Why is The Crypto Market Down Today?

0

0

The total crypto market cap (TOTAL) and Bitcoin noted a slight decline over the last 24 hours, likely due to the market cooling down. However, altcoin MemeCore (M) took a big hit, falling by 35%.

In the news today:-

- The OCC, FDIC, and Federal Reserve have authorized banks to hold clients’ crypto, emphasizing consumer protection. However, banks are prohibited from allowing clients access to the keys for these custody mechanisms.

- Strategy (formerly MicroStrategy) has committed $472.5 million to Bitcoin, leading others like Matador Technologies to follow suit. Matador plans to raise $657 million CAD over 25 months, with the majority of funds allocated to purchasing more Bitcoin.

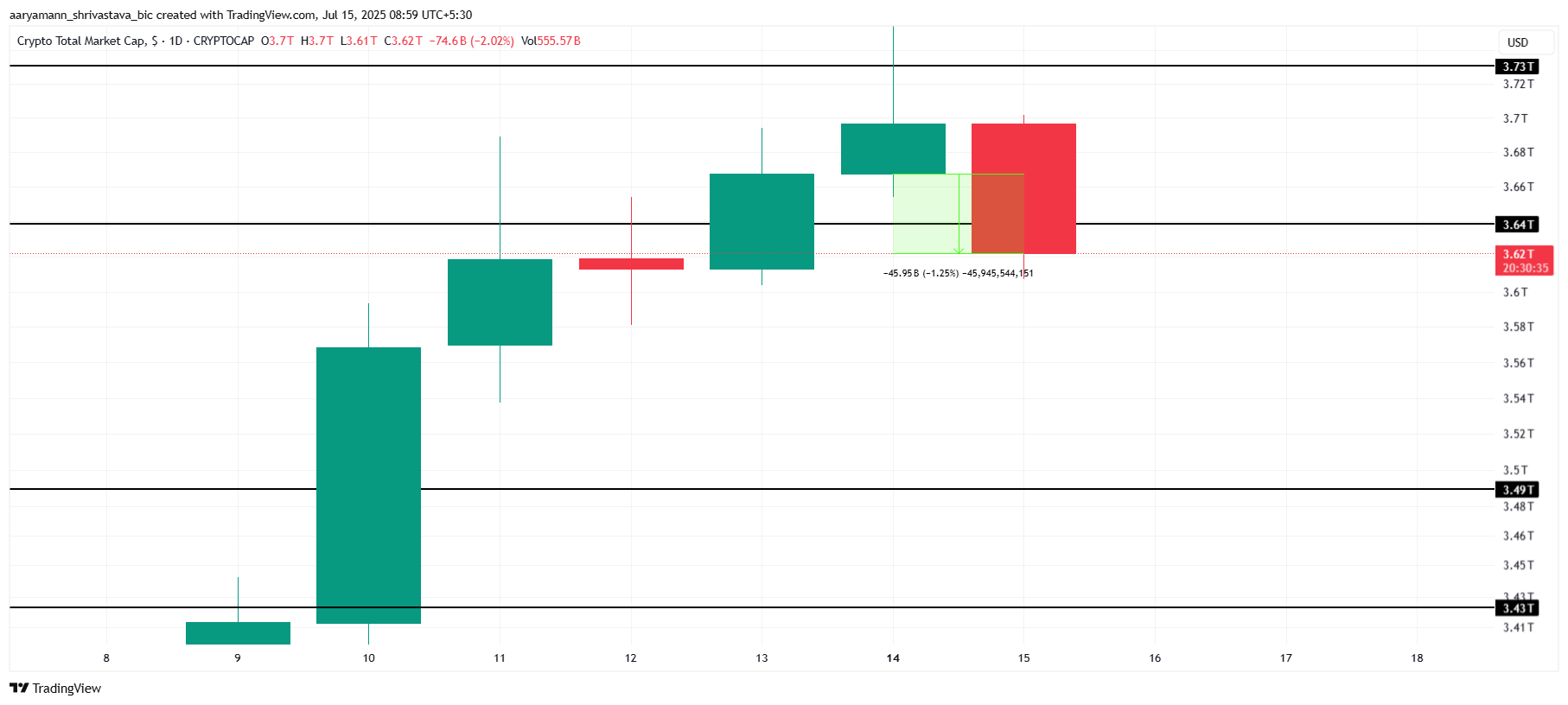

The Crypto Market Slips Below Support

The total crypto market cap has decreased by $45 billion in the last 24 hours, now standing at $3.62 trillion. This drop follows a recent surge, signaling a market cooldown. This price correction reflects broader market conditions, which could potentially lead to further declines if selling pressure continues.

If the recent market cooldown continues with sustained selling from investors, the total crypto market cap could slide further. A drop to $3.49 trillion is possible, which would erase a significant portion of the recent growth. This would mark a potential shift in investor sentiment, weakening bullish momentum.

Total Crypto Market Cap Analysis. Source: TradingView

Total Crypto Market Cap Analysis. Source: TradingView

However, if macroeconomic conditions improve and investor confidence strengthens, the crypto market could recover. Total crypto market cap may rise to $3.73 trillion, with $3.64 trillion acting as a critical support level. This would help regain upward momentum, pushing prices higher.

Bitcoin Is Holding Its Ground

Bitcoin’s price currently stands at $117,386, sliding below the key $118,000 mark. The crypto king is experiencing a cooldown following its recent rally. This pullback indicates a potential period of price consolidation, which could set the stage for a more substantial move in either direction.

If the downtrend persists, Bitcoin could dip further, potentially reaching $115,000. This level is expected to act as crucial support, providing a foundation for a possible rebound. If Bitcoin successfully holds above this level, it may regain momentum and push back toward higher levels.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

Alternatively, if Bitcoin catches any bullish momentum, it could surge past its all-time high of $119,966. Breaking through this resistance level would open the path for BTC to reach the $120,000 mark. Such a move would likely trigger further investor optimism and increase market inflows.

MemeCore Loses Sharply

MemeCore experienced a significant drop of 35% in just 24 hours, now trading at $0.40. The meme coin’s fall follows its failure to breach the $0.84 resistance level. This decline reflects a broader market struggle, with investors cautious about the market.

If the current downtrend persists, MemeCore could slip further, potentially testing the support level at $0.29. This would mark an important threshold, and a breach of this level could signal more bearish movement, putting the altcoin at risk of a deeper decline in the coming days.

MemeCore Price Analysis. Source: TradingView

MemeCore Price Analysis. Source: TradingView

However, if MemeCore captures renewed investor interest, it could quickly recover. A rebound would push the price back toward $0.84, potentially surpassing this resistance level. Such a move would likely invalidate the bearish outlook.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.