Reimagining REIT Cashflows: Managing Revenue and Expenses in Web3

0

0

By Nadine Loepfe

Real estate investing isn’t just about what you buy — it’s about what you do with it once you own it.

In traditional real estate, managing property income is often bogged down by bureaucracy, delayed reporting, and fragmented systems. Our Web3-native REIT architecture flips that model on its head. Here, smart contracts, vaults, and decentralized governance are the new financial rails. They don’t just digitize ownership, they streamline how money moves.

This article takes you inside the financial core of our system. We’ll show how rental income flows through vaults, how investors can earn compounding yield, and how proposals and payments are managed transparently on-chain. And with each step, we’ll ground it in real diagrams that help you visualize how it all works.

How the Business Generates Revenue

Before we think about investors, let’s start with the system itself. How does our REIT in web3 generate income?

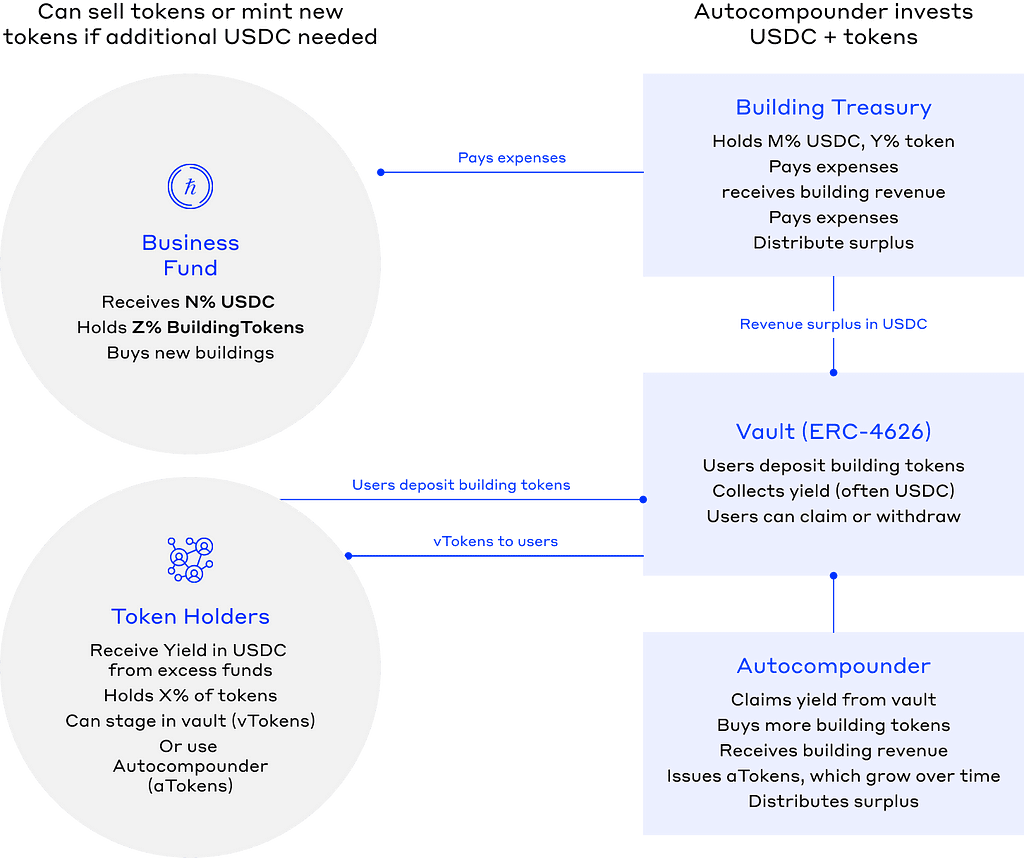

When a new building is onboarded, the initial token offering is split into three flows:

- The Building Treasury receives a percentage of the USDC (M%) and retains some of its own tokens (Y%). This treasury will later manage expenses and distribute any surplus.

- The Business or Fund takes a separate cut of the USDC (N%) and holds a share of the building’s tokens (Z%). These tokens can be sold or used later to raise capital.

- Token Holders receive the rest. They now own a slice of the building and are entitled to yield from its performance.

Each property has its own token, treasury, and governance. This modularity ensures every building can be managed independently, yet still follow a unified system.

From Rent to Real Yield: How Investors Earn

Once a building is operational, it starts to generate revenue. Rent is collected in USDC and flows directly into the building’s treasury. From there, the following happens:

- Seamless Rent Collection: Rental income, paid in USDC, flows directly and transparently into the designated building’s on-chain treasury.

- Automated Expense Management: Pre-approved operational expenses (like management fees, routine maintenance, or insurance premiums) are settled directly from this treasury, governed by the rules encoded in smart contracts or DAO proposals.

- Surplus to Yield: Any surplus USDC after expenses isn’t locked away in a bank account. It’s automatically routed to a dedicated ERC-4626 Vault.

- Direct Yield Distribution: Investors who have staked their building tokens into this vault instantly begin earning their proportional share of this surplus. No more waiting for cumbersome quarterly statements or relying on opaque, trust-based payout systems. This is real income, delivered efficiently via code.

For investors looking to maximize their returns, we introduce the Autocompounder. Instead of receiving yield as USDC, you can opt to have it automatically reinvested. The autocompounder uses the USDC yield to purchase more of that building’s tokens from the market and then re-stakes them into the vault on your behalf. You receive a “aToken” — an appreciating receipt that represents your continuously growing, compounding position in the property.

Autocompounding, Vaults, and Streaming: The Tech Behind the Magic

Our system is powered by a few foundational smart contracts:

- ERC-4626 Vaults manage deposits and distribute yield. When you stake your building tokens here, you get vTokens back, which represent your share.

- ERC-7540 Async Vaults handle queued deposits and redemptions. These are useful at the fund level, where operations are less frequent but larger in scale.

- Autocompounders harvest yield from the vault, convert it to building tokens, re-stake it, and issue aToken receipts that grow in value over time.

- Streaming Payments allow yield to flow in real time. Instead of getting paid monthly or quarterly, investors can receive rent distributions every second.

These tools make our REIT more than just digitized property — they make it programmable, efficient, and global.

Who Decides How Funds Are Spent?

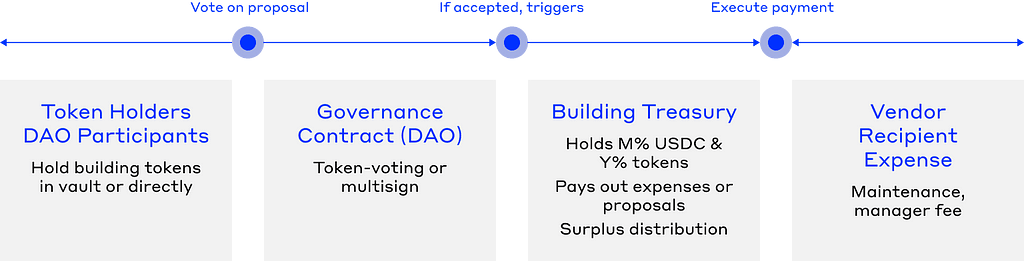

Investors in such a REIT aren’t just yield earners. They’re decision-makers, and thus we believe in empowering our investors:

- Transparent Proposal System: Every building operates under a clear governance framework. Need a significant repair? Considering a new property manager? A proposal is submitted on-chain.

- Tiered Approval Process: For routine, smaller expenses below a predefined threshold, a designated multisig group (representing day-to-day operational managers) can approve the spending directly from the building’s treasury.

For larger expenditures or significant policy changes exceeding the threshold, a formal DAO vote is triggered, requiring approval from the building’s token holders.

- On-Chain Execution: Once a proposal is approved, the Building Treasury can be instructed by the smart contract or multisig to execute the payment. Every decision, every transaction, is logged immutably on the Hedera ledger.

This two-tiered system ensures operational efficiency for everyday matters while providing token holders with ultimate control and transparency over significant financial decisions, all without the burden of micromanagement. DAO-based governance enables token holders to influence expense approvals and trigger real on-chain payments from the treasury.

Active vs. Passive Treasury Strategies

Not all properties are created equal, and neither are investment strategies. Why not accommodate both?

- Passive “Autopilot” Management: For stable, predictable properties, the system can run on pre-defined rules. Income is collected, expenses are paid, surplus is streamed to vaults, and reinvestment happens automatically. Minimal human intervention with maximum efficiency.

- Active “DAO-Driven” Management: For properties requiring more dynamic oversight (e.g., development projects, value-add opportunities, high-yield commercial spaces), the DAO of token holders takes the helm. They can propose and vote on initiatives like property upgrades, vendor selection, strategic refinancing, or even rebalancing the property’s financial reserves.

This flexibility ensures our architecture can support a diverse portfolio, from steady income-producing residential blocks to more complex, actively managed commercial ventures.

Recap: The Full Flow of Funds

Let’s trace the lifecycle of capital within our web3 powered REIT:

- Tenant Pays Rent: USDC lands directly in the specific Building’s on-chain Treasury.

- Expenses Settled: Approved operational costs are paid from the Treasury.

- Surplus Flows to Vault: Remaining USDC is automatically sent to the building’s ERC-4626 Vault.

- Investors Earn Yield: Token holders who have staked in the vault receive their share as USDC (via vTokens) or see their investment grow through the Autocompounder (via aTokens).

- Transparent Governance: All significant spending decisions are proposed, voted upon, and executed on-chain, fully visible to all token holders.

- (Optional) Real-Time Earnings: With streaming payments enabled, that yield can be accessed by investors virtually instantaneously.

Looking Ahead: The Future is Composable and Customized

Tokenizing real estate is about more than putting deeds on-chain. It’s about creating a better financial operating system for assets that already generate real-world value.

By leveraging the power of vaults, autocompounders, real-time streaming payments, and robust DAO governance, we’re unlocking levels of automation, transparency, and investor empowerment previously unimaginable in traditional real estate.

This is just the beginning. In our next post, we’ll delve into another innovation: “Slices”.

Imagine self-rebalancing, customized index funds of tokenized real estate, automatically managed by on-chain strategies tailored to your specific investment criteria — whether it’s by geography, property type, or risk profile. We’re not just dreaming about it; we’re building the blueprint.

This Hashgraph initiative showcases our commitment to positioning Hedera as the premier platform for sophisticated RWA tokenization — building this reference architecture to empower the entire ecosystem.

The future of real estate investing is on-chain, intelligent, and in your control. Stay tuned.

Reimagining REIT Cashflows: Managing Revenue and Expenses in Web3 was originally published in Hedera Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.