Ethereum Price Analysis: What’s Next for ETH Amid Mixed Whale Activity?

0

0

The post Ethereum Price Analysis: What’s Next for ETH Amid Mixed Whale Activity? appeared first on Coinpedia Fintech News

Ethereum (ETH) price has cooled off from the bullish volatility experienced earlier this week during the last two days. The large-cap altcoin, with a fully diluted valuation of about $530 billion, dropped over 3 percent in the past 24 hours to trade at about $4.4 on Friday, August 15, during the mid-North American session.

Bullish Sentiment for Ethereum Price

Ethereum’s macro bullish sentiment is bolstered by the notable surge in its futures Open Interest (OI) from about $18 billion in April this year to around $62 billion in August. As Coinpedia has reported severally times, on-chain data shows a renewed demand for Ether by institutional investors led by the U.S. spot ETH ETFs.

The macro bullish sentiment for the ETH price is backed by the rising implementation of Ether treasury strategies by corporations. For instance, SharpLink Gaming announced that it now holds 728k ETH valued at over $3.3 billion.

Earlier on Friday, BitMine acquired additional Ether valued at around $130 million, thus increasing its holdings to $5.26 billion.

Midterm Bearish Market Tone for Ether

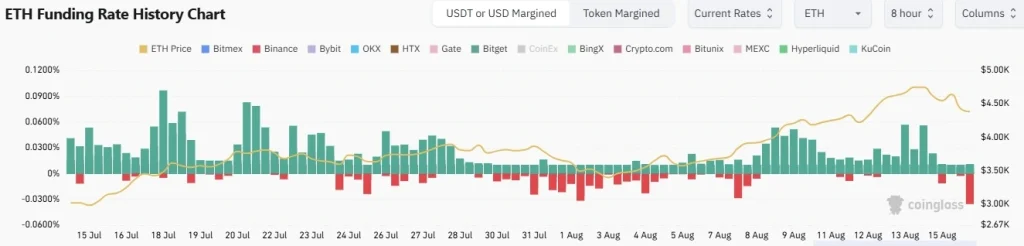

The Ether price has approached overbought levels as it nears the all-time high. According to market data analysis from CoinGlass, Ethereum’s Funding Rate turned negative, signaling midterm bearish sentiment from futures contracts traders.

The midterm bearish tone for Ether was exaggerated by the rising number of validators exiting the staking market. According to data from everstake, more than 767,000 ETH valued at $3.490 billion are waiting to leave the network.

What’s Next for ETH Price?

Ethereum price has experienced a mid-term correction in the past two days to retest a crucial support level around $4.4k. In the four-hour timeframe, the ETHUSD retested the 50 Moving Average Simple (SMA) and also a rising logarithmic trend established since the beginning of August.

https://x.com/cryptomichnl/status/1956438745684812014?s=46

According to crypto analyst Ali Michaël van de Poppe, the ETH price has entered a buy zone following a 3.5 percent drop in the last 24 hours. The macro bullish outlook for ETH remains strong fueled by favorable crypto regulations amid renewed demand from institutional investors.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.