Shocking Tariff Claim: Trump’s Bold Stance on Decades-Overdue Trade Policy

0

0

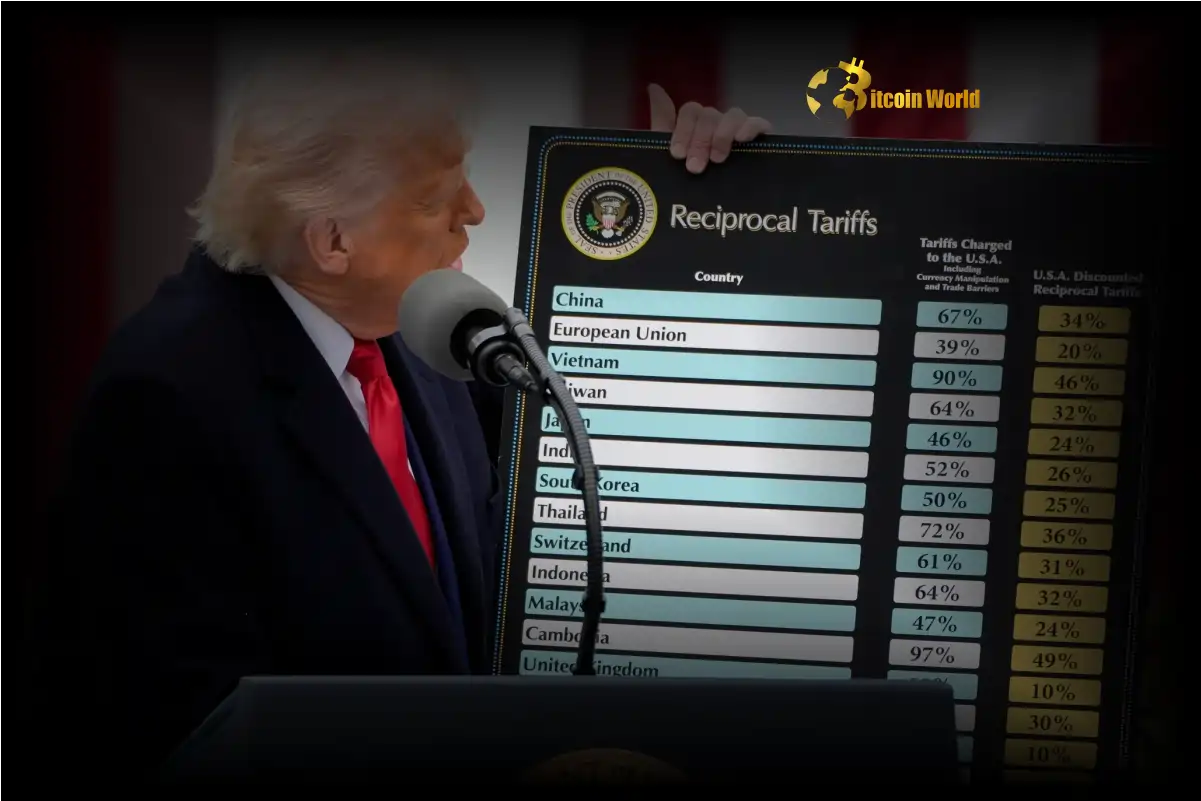

In a move that has once again ignited global economic discussions, former U.S. President Donald Trump has taken to social media platform X to assert that tariffs should have been implemented ‘decades ago.’ This statement, echoing his long-held protectionist views, arrives amidst swirling rumors and clarifications regarding potential tariff waivers, adding another layer of complexity to the already intricate landscape of international trade. For those in the cryptocurrency world, these macroeconomic shifts are not just background noise; they represent significant factors that can influence market volatility and investment strategies. Let’s dive into what this all means and why it matters.

Trump’s Tariff Declaration: A Blast from the Past?

Donald Trump’s recent declaration on X isn’t exactly new territory. Throughout his presidency, tariffs were a cornerstone of his trade policy, often framed as a tool to protect American industries and jobs. His latest statement, ‘Tariffs should have been done decades ago,’ doubles down on this stance, suggesting a long-standing conviction about the necessity of import taxes. But what’s the rationale behind this enduring belief?

- Protecting Domestic Industries: Trump’s argument frequently centers on safeguarding American businesses from foreign competition. Tariffs, in theory, make imported goods more expensive, thereby making domestically produced goods more attractive to consumers.

- National Security: Another justification often cited is national security. Industries deemed critical to national defense, like steel and aluminum, have been targets of tariffs to ensure domestic production isn’t eroded by cheaper imports.

- Trade Deficits: Trump has consistently voiced concerns about trade deficits, viewing them as a sign of economic disadvantage. Tariffs are proposed as a way to reduce these deficits by discouraging imports.

The Fake News Factor: Tariff Waivers and China

Adding intrigue to the tariff narrative is the recent episode of ‘fake news’ concerning potential trade policy shifts. Reuters reported comments attributed to National Economic Council (NEC) Director Kevin Hassett, suggesting that Trump was considering a 90-day tariff waiver for all countries except China. This news briefly sparked hopes of eased trade tensions, particularly outside of the U.S.-China dynamic. However, this report was quickly debunked, highlighting the volatile information environment surrounding trade discussions.

Why did this fake news spread, and what does it tell us?

- Market Sensitivity: Financial markets, including cryptocurrency markets, are highly sensitive to trade policy news. Any hint of easing tariffs can be interpreted positively, leading to market reactions.

- Information Warfare: In the current geopolitical climate, misinformation and disinformation are rampant. The spread of this fake news could be seen as a form of information warfare, testing market reactions or creating confusion.

- The Need for Reliable Sources: This incident underscores the critical importance of verifying information from trusted sources, especially in the fast-paced world of financial news and cryptocurrency updates.

Decoding Global Economy Impact: Are Tariffs Really the Answer?

The core question remains: are tariffs an effective tool for economic prosperity? Economists are sharply divided on this issue, and the real-world impact is complex and multifaceted. Let’s examine some key arguments:

| Argument For Tariffs | Argument Against Tariffs |

|---|---|

| Protection of Domestic Jobs: Tariffs can shield domestic industries from cheaper imports, potentially preserving jobs in those sectors. | Increased Consumer Costs: Tariffs raise the price of imported goods, which can translate to higher prices for consumers, reducing purchasing power and potentially leading to inflation. |

| National Security: Tariffs can ensure the viability of strategically important domestic industries, reducing reliance on foreign suppliers. | Retaliation and Trade Wars: Tariffs often provoke retaliatory tariffs from other countries, escalating into trade wars that harm all involved economies. |

| Bargaining Chip: Tariffs can be used as leverage in trade negotiations to pressure other countries to change their trade practices. | Reduced Trade and Economic Growth: Tariffs can disrupt global supply chains, reduce international trade volumes, and hinder overall economic growth. |

For the cryptocurrency market, the ripple effects of global economy shifts due to tariffs are worth noting. Trade wars and economic uncertainty can lead to:

- Currency Fluctuations: Tariffs can impact exchange rates, potentially increasing volatility in fiat currencies and, by extension, influencing cryptocurrency valuations.

- Inflationary Pressures: As tariffs can contribute to inflation, cryptocurrencies are sometimes seen as a hedge against inflation, potentially increasing their appeal.

- Market Volatility: Uncertainty surrounding trade policy and economic stability can lead to increased volatility across all markets, including cryptocurrencies.

Navigating the Trade Winds: Actionable Insights

So, what can we glean from Trump’s renewed tariff rhetoric and the recent fake news episode? Here are some actionable insights:

- Stay Informed, Verify Sources: In the age of rapid information dissemination, especially on social media, it’s crucial to rely on credible news sources and verify information before making investment decisions.

- Monitor Global Economic News: Keep a close watch on developments in international trade and economic policy. These macro-level trends can significantly impact financial markets, including cryptocurrency.

- Diversify Your Portfolio: Economic uncertainty underscores the importance of portfolio diversification. Spreading investments across different asset classes can help mitigate risk.

- Understand the Broader Context: Trump’s tariff statements are part of a larger ongoing debate about globalization, protectionism, and the future of international trade. Understanding this broader context is essential for interpreting current events.

The Lasting Impact of Tariff Policies

Donald Trump’s continued advocacy for tariffs highlights a persistent tension in global economics – the balance between free trade and protectionism. While proponents argue for tariffs as a necessary tool to safeguard domestic industries and national interests, critics point to the potential for increased consumer costs, retaliatory trade wars, and overall economic disruption. For cryptocurrency enthusiasts and investors, understanding these dynamics is crucial. The interconnectedness of the global economy means that shifts in trade policy, even seemingly distant ones, can create waves that reach the digital asset markets. As the debate around economic impact of tariffs continues, vigilance and informed decision-making are more important than ever.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.