XRP Price Prediction Shaken as Pullback Overshadows Record ETF Launch

0

0

Record ETF Launch Fails to Lift XRP Price

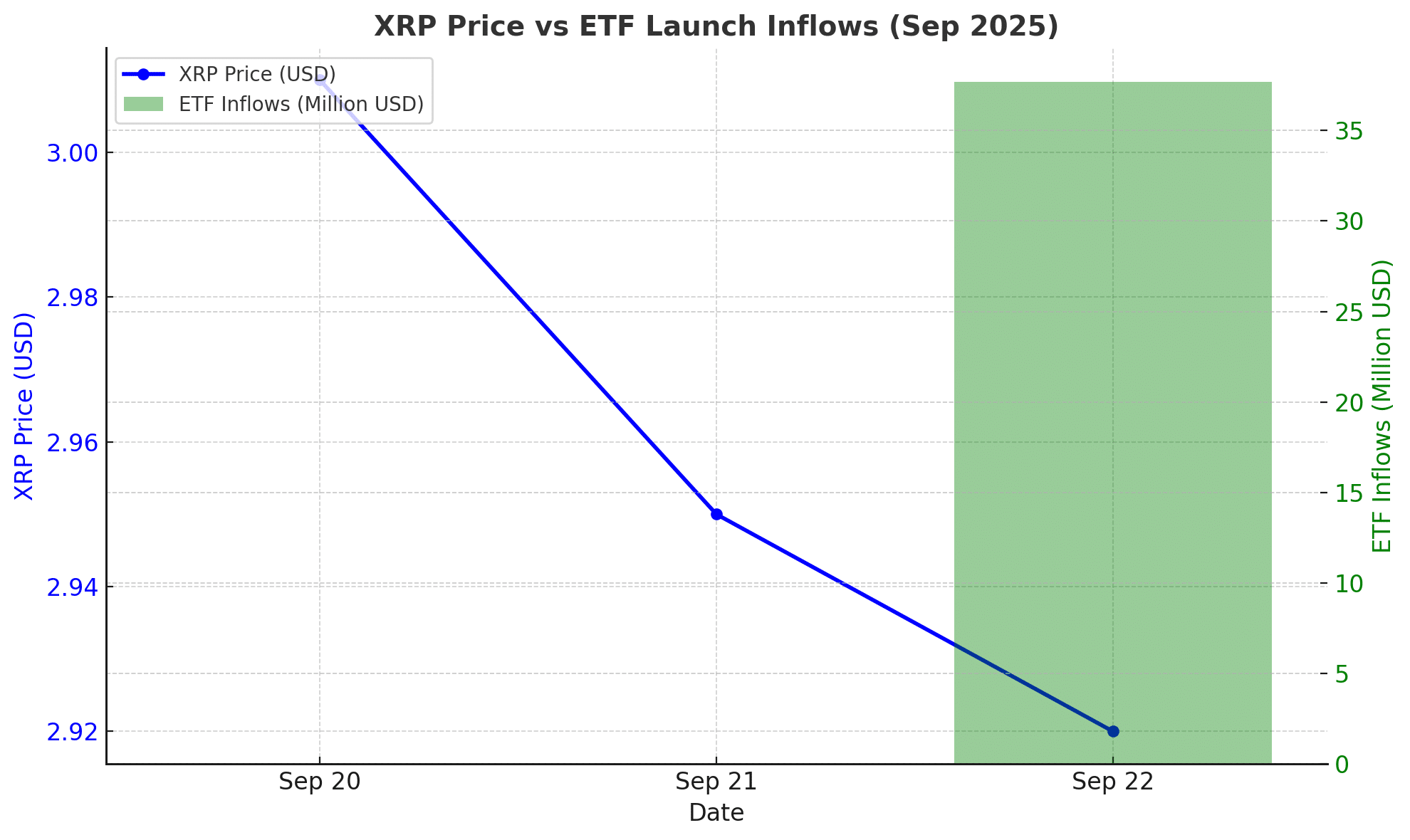

XRP entered the week with high expectations as its long-awaited exchange-traded fund debuted in the United States. The launch attracted nearly $37.7 million in first-day trading volume, marking the strongest debut of any crypto ETF in 2025.

Yet, despite this historic milestone, the XRP price prediction narrative turned bearish as the token slid by more than 3%. XRP fell from a peak of $3.01 to trade near $2.92, erasing much of the initial excitement.

The selling pressure highlighted how broader market forces can outweigh even groundbreaking institutional developments. Bitcoin’s pullback from recent highs spilled into the altcoin market, overshadowing XRP’s milestone.

Market strategist Oliver Grant commented on X, “ETF success alone doesn’t guarantee immediate price lift. Broader sentiment still drives direction, and right now Bitcoin weakness is dictating the tone.”

Resistance at $3.00 Stalls Momentum

Technical charts show XRP repeatedly struggling to sustain closes above the $3.00 resistance zone. This level has become a psychological barrier for traders, with repeated rejections adding to cautious sentiment. On-chain data also reveals a spike in trading volume during the dip, with more than 260 million tokens exchanging hands, a sign of heavy institutional profit-taking.

Indicators such as the relative strength index (RSI) and moving averages suggest consolidation in the short term. The RSI cooled from overbought levels, while price action remains pinned between $2.87 support and $3.00 resistance. Analysts note that a decisive break above $3.00 on strong volume would be critical to shift the XRP price prediction back into bullish territory.

ETF Inflows Show Institutional Appetite

While the price reaction disappointed many retail investors, the ETF’s robust inflows underscore strong institutional appetite for XRP. The fact that an ETF launch reached record trading volume in a crowded crypto market signals that professional investors are positioning for long-term exposure.

Blockchain policy researcher Marcus Lee explained, “ETFs are long-horizon instruments. Institutions aren’t chasing daily swings; they’re securing regulated exposure. That creates a foundation for future stability, even if short-term XRP price prediction looks weak.”

This distinction between institutional and retail focus has become clear. Retail traders remain fixated on immediate price movements, while institutions prioritize regulated entry points that reduce custody and compliance risks.

Broader Market and Fed Impact

XRP’s trajectory is also being shaped by macroeconomic conditions. The Federal Reserve’s policy outlook continues to weigh on risk assets, with expectations of rate adjustments fueling volatility across equities and digital currencies alike. As Bitcoin retreats on uncertainty, XRP and other altcoins often follow suit.

Derivatives markets have also turned more cautious. The long-to-short ratio has tilted bearish, signaling that traders are hedging against further downside. If Bitcoin stabilizes, XRP may regain momentum, but for now, sentiment remains restrained. With the ETF launch providing a long-term tailwind, the near-term XRP price prediction remains tied to broader market currents and macro policy shifts.

Conclusion

The launch of the XRP ETF represents a landmark achievement, attracting record inflows and showcasing institutional demand. Yet, the token’s immediate price performance underscores a familiar reality: technical barriers, Bitcoin pullbacks, and macro pressures still dominate short-term moves.

For XRP to reclaim a bullish narrative, it must decisively break resistance at $3.00 while maintaining institutional inflows. Until then, the XRP price prediction reflects a market balancing optimism with caution.

FAQs about XRP ETF

Why did XRP fall after the ETF launch?

Despite a record ETF debut, Bitcoin’s pullback triggered selling across altcoins, dragging XRP lower.

What is the key resistance level for XRP?

XRP has faced repeated rejection around $3.00, making it the critical level to watch.

How does the ETF affect long-term XRP price prediction?

The ETF signals strong institutional demand, which supports long-term stability despite short-term volatility.

What risks could weigh on XRP in the near term?

Macro factors such as Fed policy, Bitcoin’s direction, and derivatives market sentiment may pressure XRP further.

Glossary

ETF (Exchange-Traded Fund): A regulated investment vehicle that tracks the price of an asset or group of assets.

Resistance Level: A price ceiling where selling pressure often halts upward movement.

Relative Strength Index (RSI): A momentum indicator used to measure overbought or oversold conditions.

Derivatives Market: Financial contracts like futures or options used to speculate or hedge crypto price movements.

Institutional Investor: Large entities such as hedge funds or asset managers investing significant capital.

Support Zone: A price range where demand typically prevents further declines.

Read More: XRP Price Prediction Shaken as Pullback Overshadows Record ETF Launch">XRP Price Prediction Shaken as Pullback Overshadows Record ETF Launch

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.