Why the Crypto Market Is Crashing Again as Selloff Extends Into New Week

0

0

The crypto market crash continued to shake investors as major tokens slipped again to start the week. Prices fell sharply, extending losses from October’s historic decline.

Leading assets Bitcoin and Ethereum continued to lack the momentum to bounce back. Analysts reported that the selloff was due to profit-taking and weak fundamentals, leaving traders worried.

Market sentiment is delicate, given that no specific factors or events are causing the downtrend. The trust in digital assets weakens, and many exchanges have lost worldwide confidence.

Crypto Market Crash Deepens as Bitcoin and Altcoins Loses Momentum

Bitcoin traded near $107,000 after briefly touching $110,000 last week. The largest cryptocurrency lost its recent momentum, dragging most of the market down. Ethereum, BNB, and Solana slipped nearly 4%.

Also Read: From Early Bitcoin Days to Secure Devices: Cold Storage Story Explained

Dogecoin and Cardano’s ADA dropped 5%, marking the steepest losses among major tokens. Only Tron’s TRX managed to stay flat. The crypto market crash unfolded without a clear catalyst.

Analysts believe profit-taking over the weekend and weak fundamentals triggered the correction. The sentiment across the digital asset sector remains fragile.

Institutional Demand Declines

Crypto analyst Charles Edwards noted that Bitcoin’s institutional demand has fallen below its daily mining supply. It is the first time in seven months that this metric has turned negative.

Edwards said this trend was once the main support for the market. Now, with fewer institutional buyers, Bitcoin’s outlook looks uncertain.

He estimated that about 188 corporate treasuries still hold Bitcoin, but most lack a clear business model. Their heavy positions, combined with shrinking interest from large investors, have added pressure during the ongoing crypto market crash.

Spot ETF Flows Contract

The latest data shows spot Bitcoin ETFs, a major driver of institutional inflows earlier this year, are also slowing down. After the October 10 crash, ETF buying fell sharply, and total institutional demand dropped below Bitcoin’s daily supply.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Nov 2025 | $ 108,581 | $ 115,755 | $ 124,349 |

15.28%

|

| Dec 2025 | $ 112,297 | $ 129,087 | $ 145,112 |

34.52%

|

Charts tracking buying and selling pressure have shifted from green to red. Analysts view this as a sign of rising institutional selling.

Whale Activity on the Rise

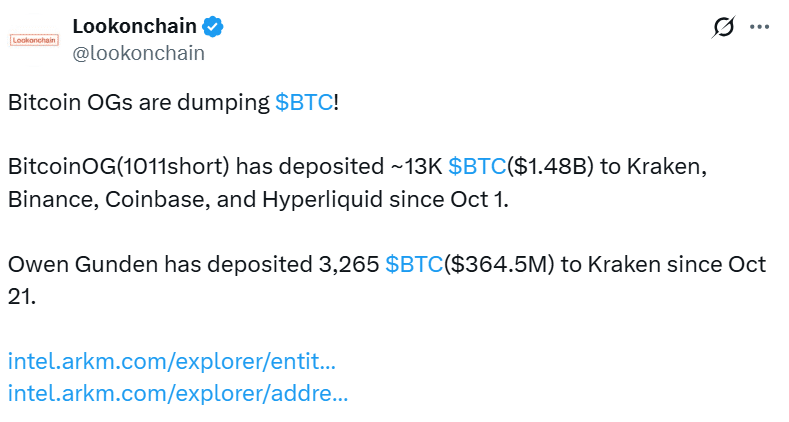

On-chain platform Lookonchain reported growing selling pressure from whale investors. One whale, identified as “BitcoinOG (1011short),” moved about 13,000 BTC worth $1.48 billion to exchanges since October 1.

The deposits went to Kraken, Binance, Coinbase, and Hyperliquid. Such movements often signal potential sell-offs. Large holders taking profits or exiting positions have deepened the crypto market crash, as more supply hits exchanges during already weak demand.

Long-Term Holders Take Profits

Data from Glassnode shows Bitcoin sales by long-term holders have tripled since June. Many investors who bought near $93,000 began realizing profits in October. Despite heavy selling, total spot trading volume reached $300 billion for the month — the highest in a year.

This indicates that liquidity remains strong, even as volatility spikes during the crypto market crash. Some traders see this as a healthy correction after several weeks of overextended gains.

Gold Market Reaction

While crypto prices slid, gold steadied around $4,000 per ounce. The yellow metal fell earlier after China removed tax rebates for certain gold retailers. The policy could limit demand from one of the world’s largest markets.

Despite the dip, gold remains up more than 50% this year. Analysts say gold and Bitcoin have moved more closely together lately. Both assets now respond similarly to global risk factors such as inflation, policy changes, and geopolitical tension.

Fed Policy and Outlook

The pause in rate hikes by the US Federal Reserve has temporarily lifted some pressure off the markets. Risk assets could be supported by lower borrowing expenses at some point. Nonetheless, traders are exercising caution.

A significant number of market participants are juggling risk-off as well as risk-on assets. The crypto asset meltdown demonstrates how ephemeral confidence in digital assets is.

According to analysts, the return of institutional inflows and low volatility virtually across the board are prerequisites for a return to normalcy. Until that point, however, the market will remain highly unstable.

Conclusion

The crypto market crash marks another test for investors. Declining institutional demand, heavy whale activity, and shifting macro trends continue to shape the landscape. Bitcoin and gold are moving in tandem, reflecting shared global pressures.

Also Read: Bitcoin Price Prediction: How Saylor and Kiyosaki See BTC Surging to $200K

Appendix: Glossary of Key Terms

Crypto Market Crash – A sudden, widespread, and aggressive plunge in cryptocurrency prices. This is generally driven by profit-taking, sentiment, or macroeconomic slowing.

Bitcoin – The very first and most significant cryptocurrency by market cap. Often the bellwether cryptocurrency’s success and growth also reflects that of the rest of the field.

Altcoins – The word applied to any cryptocurrency that isn’t Bitcoin. This includes but is not restricted to Ethereum, Solana, Dogecoin, and Cardano.

Institutional Investors – Large-scale buyers willing to place large quantities of money or financial derivatives into electronic currencies.

Spot ETF – An Electronic funds transfer which holds tangible Bitcoins versus mirrored assets. Buying and selling allows for direct experience of demand activity.

Whales – Large-bodied, muscular mammals that live beneath the foreign exchange trading market.

Frequently Asked Questions Crypto Market Crash

1- What caused the crypto market crash?

Profit-taking, reduced institutional demand, and weak fundamentals triggered the recent decline.

2- How far did Bitcoin fall?

Bitcoin dropped from about $110,000 to $107,000 in early Monday trading.

3- Are institutions still buying Bitcoin?

Institutional buying has slowed sharply and now trails Bitcoin’s daily mining output.

4- How are whales affecting the market?

Large investors have transferred billions in Bitcoin to exchanges, adding selling pressure.

Read More: Why the Crypto Market Is Crashing Again as Selloff Extends Into New Week">Why the Crypto Market Is Crashing Again as Selloff Extends Into New Week

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.