Bitcoin-related Stocks Soar After Trump’s Tariff Truce

0

0

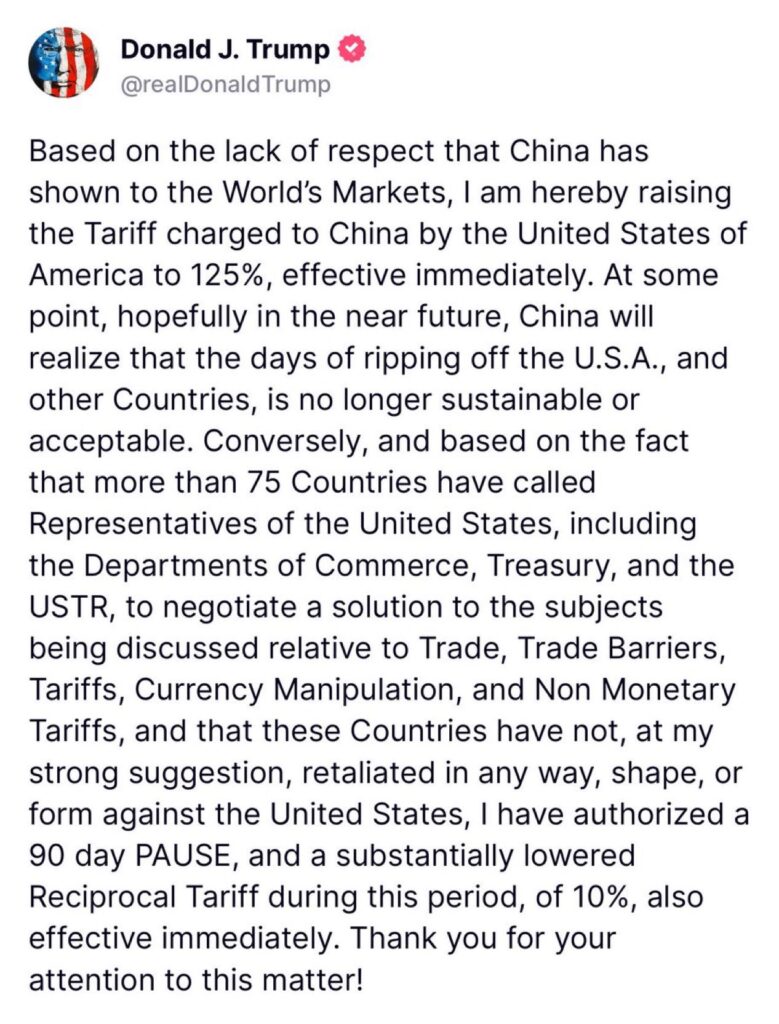

The American markets experienced a spectacular turnaround this Wednesday, April 9, causing a surge in bitcoin-related stocks. The cause: the 90-day pause on tariffs announced by President Donald Trump. A partial truce that excludes China, but was enough to rekindle the appetite for crypto assets.

Trump’s Tariff Truce: Bitcoin Markets on the Rise

At the moment China retaliates against Donald Trump’s tariffs by imposing 84% tariffs on American products, Washington observes a strategic 90-day pause. A respite that allowed the market to resume its bullish path. Among the highest gains, we have Strategy. The largest publicly traded bitcoin holder saw its stock rise by 23% to $292, after falling to $236 at the beginning of the week.

Then the ETF T-Rex 2X Long MSTR skyrocketed by 46%, confirming investor interest in leveraged products related to BTC. Coinbase, the crypto exchange platform, recorded an 18% increase, reaching $179. A performance supported by Ark Invest, Cathie Wood’s fund, which has bought over $31 million in Coinbase shares in recent days. In bitcoin mining, the trend is equally explosive:

- Bitfarms (+26%);

- Marathon (+18%);

- Riot Platforms (+13%);

- CleanSpark (+15%);

- TeraWulf (+12%).

All benefited from this historic rebound in bitcoin stocks. Even Robinhood, whose crypto revenues exploded at the end of last year, saw its stock rise by 23%.

Why Such Enthusiasm?

Investors anticipate a period of relaxation in the markets, favorable for risk assets. Crypto stocks, historically correlated with bitcoin movements and macroeconomic announcements, fully benefit from this new dynamic. The climate of uncertainty eases, and traders seek to reposition themselves on high-potential stocks.

This renewed interest illustrates once again the impact of political decisions on the broader crypto ecosystem. Beyond bitcoin, it is now the publicly traded companies exposed to blockchain that play a role as an advanced indicator of market sentiment.

As Japan arrives in Washington to discuss Trump’s tariffs, this commercial calm has temporarily lifted a sword of Damocles that hung over the markets. Bitcoin-related crypto stocks, often hypersensitive to geopolitical decisions, emerge strengthened. It remains to be seen whether this rebound is sustainable or if it is just a technical bounce.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.