Helius Launches Latest Solana Treasury with $500 Million Private Placement

0

0

On Friday, Sept. 19, Nasdaq-listed Helius Medical Technologies (HSDT) announced the completion of a $500 million private placement to establish a Solana ETH $4 464 24h volatility: 2.8% Market cap: $538.78 B Vol. 24h: $28.32 B treasury reserve. The transaction included common stock and stapled warrants, structured to potentially raise more than $1.25 billion if all warrants are exercised.

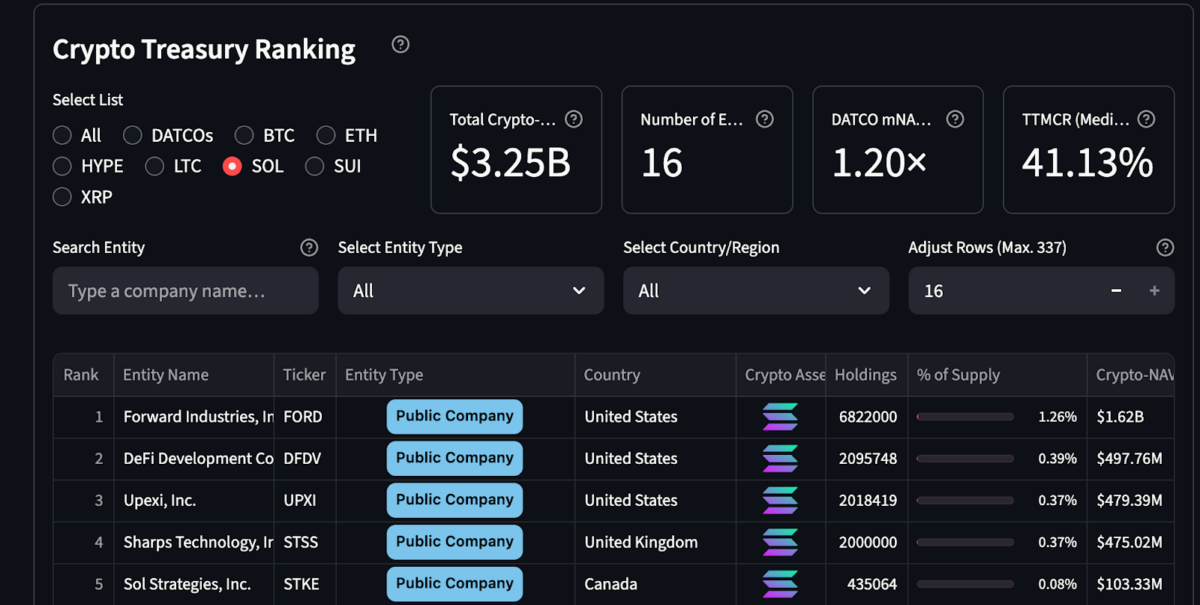

Solana Treasury Reserve Entities as of Sept. 19, 2025 | Source: SentoraResearch

The $500 million investment, co-led by Pantera Capital and Summer Capital, places Helius’ crypto net asset value (NAV) second largest among Solana treasury entities, behind Forward Industries which has crossed total holdings of $1.6 billion according to SentoraResearch data.

According to Solana Floor, Helius also stated that its treasury strategy will focus on holding SOL as the core reserve asset, citing Solana’s ~7% native staking yield as a competitive advantage over non-yield-bearing assets like Bitcoin.

Beyond staking, the firm expects to allocate selectively into decentralized finance and on-chain protocols to generate additional passive income while maintaining a conservative risk profile.

Solana Staking Deposits Rise $2.5 Billion Despite 5% Price Dip

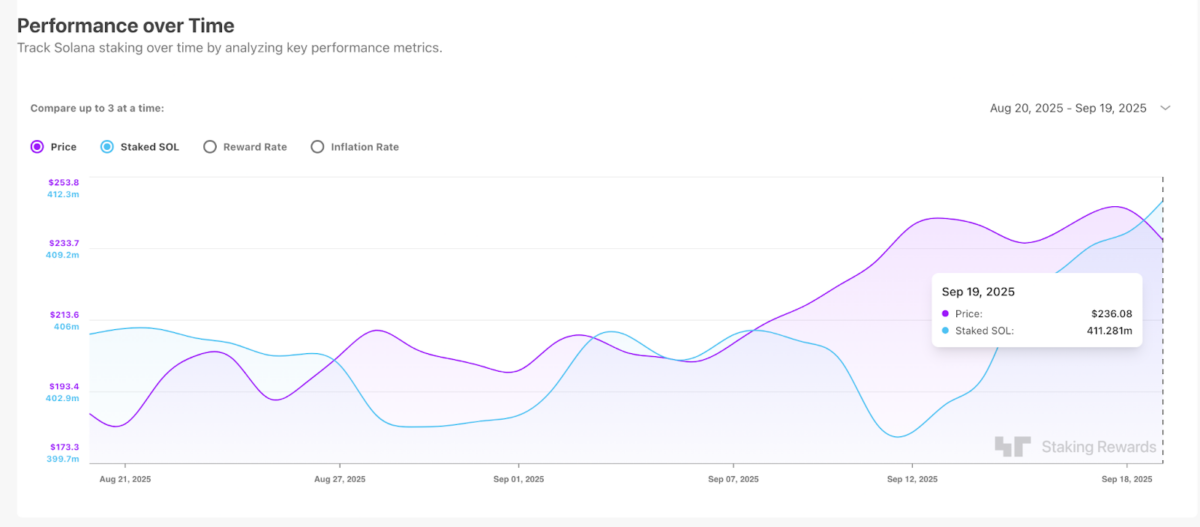

On-chain data shows Solana staking inflows have been trending upward over the past week. StakingRewards.com data reveals deposits increased from 400.8 million SOL on Sept. 12 to 411.3 million SOL at press time on Sept. 19.

Solana Staking Deposits Rise $2.5 Billion between Sept. 12 and Sept. 19 | Source: StakingRewards.com

Valued at current prices, the increased staking deposits of 10.5 million SOL are worth approximately $2.5 billion.

Moreover, this staking deposit surge coincides with nearly $300 million in inflows from Rex Osprey’s Solana Staking ETF (SSK).

For proof-of-stake networks, rising staking participation enhances network security while signaling that large stakeholders are opting to lock up assets instead of exiting amid the 5% intraday price downturn.

Solana Price Forecast: Rebound Hopes Hinge on $240 Support

At press time, Solana traded at $236.82, down 4.33% on the day, plunging below the critical support level 7-day Simple Moving Average (SMA) near $240.

However, the MACD remains bullish, with the signal line at 12.52 above the red line at 11.43, though the histogram shows weak market activity.

Solana (SOL) technical price analysis | TradingView, Sept. 19, 2025

Solana’s daily trading volume on Binance stands at $711 million, down 27% from the $970.6 million the previous day. However, the decline in volume suggests sellers may lack conviction, leaving room for a potential rebound if buy-side support emerges.

If Solana sustains the $240 support, bulls may attempt a rebound toward $250 and beyond. Conversely, a break below $235 could see Solana’s price tumble toward the 30-day SMA of $214 before finding another major supply zone.

The post Helius Launches Latest Solana Treasury with $500 Million Private Placement appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.