BTCFi Season Kickstarts on Starknet with tBTC

0

0

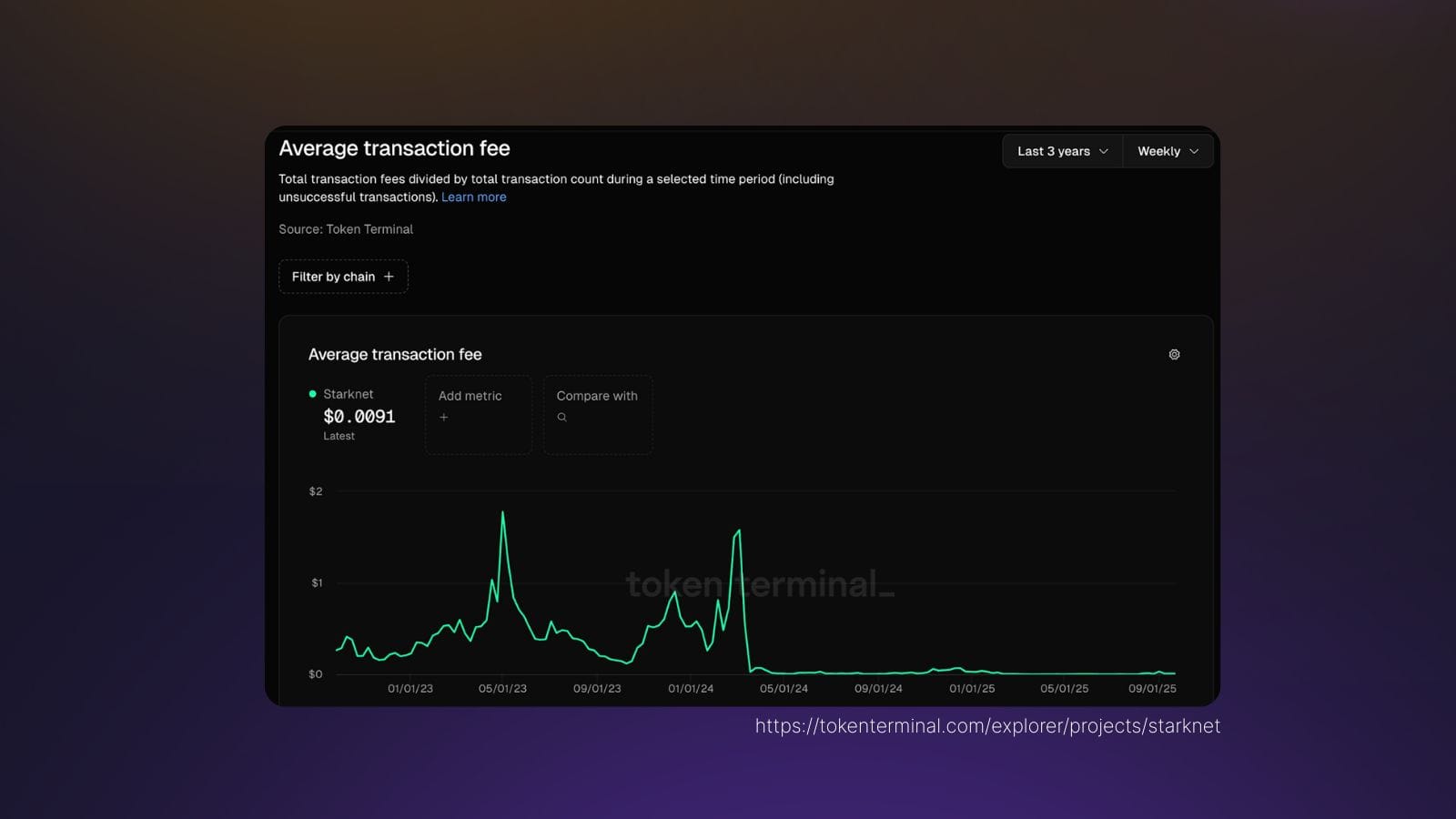

In June, Threshold and Starknet enabled the direct minting of tBTC, delivering DeFi-enabled Bitcoin at a cost of less than $0.01 per transaction.

Now, BTCFi Season enters its next phase, featuring incentivized liquidity provisioning, staking, lending, and borrowing, allowing users to unlock Bitcoin in DeFi while maintaining cryptographic self-custody via tBTC. Powered by a zero-knowledge infrastructure that cuts transaction costs by more than 99%, Starknet is opening the door to institutional-grade participation in onchain Bitcoin strategies.

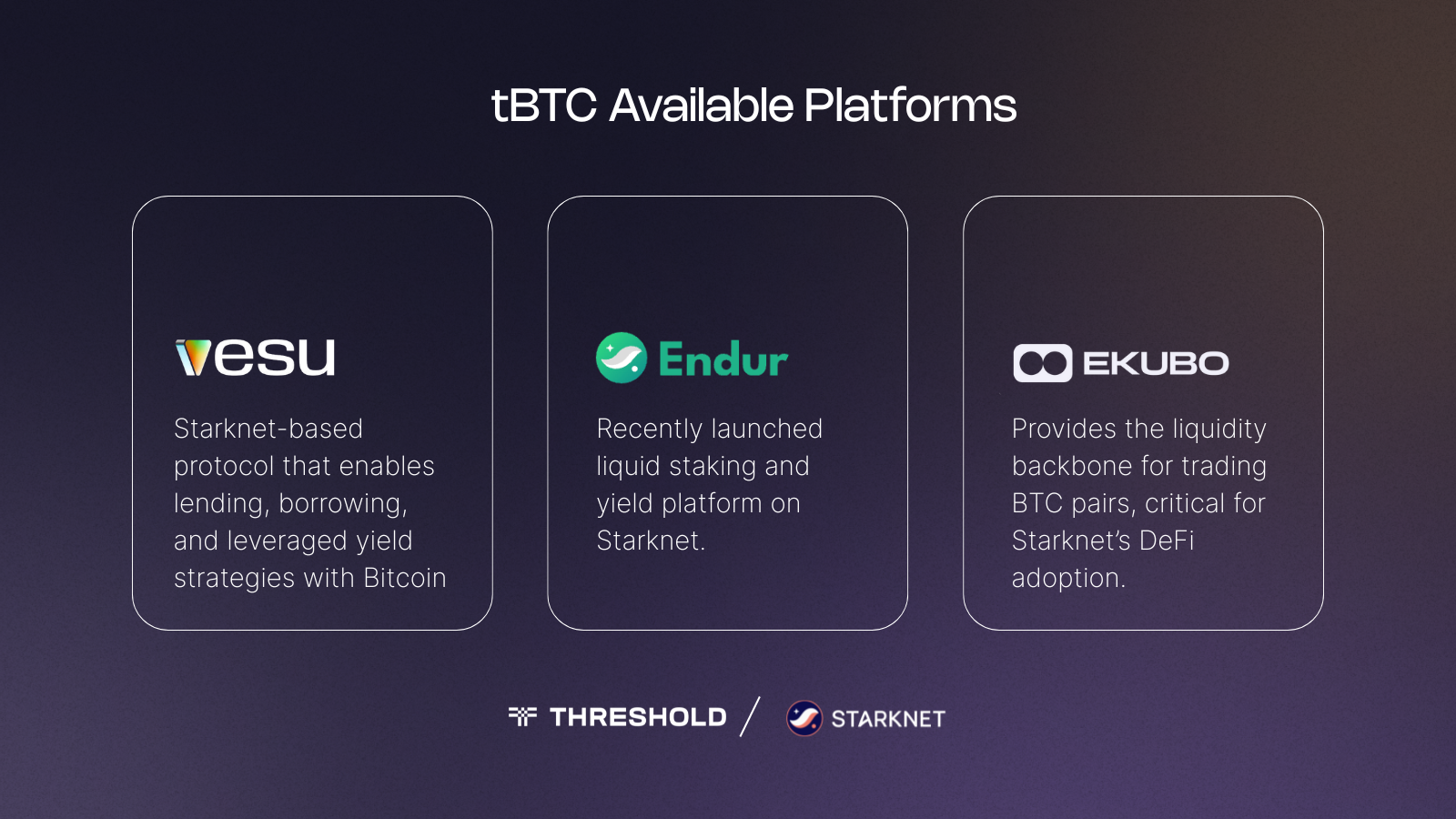

As part of this campaign, backed by 100M STRK rewards, Starknet is driving Bitcoin inflows into its network by onboarding leading Bitcoin-based protocols and trusted onchain Bitcoin assets into its DeFi ecosystem. Showing its support with boosted yields across Starknet BTCFi. For tBTC, this means:

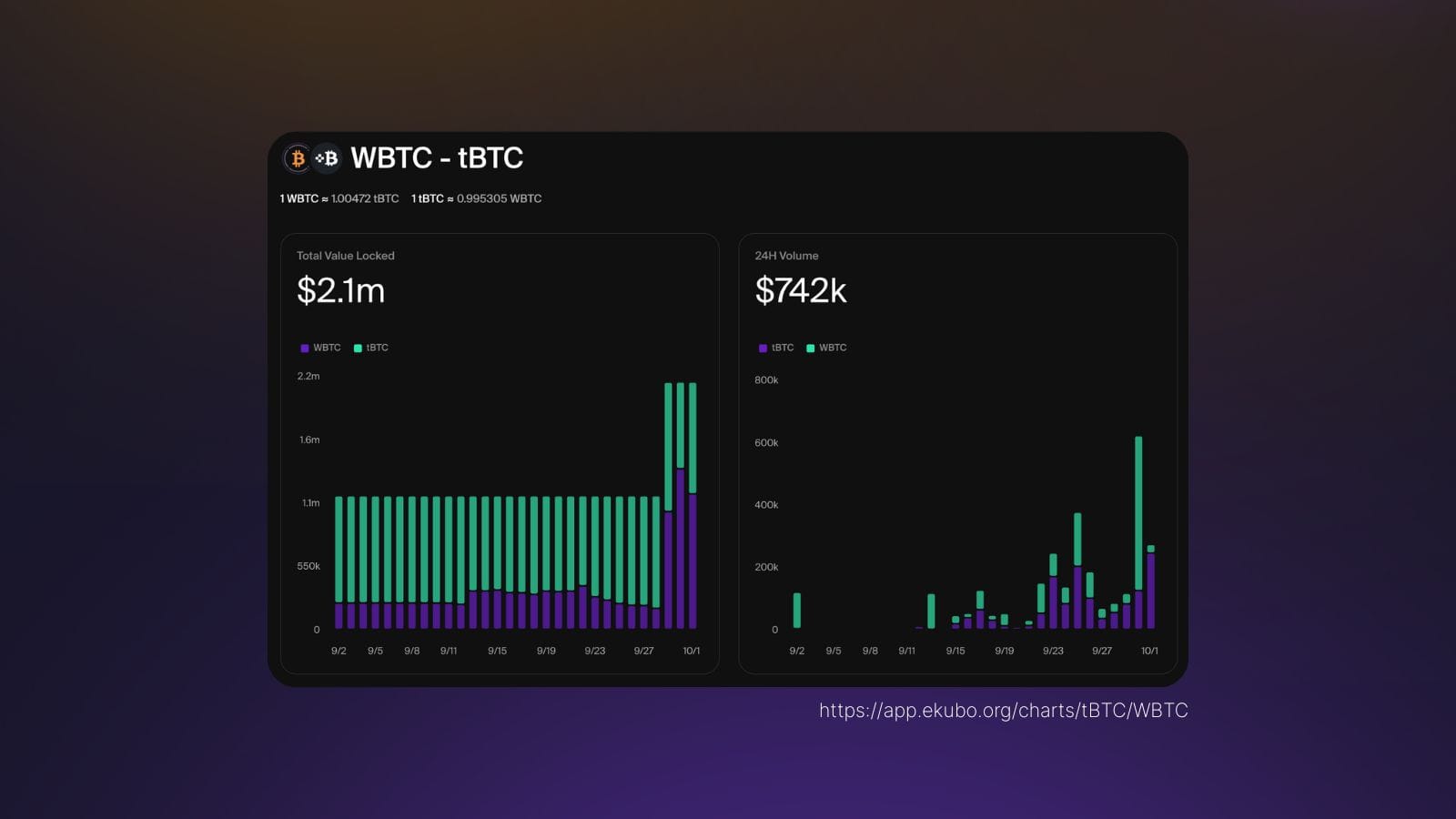

- Targeted 5% APR → tBTC/WBTC liquidity on Ekubo

- Targeted 2.5% APR → xtBTC/tBTC liquidity on Endur (xtBTC = liquid staking token for tBTC on Starknet)

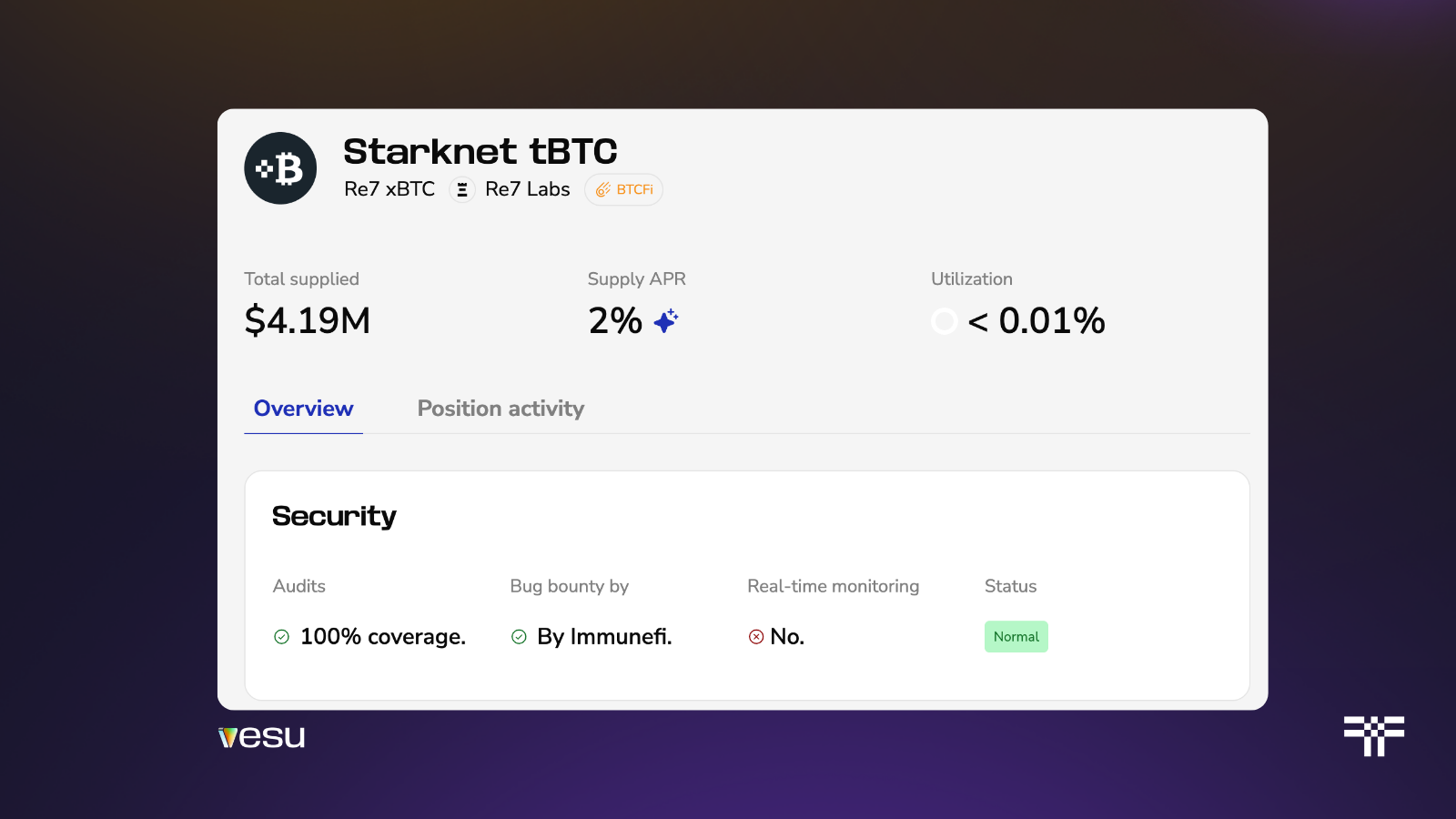

- Targeted 2% APR → Supplying tBTC on Vesu

Starknet enables institutional Bitcoin returns through ZK technology

Starknet’s zero-knowledge architecture creates unprecedented conditions for financial computation. This infrastructure now enables productive deployment with the same precision that made direct tBTC minting possible on Starknet, with transactions costing just pennies.

The underlying technology, STARK (Scalable Transparent Argument of Knowledge), functions like a compression algorithm for financial truth. While Ethereum processes each transaction individually, STARKs bundle thousands into a single mathematical proof. This compression enables Starknet’s transaction costs of $0.01 or less, allowing capital-efficient strategies to be profitable at any scale within the on-chain Bitcoin economy.

$4M incentive campaign: tBTC distribution and capacity limits

Threshold Network activates targeted incentives across three strategic venues:

Note: xtBTC is the liquid staking token for tBTC on Starknet, allowing users to earn staking rewards while maintaining liquidity.

Campaign Duration: 30 days from September 30th activation

Early Participation Advantage: Premium APR for early deployers

These rates represent subsidized infrastructure building. Ekubo, Endur, and Vesu require Bitcoin liquidity depth to serve institutional flows. Early participants capture the arbitrage between subsidized rates and organic market yields.

Yield rates follow predictable compression curves as TVL increases. Initial capital deployment captures maximum rates. In the second week, participants might experience approximately 30% rate reduction. Month-end stabilization occurs at organic market rates.

How ZK Proofs generate sustainable bitcoin returns

Unlike traditional farming's token emission models, Starknet's architecture derives profitability from fundamental economic activity. This diversity strengthens onchain Bitcoin infrastructure, with each approach serving different risk appetites. Starknet's return mechanisms include:

- Trading fees from bilateral exchange: 0.3% on every swap, automatically distributed to liquidity providers

- Lending spreads from capital demand: Market-determined rates where borrowers compensate lenders

- Arbitrage capture from market inefficiency: Price discrepancies generate sustainable revenue streams

- Mathematical verification for every transaction: All returns remain auditable through cryptographic proofs

Risk management for compliance-ready Bitcoin

Eigenlayer's slashing conditions redefined institutional risk parameters in 2025. As restaking protocols demonstrate volatile drawdown scenarios, treasuries holding more than 1M BTC evaluate productive deployment beyond passive custody. MakerDAO's $1B RWA pivot and Aave v3's efficiency mode create new capital deployment frameworks demanding verifiable infrastructure.

Consider the current landscape:

- Centralized Platforms: Bybit's recent $1.4B breach and limitations of proof-of-reserve audits, which “don't reveal off-balance-sheet liabilities or prove that reserves aren't borrowed temporarily for the f”. These highlight the risks of custody concentration that committees cannot ignore.

- Traditional DeFi: Transaction costs can exceed position profitability for smaller liquidity deployments on Ethereum. Meanwhile sandwich attacks through private mempools often extract 5-7% from unprotected trades.

- tBTC on Starknet: STARK proofs enable transaction verification without state exposure. Threshold’s trust-minimized architecture eliminates single points of failure. $0.01 costs enable automated position management.

Evaluate these against opportunity costs - M2 expansion accelerates while Bitcoin at $110K+ demands productive strategies beyond MicroStrategy's leverage playbook.

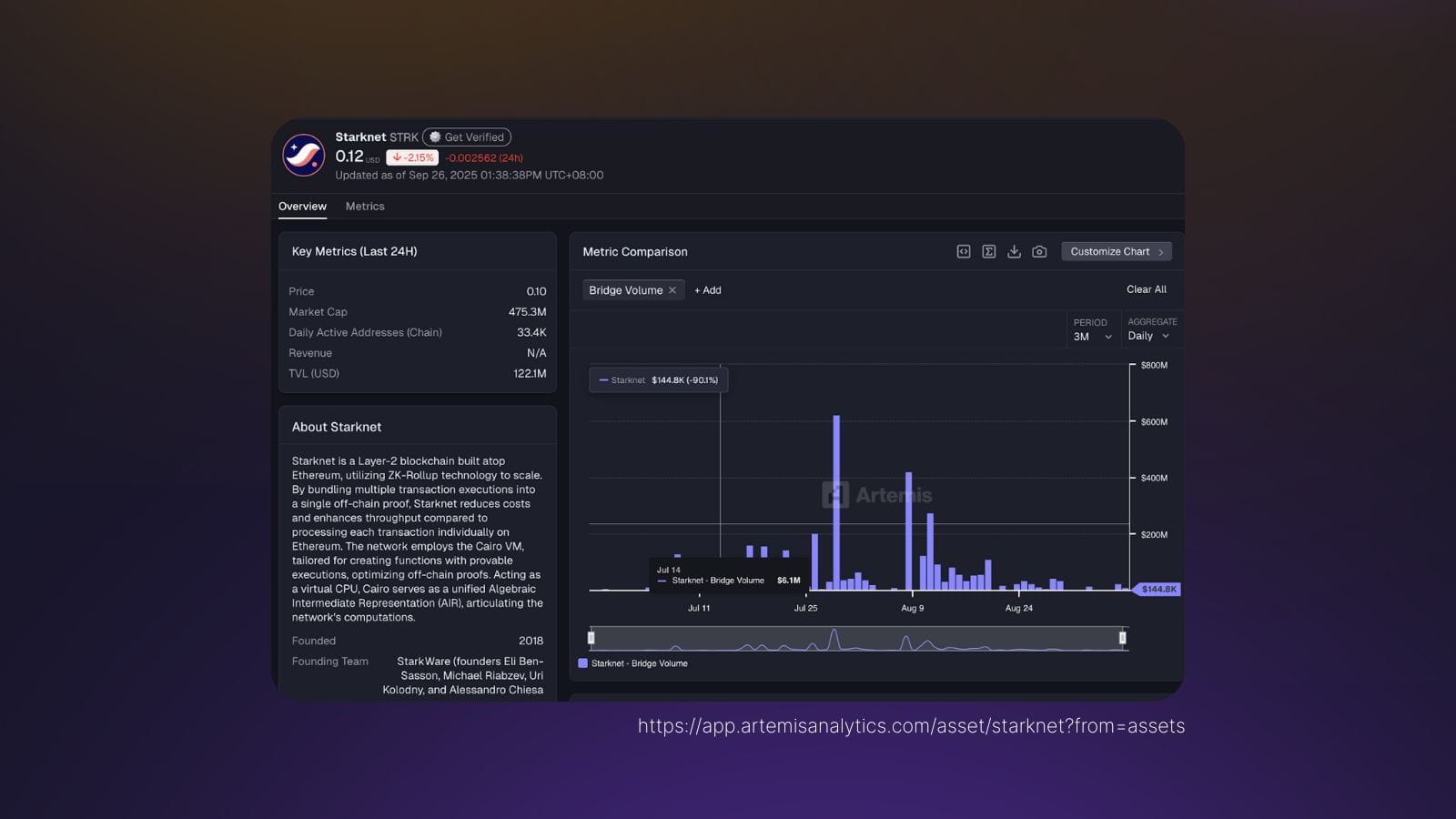

Why Starknet for tBTC: ZK infrastructure meets capital innovation

The integration of tBTC on Starknet last June 2025 has established trust-minimized rails for institutions interested in exploring DeFi liquidity provisioning. 33,000+ daily active users on Starknet validate sustainable adoption patterns. tBTC now anchors the #1 liquidity pool for Bitcoin against USD pairs on Starknet, reinforcing its position as the most reliable entry point for Bitcoin liquidity.

BitcoinFi on Starknet transforms this foundation into an integrated, productive ecosystem. The convergence of STARKs with Threshold cryptography creates an infrastructure that satisfies both DeFi natives seeking capital efficiency and institutions requiring verifiable custody. This positioning, where reliability meets revolution, makes tBTC the natural choice for sophisticated participants navigating the BTCFi ecosystem.

tBTC x Starknet BTCFi strategy suggestions: timing and position sizing

- Basis Trading Vault by 0D Strategy: 0D is a market-neutral product designed for stable returns. Here, tBTC is deposited as collateral into Vesu to borrow USDC. That USDC is then deployed into 0D’s carry and liquidity provisioning strategies. Returns are generated from lending interest, arbitrage opportunities, trading fees, and funding premia.

Target APR: ~6%

Redemption Period: 48 hours

Relevant Partner Protocols: 0D, Extended, Vesu - xtBTC Looping Vault by Endur Strategy: A leveraged strategy for those seeking to maximize xtBTC yields. Users deposit xtBTC as collateral into Vesu to borrow tBTC. The borrowed tBTC is liquid staked to mint more xtBTC, which is resupplied back into Vesu. This looping mechanism compounds staking rewards while maintaining liquidity.

Target APR: ~6%

Redemption Period: 1-2 hours

Relevant Partner Protocols: Endur, Troves, Vesu - mRe7BTC Tokenised Fund Strategy: A tokenized Bitcoin yield fund built for longer-term allocations. tBTC is accepted as a deposit into Re7’s BTC Yield Fund, which issues the receipt token mRe7BTC via Midas. Returns are primarily generated through derivatives trading on Deribit, complemented by select Starknet DeFi strategies.

Target APR: 10-20%

Redemption Period: End of the current month. Minimum of 1 calendar month deposited.

Relevant Partner Protocols: Re7, Midas

Technical requirements:

- Argent or Braavos wallet with multisig capabilities

- 0.1 ETH for gas (covers ~10,000 transactions)

- 3-4 hour bridge time via canonical Starkgate

Bitcoin’s untapped potential is finally finding a home on Starknet. With staking, lending, and liquidity solutions now live, tBTC enables users to move beyond holding and put their Bitcoin to work. From liquid staking via Endur, to leveraged strategies on Vesu, to deep liquidity on Ekubo, the foundation for BTCFi on Starknet is being built.

Together, these products and integrations establish tBTC as the backbone of Starknet’s BTCFi ecosystem, offering both institutional-grade and DeFi-native participants multiple paths to deploy Bitcoin productively.

Access points:

- Ekubo Liquidity Pools:

- tBTC/WBTC https://app.ekubo.org/charts/tBTC/WBTC

- xtBTC/tBTC https://app.ekubo.org/charts/xtBTC/tBTC

- Lend tBTC on Vesu at 2% APR:

https://vesu.xyz/earn/0x03a8416bf20d036df5b1cf3447630a2e1cb04685f6b0c3a70ed7fb1473548ecf/0x04daa17763b286d1e59b97c283c0b8c949994c361e426a28f743c67bdfe9a32f - Stake tBTC to xtBTC (the staking token of tBTC on starknet)

https://app.endur.fi/tbtc - Direct Mint (BTC - tBTC on Starknet): https://dashboard.threshold.network/tBTC/mint

- Bridge (tBTC from Ethereum L1 → Starknet): https://starkgate.starknet.io/ethereum/bridge?mode=deposit

Disclaimer: As with all DeFi, smart contract risk remains, and impermanent loss can impact liquidity positions during volatility

Disclaimer: The information provided is for informational purposes only and does not constitute financial, investment, or legal advice. Investing in cryptocurrency and digital assets involves a high degree of risk. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.