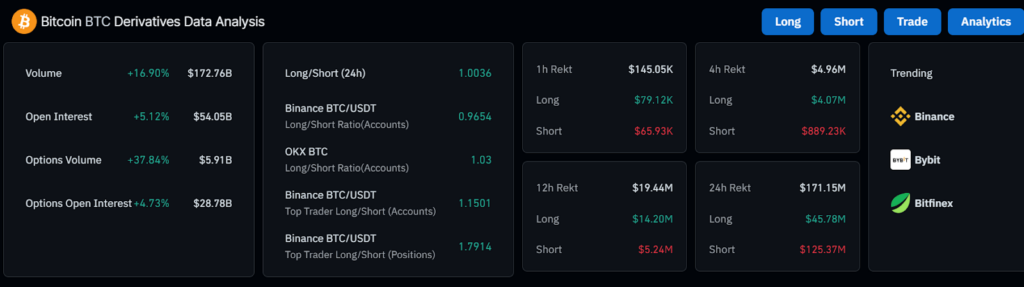

The derivatives market of Bitcoin is also seen to have significant strength. According to recent data, the total trading amount of BTC derivatives has increased by 16.9% to $172.76 billion.

Open interest went up 5.12% to $54.05 billion, and options volume increased to 37.84 % of $5.91 billion. These increases further imply that trading activity increases due to the expectation of the CPI number and fluctuation in the market.

According to Binance, the BTC/USDT long/short ratio (accounts) is at 0.9654, indicating the presence of slightly more short positions. However, the leading top trader’s long/short ratio by position equals 1.7914, demonstrating that the leading market participants are rather extended in the bullishness of their positioning.

Also, the Bitcoin futures open interest remains elevated and follows the same trend as the BTC price movement. This is evident in the open interest chart by Coinglass, supporting the increased leverage taking place as BTC approaches its all-time high prices.

Industry Expert Forecasts Bitcoin to Reach $250,000

Bitcoin is now priced at $81,385 after having a 5.26% increase over the past 24 hours. The market capitalization of the asset is $1.61 trillion, and the trading volume within a 24-hour period has increased by 29.91 percent, reaching $75.32 billion.

Adding to the optimism, Cardano founder Charles Hoskinson said that the current price of the asset could touch $250,000 by this year-end or the next. In the CNBC interview, Hoskinson identified the next sources of growth in the segment, including more institutions and collaborations with tech giants, including Microsoft and Apple.

He added that market fears regarding geopolitical tariffs should subside over time as international relations influence the discussions, and the US Fed rates are expected to be cut. This would lead to increased liquidity levels within the financial markets which in turn would be suitable for risk assets like Bitcoin. According to Hoskinson, once the market opens up to geopolitical changes, the combination of trust and the realization of technology will send Bitcoin to the next level.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.