3 US Crypto Stocks to Watch Today

0

0

Crypto US stocks are in the spotlight today as Strategy (MSTR), Riot Platforms (RIOT), and Coinbase (COIN) all sit near key technical levels.

Strategy and Riot are set to report earnings later this afternoon, while Coinbase’s results are expected on May 8. All three stocks are up in pre-market trading, fueled by growing interest in Bitcoin and broader crypto momentum. With critical support and resistance levels in play, today’s trading session could set the tone for the next move across the sector.

Strategy Incorporated (MSTR)

Strategy (formerly MicroStrategy) has been on a notable upward trajectory. It closed slightly lower yesterday at -0.35% but rose 3.60% in the pre-market.

The stock has surged 31% over the past month, driven largely by its aggressive Bitcoin acquisition strategy. The company recently added 15,355 BTC for $1.42 billion. Its total BTC holdings are now at 553,555 BTC, making it one of the biggest BTC whales in the market.

This bold accumulation reinforces Strategy’s status as the largest corporate holder of Bitcoin, a role that continues to draw interest from both institutional players and retail investors.

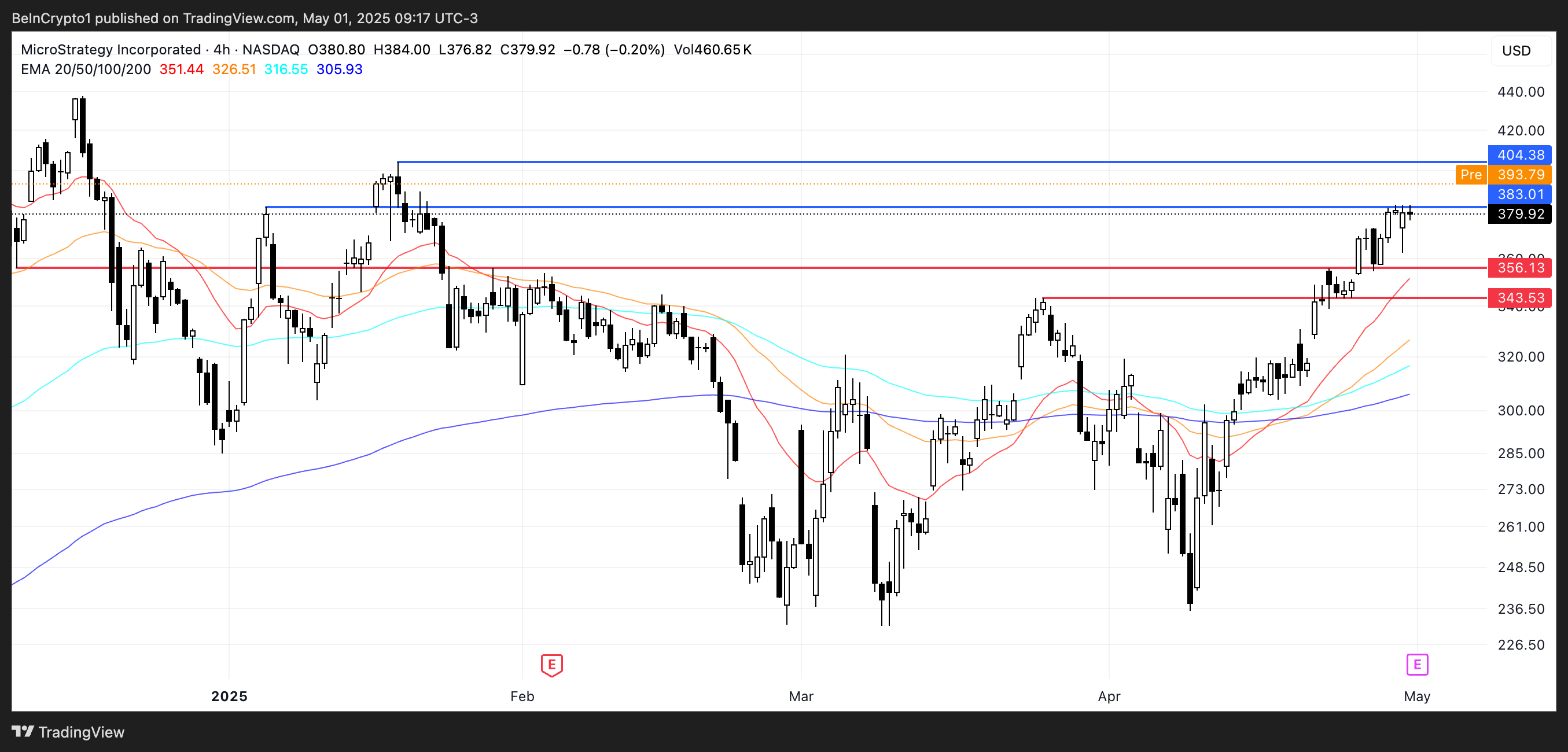

MSTR Price Analysis. Source: TradingView.

MSTR Price Analysis. Source: TradingView.

All eyes are now on Strategy’s earnings call, scheduled for 5 PM EDT today. This call could serve as a key catalyst for the stock’s next move. Technically, MSTR is nearing a critical resistance level at $383.

A break above this zone could trigger a rally toward $404, a price level not seen since mid-December.

With momentum building and Bitcoin sentiment remaining elevated, the earnings report may play a pivotal role in determining whether this rally has more room to run.

Riot Platforms (RIOT)

Riot Platforms (RIOT), one of the largest Bitcoin mining companies in the United States, is set to report earnings today at 4:30 PM EDT. The stock closed yesterday down 2.43% but is showing strength in the pre-market, up 3.45%.

This pre-market move brings RIOT close to a short-term resistance at $7.53—if broken, it could pave the way for a push toward $8.05.

However, downside risks remain, as the stock also hovers near key support at $7.19. A break below that level could trigger further selling pressure, with the next support zone near $6.23.

RIOT Price Analysis. Source: TradingView.

RIOT Price Analysis. Source: TradingView.

Riot Platforms operates large-scale mining facilities and is heavily exposed to Bitcoin price action. As such, its share price tends to reflect broader crypto market volatility.

Technically, RIOT’s RSI has dropped from 65 to 49.47 over the past six days, indicating a cooling in momentum and a more neutral setup heading into earnings.

With key support and resistance levels in play, today’s earnings call may determine whether RIOT breaks higher or falls further in the short term.

Coinbase (COIN)

Coinbase (COIN), the largest cryptocurrency exchange in the US, has gained over 16% in the past 30 days, riding the broader strength in crypto markets.

Despite closing 1.57% lower yesterday, the stock is up 3.15% in pre-market trading, showing renewed interest ahead of its upcoming earnings call scheduled for May 8.

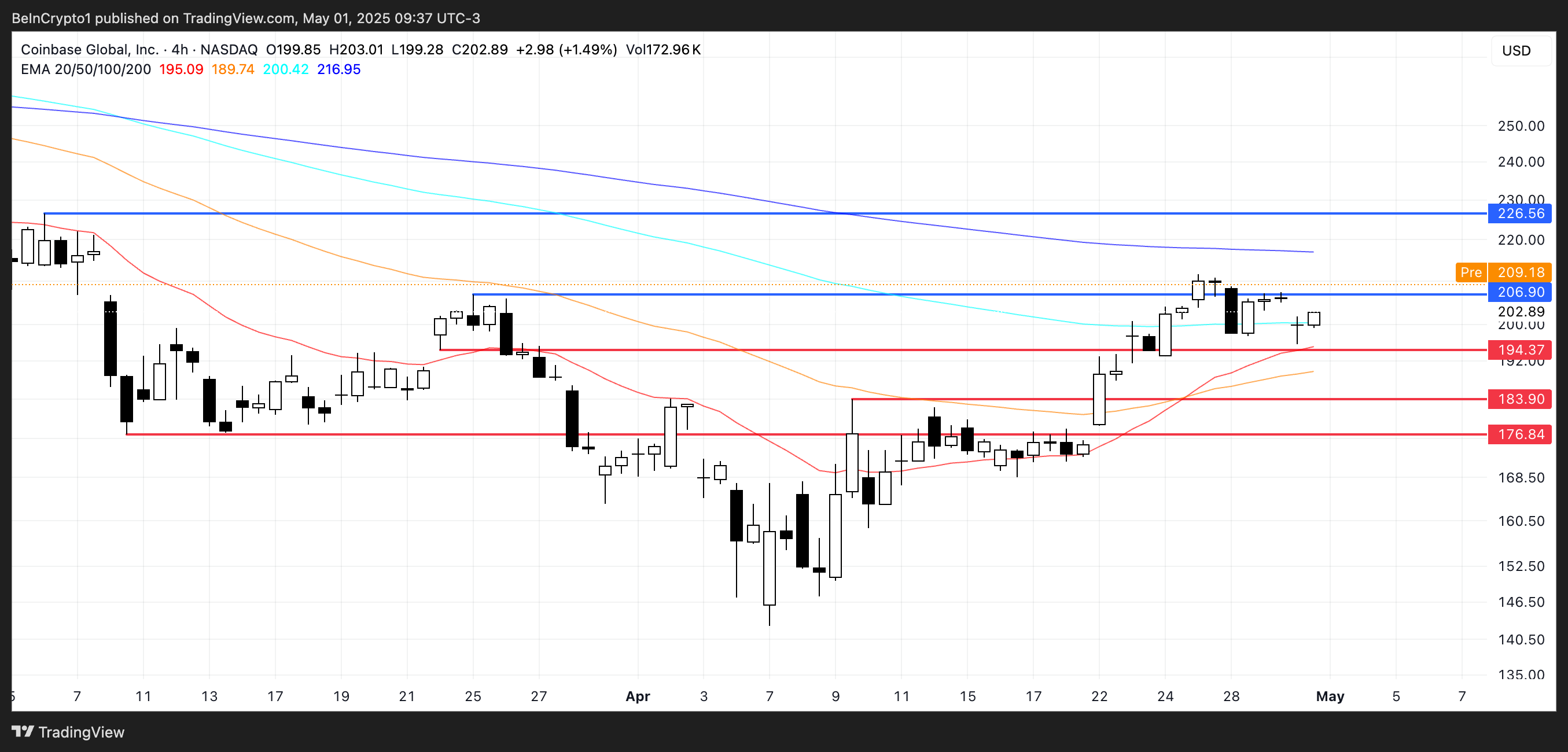

COIN Price Analysis. Source: TradingView.

COIN Price Analysis. Source: TradingView.

From a technical standpoint, COIN is approaching a key resistance level at $206.90. A decisive breakout above this level could trigger bullish momentum, with the next target around $226.56.

However, downside risks are also present: if a pullback occurs, support at $194.37 will be closely watched.

A break below that could accelerate losses toward $183.90 or even $176.84, making the upcoming days particularly important for short-term direction.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.