Polkadot price prediction 2025-2031: Will DOT recapture $20 soon?

0

0

Key takeaways

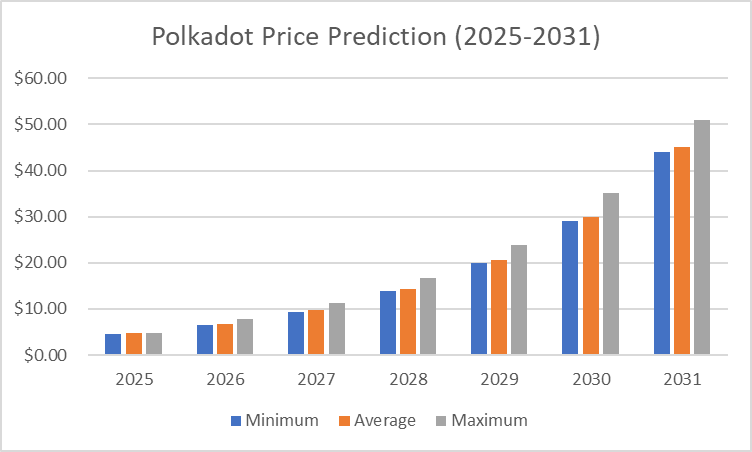

- In 2025, Polkadot might reach a maximum price value of $4.92 and an average value of $4.58.

- In 2028, the DOT price is expected to range from a maximum of $15.81 to a minimum of $13.00.

- The price of Polkadot is predicted to reach a maximum value of $48.15 in 2031.

Polkadot (DOT) has shown impressive growth and resilience in a volatile cryptocurrency market, supported by its strong multichain protocol architecture, which ensures network security—and investor confidence. A major contributor to this success is the Sinai Upgrade on the Acala Network, which enhances functionality and security.

With over 32 million transactions validated in October 2024 by the Polkadot Relay Chain, the network demonstrates significant activity and utility, contributing to its substantial market capitalization. A notable increase in unique wallets further signals growing user adoption and engagement, strengthening Polkadot’s position as a leading blockchain platform. Will DOT reach new heights soon? Let’s get into the Polkadot price prediction for 2025-2031.

Overview

| Cryptocurrency | Polkadot |

| Token | DOT |

| Price | $4.18 |

| Market Cap | $6.79B |

| Trading Volume | $274.48M |

| Circulating Supply | 1.62B DOT |

| All-time High | $55.00 Nov 4, 2021 |

| All-time Low | $2.69 Aug 19, 2020 |

| 24-hour High | $4.37 |

| 24-hour Low | $4.09 |

Polkadot price prediction: Technical analysis

| Volatility | 4.80% |

| 50-Day SMA | $ 4.04 |

| 14-Day RSI | 50.02 |

| Sentiment | Bullish |

| Fear & Greed Index | 71(Greed) |

| Green Days | 16/30 (53%) |

| 200-Day SMA | $ 4.13 |

Polkadot price analysis: DOT holds steady above $4.20 as bullish momentum builds

- Strong Support DOT is holding firm around $4.20, showing solid buyer interest and price stability.

- Breakout Potential The tight range suggests momentum is building for a move above $4.43 toward $4.60.

- Rising optimism and improving market sentiment support Polkadot’s steady recovery and growing bullish outlook.

As of October 7, 2025, Polkadot (DOT) is trading at $4.30, showing a 2.91% gain in the last 24 hours. The cryptocurrency has displayed a positive momentum, recovering from its lower range and maintaining stability above the $4.20 mark. The key resistance levels are noted at $4.43, while support remains firm at $4.18, signaling a steady trading channel. DOT’s price behavior indicates renewed optimism among traders as it continues to hold within a short-term bullish zone. The recovery coincides with improving sentiment across the broader crypto market, supporting Polkadot’s upward movement.

Polkadot 1-day price chart: DOT building strength above support

The daily chart reveals that Polkadot is forming a gradual bullish structure as it trades above its key support at $4.18. The recent bounce toward $4.30 suggests buyers are defending lower levels effectively, showing resilience in the current market setup. DOT remains positioned near its short-term moving averages, indicating that a bullish trend is beginning to outweigh selling momentum. A clear breakout above $4.43 could validate this strength, potentially opening the path for a move toward the $4.60–$4.70 range.

The Relative Strength Index (RSI) hovers around the neutral zone, reflecting balanced conditions with a slight bullish tilt. The MACD line indicates convergence, suggesting a potential continuation of the upward trend if volume increases. However, failure to sustain above the critical support at $4.25 could invite short-term corrections. Back to the $4.18 support. For now, DOT’s daily trend structure suggests consolidation within a narrow range, with momentum gradually shifting in favor of buyers.

Polkadot 4-hour price chart: DOT consolidation before a breakout

On the 4-hour timeframe, Polkadot is consolidating tightly between $4.18 and $4.43, forming a short-term symmetrical structure that reflects indecision among traders. The price has repeatedly tested both the upper and lower bounds, confirming the significance of these levels as immediate barriers to further movement in the upcoming parachain auctions. The short-term moving averages are aligning closely, indicating that a breakout may be approaching. A confirmed close above $4.43 could lead to increased momentum, while a dip below $4.18 might trigger minor pullbacks toward $4.10.

The RSI remains mid-range, suggesting that DOT still has room to rise before becoming overbought. Trading volume has remained steady, suggesting accumulation during this consolidation phase. Traders are closely watching for a decisive move supported by substantial volume to determine the next directional shift. If bullish pressure persists, DOT could break out of its current pattern, signaling renewed upward momentum in the short term.

Polkadot technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value ($) | Action |

| SMA 3 | $ 4.10 | BUY |

| SMA 5 | $ 4.20 | BUY |

| SMA 10 | $ 4.12 | BUY |

| SMA 21 | $ 4.15 | BUY |

| SMA 50 | $ 4.04 | BUY |

| SMA 100 | $ 3.97 | BUY |

| SMA 200 | $ 4.13 | BUY |

Daily exponential moving average (EMA)

| Period | Value ($) | Action |

| EMA 3 | $ 4.08 | BUY |

| EMA 5 | $ 4.04 | BUY |

| EMA 10 | $ 3.98 | BUY |

| EMA 21 | $ 3.95 | BUY |

| EMA 50 | $ 3.93 | BUY |

| EMA 100 | $ 3.99 | BUY |

| EMA 200 | $ 4.30 | BUY |

What can you expect next for Polkadot (DOT)?

Polkadot’s steady performance above $4.20 suggests that the expected average trading price indicates the current bullish momentum may continue. If buying pressure holds. A breakout above the $4.43 resistance could pave the way toward $4.60 or higher, confirming renewed market confidence.

However, if DOT fails to sustain above $4.25, a short-term pullback toward $4.18 remains possible before the next upward attempt. Overall, as long as DOT maintains support above $4.20, the near-term price action favors gradual gains. And a potential continuation of its recovery trend.

Is Polkadot a good investment?

Polkadot continues to show resilience, maintaining solid support and attracting steady investor interest. Its long-term potential lies in its strong ecosystem and innovative multichain technology, which enables seamless interoperability between blockchains. As the network expands with new parachain developments and DeFi integrations, DOT’s utility and demand are expected to grow.

In the short term, DOT’s performance will depend on broader market conditions and its ability to hold above key support levels. For long-term investors, Polkadot remains a promising project with strong fundamentals, though patience and awareness of market volatility are essential.

Why is Polkadot up today?

Polkadot’s recent price increase can be attributed to a combination of improving market sentiment and renewed buying interest across major cryptocurrencies. The broader cryptocurrency market recovery has strengthened investor confidence, prompting accumulation near key support levels as some anticipate a new all-time high.

Additionally, Polkadot’s consistent network growth and rising activity within its parachain ecosystem are reinforcing optimism among traders in the broader blockchain ecosystem. These factors, along with steady technical support above $4.20, have fueled the current bullish momentum and lifted DOT’s price toward the $4.30 range.

Recent news on Polkadot

Grayscale has updated its S-1 registration filings with the SEC for two proposed cryptocurrency ETFs—one for Cardano (ADA) to trade on NYSE Arca under the ticker GADA and another for Polkadot (DOT) to trade on Nasdaq under the ticker DOT. Both funds would hold the underlying assets directly, track CoinDesk pricing indices, and use Coinbase Custody, mirroring the firm’s existing Bitcoin and Ethereum products. The filings update earlier 19b-4 applications from February 2025, though SEC approval remains pending, with the Cardano ETF decision now delayed to October 26.

The amendments reflect Grayscale’s continued push amid a crowded field of 96 pending crypto ETF applications, including Solana, XRP, Ethereum, Bitcoin, and Litecoin. Market optimism has risen regarding the expected price for the Cardano ETF. Polymarket data show approval odds for the Cardano ETF climbing to 87%, supported by Grayscale’s renewed efforts, strong ADA performance, and recent regulatory clarity around staking that could accelerate approvals across the sector.

Will Polkadot reach $10?

Yes, according to long-term predictions, Polkadot is projected to reach up to $10 by 2027, with expectations for next week also showing positive trends.

Will Polkadot reach $40?

Yes, according to the long-term predictions, Polkadot is projected to reach up to $40 by 2031.

Will Polkadot reach $100?

Reaching $100 for Polkadot (DOT) is highly ambitious and unlikely in the near term.

Does Polkadot have a promising long-term future?

Based on Polkadot’s ongoing buying demand and positive community support, the DOT price is set to make new highs in the coming years. However, you are advised to do your research before investing in the volatile market.

Polkadot price prediction October 2025

Here are the current Polkadot price movements in October 2025. The potential low is $3.94, while the current price might average around $4.36. On the higher end, DOT could reach up to $4.48.

| Month | Potential Low | Potential Average | Potential High |

| October | $3.94 | $4.36 | $4.48 |

Polkadot price prediction 2025

The DOT price prediction for 2025 anticipates a minimum value of $4.41 and a maximum value of $4.92. The token price and the coin’s average value could be around $4.58.

| Polkadot Price Prediction | Potential Low | Potential Average | Potential High |

| 2025 | $4.41 | $4.58 | $4.92 |

Polkadot Price Predictions 2026-2031

| Year | Minimum Price | Average Price | Maximum Price |

| 2026 | $6.17 | $6.40 | $7.91 |

| 2027 | $9.04 | $9.29 | $10.90 |

| 2028 | $13.00 | $13.37 | $15.81 |

| 2029 | $19.53 | $20.20 | $22.60 |

| 2030 | $27.42 | $28.23 | $33.83 |

| 2031 | $41.22 | $42.64 | $48.15 |

Polkadot price prediction 2026

According to the Polkadot prediction for 2026, DOT could reach a maximum price of $7.91, with the lowest price expected to be $6.17, and an average forecast price of $6.40.

Polkadot price prediction 2027

The price of Polkadot is predicted to reach a minimum value of $9.04 in 2027. Per expert analysis, DOT tokens could reach a maximum value of $10.90 and an average trading price of $9.29.

Polkadot price prediction 2028

Cryptopolitan predicts that in 2028, the Polkadot network will reach a minimum price level of $13.00, a maximum price of $15.81, and an average trading price of $13.37.

Polkadot price prediction 2029

The price of Polkadot is predicted to reach a minimum value of $19.53 in 2029. Traders can anticipate a maximum value of $22.60 while monitoring key support levels and an average trading price of $20.20.

Polkadot price prediction 2030

According to the Polkadot price prediction for 2030, DOT could reach a maximum price of $33.83, a minimum price of $27.42, and an average forecast price of $28.23.

Polkadot price prediction 2031

In 2031, Polkadot’s price is predicted to reach a minimum level of $41.22. Should positive market sentiment persist, DOT can attain a maximum cost of $48.15 and an average trading price of $42.64.

Polkadot market price prediction: Analysts’ DOT price forecast

| Firm | 2025 | 2026 |

| DigitalCoinPrice | $9.59 | $11.16 |

| Coincodex | $4.42 | $6.61 |

Cryptopolitan’s Polkadot (DOT) Price Prediction

The DOT price prediction for 2025 anticipates a minimum value of $3.94 and a maximum value of $4.92. The token price and the coin’s average value could be around $4.76. By the end of 2031, we expect the DOT price to reach a maximum level of $48.15.

Polkadot historic price sentiment

- After spending most of the second half of 2020 trading around $4-$5, the price broke above the previous all-time high of $7 on December 29 and quickly reached the Polkadot price projection of $10.

- Polkadot experienced rapid growth, with its price climbing from around $3 in January to an all-time high of approximately $57.50 in May 2021.

- After the peak, the price declined sharply, falling to around $10 by July before partially recovering to over $40 in November 2021.

- In 2022, Polkadot price steadily declined, starting the year around $30 and dropping below $10 by mid-year.

- By the end of 2022, the price stabilized near $5 as bearish market conditions dominated the cryptocurrency space.

- The price of DOT hovered between $5 and $7 for most of 2023, reflecting a period of consolidation and limited market excitement.

- In January 2024, Polkadot’s price remained relatively stable, trading around the $5–$6 range.

- By July 2024, Polkadot showed slight signs of recovery, with its price rising to around $7–$8. This modest uptick was likely driven by increasing market interest.

- In December 2024, Polkadot showed signs of recovery, with its price climbing to around $10.4.

- In January 2025, Polkadot peaked at $7.98 but lost momentum towards the end of the month, resulting in a trading range of $4.64 to $5.28 in February.

- In March 2025, Polkadot (DOT) traded at approximately $4.30.

- In April 2025, Polkadot (DOT) experienced a gradual downtrend, with its price hovering slightly below the $4 mark amid ongoing market volatility.

- In May, Polkadot (DOT) began trading at around $ 4.10 and exhibited moderate fluctuations. As of the latest update, the price has declined slightly and is currently hovering near $ 3.90, reflecting a mild bearish trend so far.

- Polkadot (DOT) declined from a high of around $4.20 to approximately $3.30 in June, with a consistent downtrend and brief rebounds near $3.60 in July.

- In August 2025, Polkadot traded around $4.10, maintaining a steady pace with limited volatility. The price slightly dipped during September 2025, hovering near $4.00 as market sentiment remained neutral.

- By October 2025, DOT showed mild recovery, trading near $4.30, suggesting cautious accumulation among traders amid broader market stabilization.

0

0

Управляйте всей своей криптовалютой, NFT и DeFi из одного места

Управляйте всей своей криптовалютой, NFT и DeFi из одного местаБезопасно подключите используемый вами портфель для начала.