Solana Skyrockets Past $200: Unveiling 3 Key Growth Drivers

1

0

Solana’s (SOL) meteoric rise past $200, for the first time since December 2021, marks a milestone in the blockchain and DeFi sectors.

Here are three critical reasons behind its ascent and insights into its future trajectory.

Solana’s DeFi Ecosystem Soars

Firstly, Solana’s DeFi presence is commanding. It has overtaken Arbitrum, securing the fourth-largest spot in the blockchain network for DeFi.

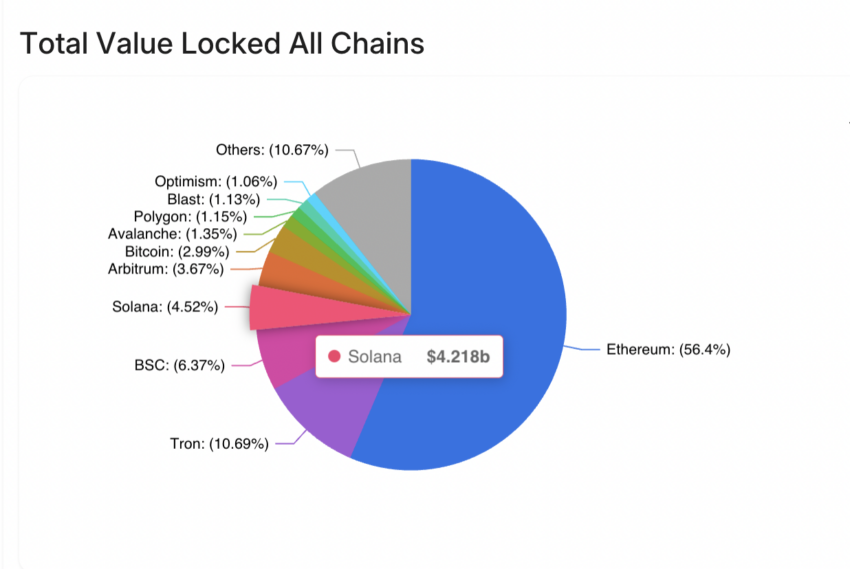

According to DeFiLlama, it boasts over $4.21 billion in total value locked (TVL). Remarkably, this figure represents a 127% increase within a single month. This surge places Solana at the forefront of DeFi network growth.

Read more: Top 6 Projects on Solana With Massive Potential

Total Value Locked on All Chains. Source: DefiLlama

Total Value Locked on All Chains. Source: DefiLlama

Secondly, Solana’s Decentralized Exchanges (DEX) volume has skyrocketed. Fueled by the rising popularity of meme coins like Solama, Book of Meme, and Bonk, Solana’s DEXs now lead in trading volume.

Solana’s daily trading volume has hit $3.085 billion, surpassing Ethereum’s $2.037 billion. Notably, Raydium, Jupiter, and Orca, the top DEX platforms on Solana, have processed significant volumes.

Their success is largely due to Solana’s lower transaction fees. As a result, they have attracted a substantial user base and developer interest, moving away from traditional Ethereum-based platforms.

Lastly, the growth in Solana’s staking ecosystem is impressive. Marinade Finance reports over $2.16 billion in staked assets, a 66% jump in 30 days. Following it is Jito and BlazeStake, which have considerable staked assets.

According to Coinbase, over 65% of Solana is staked, highlighting the community’s commitment to the network’s success. Moreover, this also indicates a temporary decrease in Solana’s circulating supply.

The price surge of Solana to over $200 has coincided with its peak search interest on Google Trends. This reflects an increased public interest and the platform’s growing prominence. Interestingly, Solana has surpassed Ethereum in global search interest, showcasing its rising market influence.

“[This is] much bigger news than people realize,” Helius Labs CEO wrote on X.

However, it now encounters resistance between $200 and $205, a crucial juncture that could determine its price trajectory.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

Solana (SOL) Price Performance. Source: TradingView

Solana (SOL) Price Performance. Source: TradingView

Should Solana close daily above the resistance level, minimal obstacles stand in its way to new all-time highs. Meanwhile, its market capitalization has already exceeded previous records.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.