Bitcoin ETFs Cross $5B in Inflows, Analysts Eye $150K BTC Price

0

0

Bulls are aiming higher for Bitcoin BTC $121 259 24h volatility: 0.7% Market cap: $2.42 T Vol. 24h: $66.47 B price in this quarter as institutional investors show massive appetite for the cryptocurrency in October. Bitcoin exchange-traded funds (ETFs) have already amassed more than $5 billion in cumulative net inflows since this month’s start.

On Oct. 9, these funds attracted $197 million, according to the data by SoSoValue. BlackRock’s IBIT led the charge, accounting for $255 million in inflows.

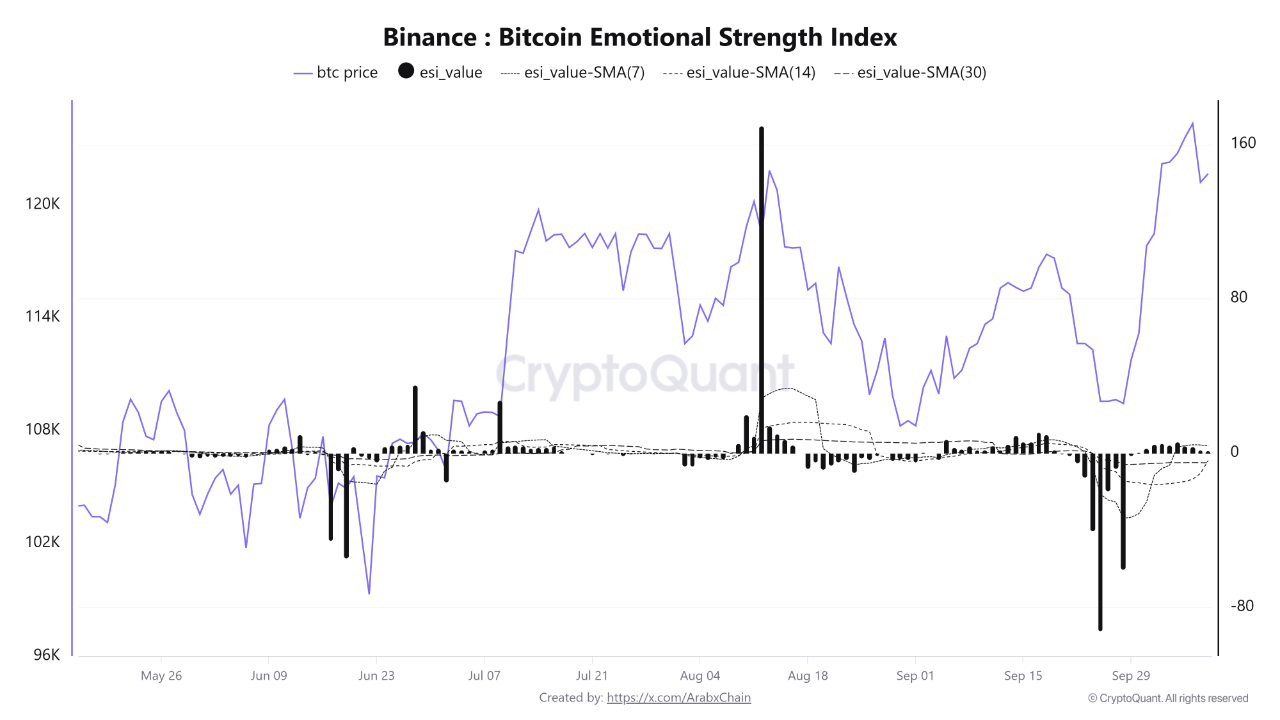

Data from CryptoQuant suggests a broader shift in investor sentiment in October. Analysts note that if Bitcoin continues to hold above $120,000, it could signal the start of another accumulation phase by smart investors.

Bitcoin Emotional Strength Index on Binance | Source: CryptoQuant

This suggests that institutional investors, who had previously been cautious amid uncertain market conditions, are now capitalizing on weak selling pressure on exchanges to increase their holdings.

Analysts Forecast $150K

At the time of writing, Bitcoin is trading at around $121,400, about 3.5% lower than its recent high of $126,000 on Oct. 7. Despite this mild correction, many analysts remain confident that the rally is far from over.

Crypto analyst BitBull explained that several institutional investors appear to be waiting for gold to reach a local peak before reallocating capital into Bitcoin. He predicts that Bitcoin could outperform gold later in the quarter, potentially climbing past $150,000.

$BTC pump isn't over yet.

Big money is now waiting for Gold to form a local top before going all-in Bitcoin.

I'm convinced that Bitcoin will outperform Gold in Q4 and rally over $150,000. pic.twitter.com/O2eYmbzwPf

— BitBull (@AkaBull_) October 9, 2025

Similarly, on-chain expert James Check recently stated in an interview that $110,000 now acts as Bitcoin’s new structural bottom. He also added that the “most logical next step” would be a climb toward $150,000, which would push Bitcoin’s market cap to around $3 trillion.

Meanwhile, financial institutions are embracing what market strategists are calling the “debasement trade,” as a weakening US dollar boosts interest in hard assets like Bitcoin and gold.

However, not everyone expects a straight path upward. Analyst Ted Pillows cautioned that Bitcoin may retest the $118,000–$120,000 support range in the near term. He explained that around these levels, there are large buy orders on Binance.

It seems like $BTC wants to retest $118,000-$120,000 support level.

Some strong bids are there on Binance around this level, so maybe Bitcoin could dump towards this level.

After that, a rally is expected if buyers step in. pic.twitter.com/66DA66v9PW

— Ted (@TedPillows) October 10, 2025

However, Ted expects a rally in the mid-term if buyers step in.

The post Bitcoin ETFs Cross $5B in Inflows, Analysts Eye $150K BTC Price appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.