Trump Jr.-Backed Thumzup Approves $10M Buyback as Bitcoin and Dogecoin Treasury Expands

0

0

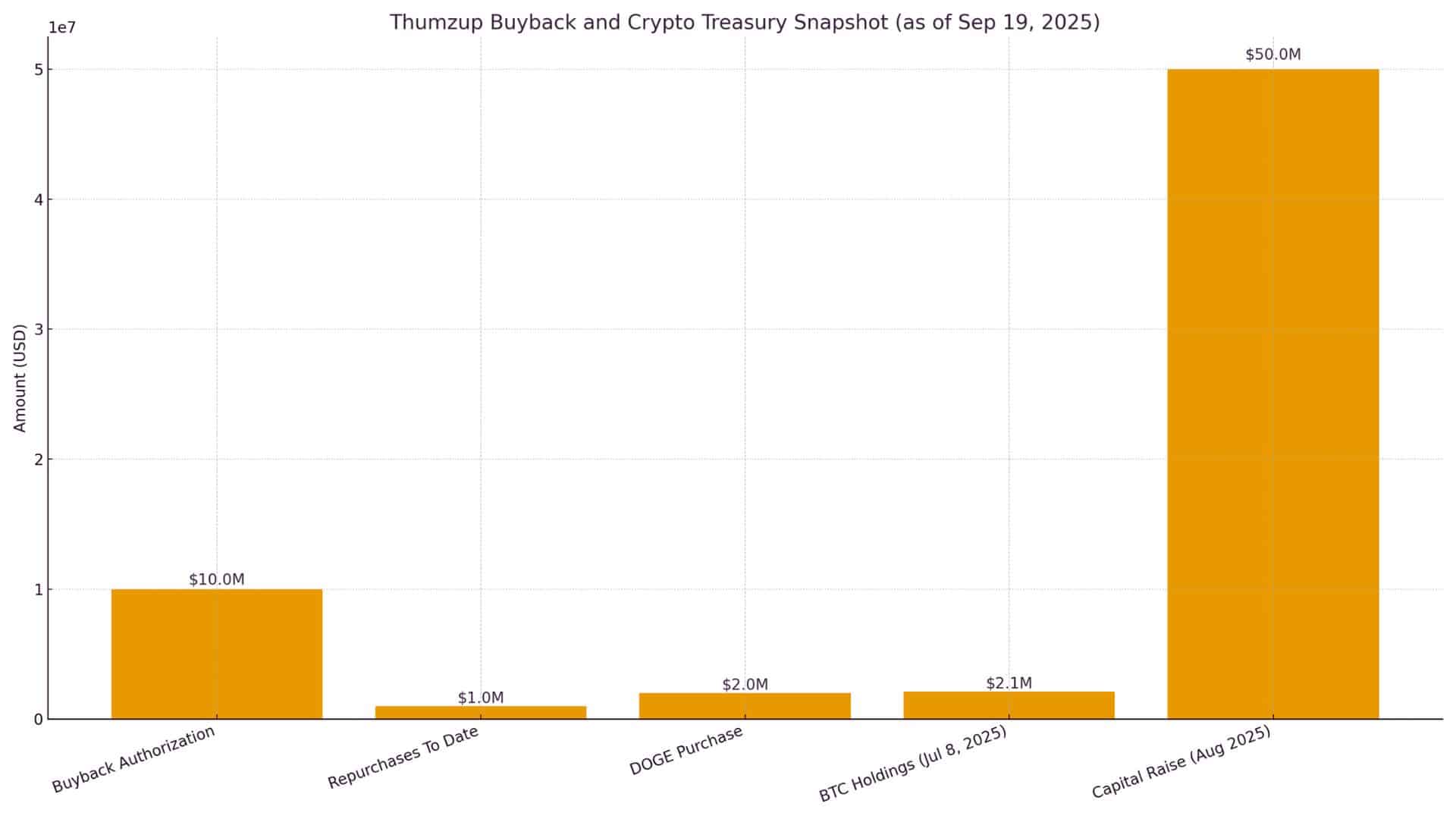

According to recent company updates, the Thumzup buyback now totals $10 million, with open-market repurchases already completed this month. The move is accompanied by a disclosed Dogecoin purchase and earlier funding that supports the plan.

This report utilizes primary sources and regulatory-linked wires to present the latest information.

Headline numbers

The board approved a $10 million authorization that runs through December 31, 2026. As of September 19, 2025, the company reported the repurchase of 212,432 shares for approximately $1 million at an average price of $4.71. Details appear in the official wire announcement of the Thumzup buyback.

“Dogecoin’s increasing recognition… is a transformative moment,” the CEO said when disclosing an initial DOGE purchase of roughly $2 million at about $0.2665 average.

Funding is in place. The firm priced a $50 million offering at $10 per share in August, with proceeds earmarked for digital asset accumulation and mining infrastructure.

Also Read: Trump Jr Backed Thumzup Dogecoin Mining Deal Stuns Investors

Bitcoin Reserves and Trump Jr. Factor

Thumzup’s sizeable Bitcoin holdings and the unusual attention surrounding Trump Jr.’s backing. The company’s reported position of more than 19,000 BTC places it among the growing list of firms using Bitcoin as a central treasury asset, not just a speculative hedge.

Combined with the visibility of Trump Jr.’s involvement, Thumzup’s strategy takes on a broader dimension, one that ties corporate finance, digital assets, and political influence into a single narrative.

This makes the buyback and Dogecoin purchase part of a much larger story about how companies are reshaping their identities in the crypto era.

Why the Thumzup buyback matters

The Thumzup buyback can retire shares while the crypto strategy scales. It can also steady per-share metrics during volatile trading. When paired with DOGE accumulation and a mining build-out, the Thumzup buyback signals confidence in near-term execution. For holders, the TZUP buyback acts as a backstop when sentiment swings.

Strategy at a glance

- Authorization: $10,000,000 through 12/31/2026

- Repurchases to date: 212,432 shares ≈ $1,000,000 at $4.71 average

- DOGE disclosure: ~7.5M tokens ≈ $2,000,000 at ~$0.2665 average

- Capital runway: $50,000,000 gross offering at $10 per share

- Treasury policy: Management may hold significant liquid assets in Bitcoin under prior board guidance

| Pillar | Purpose | Status |

|---|---|---|

| Thumzup buyback | Reduce float, support value | Active through 2026 |

| DOGE purchase | Build treasury, prep mining | Disclosed and funded |

| Capital raise | Finance crypto plan | Closed at $10 per share |

Market read

Coverage surrounding the DOGE disclosure revealed brisk trading and rapid shifts in sentiment. The TZUP buyback provides management with a lever when headlines move quickly. If execution keeps pace, the TZUP buyback, combined with mining and treasury steps, can create a cleaner earnings runway.

In short, the TZUP buyback supports the story while the asset base grows.

What to watch

- New filings that update repurchase totals

- Any mining capacity milestones

- Treasury snapshots for DOGE and BTC

Each update can shape how the TZUP buyback interacts with cash needs and growth plans. The TZUP buyback remains a live signal of confidence, especially into year-end windows.

Conclusion

Based on the latest research, Thumzup buyback momentum is aligned with funding, DOGE accumulation, and operational expansion. If the team hits its checkpoints, the TZUP buyback can help smooth the path while crypto assets and mining output develop.

Keep an eye on near-term disclosures; the TZUP buyback will show its value as those numbers refresh.

Also Read: BREAKING: Trump Jr.-Backed Thumzup Approves $250M Crypto Push, Altcoins Included

Summary

The Thumzup buyback totals $10 million and has already resulted in executed repurchases. The firm also disclosed about $2 million in DOGE and earlier BTC holdings. A $50 million raise funds the plan, while a DogeHash deal targets DOGE production.

The TZUP buyback offers a parallel path to value as crypto exposure grows. Key figures, dates, and sources confirm the setup and the near-term path.

Glossary of key terms

Buyback: A company’s purchase of its own stock.

Treasury assets: Crypto or cash held on the balance sheet.

Average price: Total spend divided by the number of units bought.

Mining: Using hardware to secure a network and earn rewards.

FAQs on Thumzup Buyback

Q1: How big is the program?

The Thumzup buyback totals up to $10 million through December 31, 2026.

Q2: What has been repurchased so far?

212,432 shares for about $1 million at a $4.71 average.

Q3: What crypto exposure is disclosed?

Approximately $2 million in DOGE, with prior guidance that allows for significant BTC holdings.

Q4: How is it funded?

A $50 million offering, priced at $10 per share, supports the plan.

Read More: Trump Jr.-Backed Thumzup Approves $10M Buyback as Bitcoin and Dogecoin Treasury Expands">Trump Jr.-Backed Thumzup Approves $10M Buyback as Bitcoin and Dogecoin Treasury Expands

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.