Bitcoin ETF Inflows Near $3B as XRP, Dogecoin, and Solana See Short-Term Pullback

0

0

According to sources, Bitcoin ETF inflows are keeping the market strong as $2.7 billion moved into crypto ETPs this week, showing continued interest from institutions in $BTC.

Traders are staying positive even though altcoins like XRP, Dogecoin, and Solana saw small drops. This shows that Bitcoin is seen more and more as a safe digital asset similar to gold.

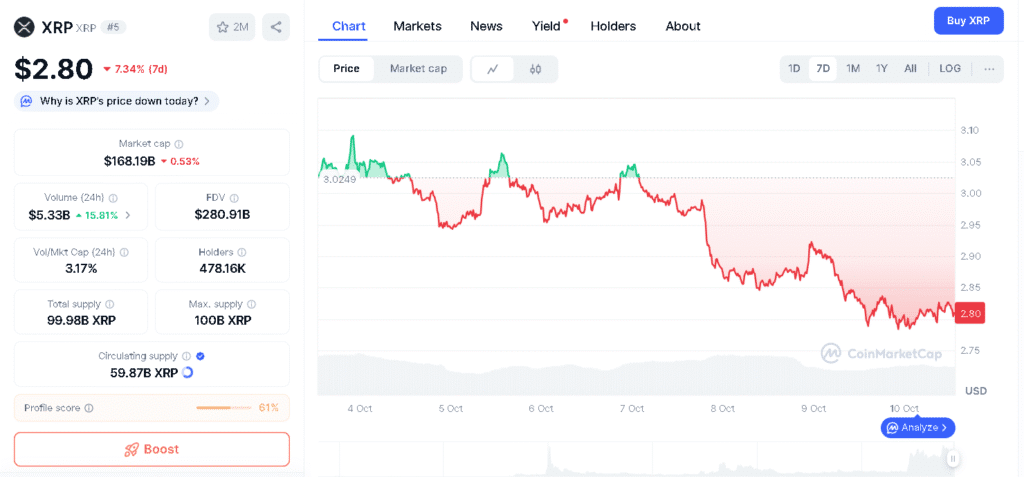

What Caused XRP’s Recent Pullback?

XRP hovered near $2.78 and $2.85, with sellers active at $2.85 and buyers stepping in around $2.78.Selling by institutions and increased leverage risks caused a short term decline

Even with this pullback, futures open interest rose to $9 billion, showing strong involvement from major investors. Analysts point out that $2.78 is a key support level for XRP.

If this level breaks, the price could slide toward $2.72. Traders are watching Bitcoin ETF inflows and the Federal Reserve’s next move for signals on where the market may head.

Also read: Bitcoin ETF Inflows Top $1.18B, Fueling Bullish Outlook for $BTC Toward $160K

What’s Behind DOGE and SOL’s Dip?

Dogecoin and Solana saw selling pressure after recent gains, which is seen as part of a normal market cooldown. Solana has attracted $2.7 billion in crypto ETP inflows this year, while XRP has drawn about $1.9 billion.

Experts say that even with the recent dips, the long term trend is still strong. Support from Elon Musk and DOGE ETF filings by companies such as 21Shares, Bitwise, and Grayscale have provided additional institutional backing.

Analysts expect Solana to trade between $221.06 and $230.82 in October, with the average price near $225.26. DOGE may trade between $0.239 and $0.306, with a slow rise expected later in the year.

| Metric | Value/Range |

|---|---|

| Bitcoin ETF Inflows This Week | $2.7 billion |

| Total Crypto ETP Inflows 2025 | $48 billion+ |

| Bitcoin Market Share of ETPs | 62% |

| Bitcoin Price Range | $120,000 to $126,000 |

| XRP Price Range | $2.78 to $2.85 |

| XRP Futures Open Interest | $9 billion |

| Solana Price Range (October) | $221.06 to $230.82 |

| Dogecoin Price Range (October) | $0.239 to $0.306 |

| Privacy Coin Zcash (ZEC) Growth | +80% (1 week) |

| Privacy Coin Monero (XMR) Price | $334.89 |

| Privacy Coin Railgun Gain | +40% (24 hours) |

How Are Bitcoin ETF Inflows Affecting the Market?

This week’s $2.7 billion in Bitcoin ETF inflows adds to a wider trend, with overall crypto ETP inflows crossing $48 billion in 2025. Bitcoin is seeing a smaller portion of overall inflows, dropping from 86% last year to 62%, while Ethereum, Solana, and XRP are drawing more investor interest.

The steady inflows into Bitcoin ETFs are keeping $BTC prices stable between $120,000 and $126,000. Traders say this strong interest from institutions is cushioning the market against selling during brief pullbacks.

Also read: Bitcoin ETF Inflows Surge as BlackRock’s IBIT Controls Over Half the Market

Are Privacy Coins Leading the Next Wave?

Privacy coins are making a strong comeback in the market. Over the past week, Zcash (ZEC) climbed 80%. while Monero (XMR) rose to $334.89. Smaller tokens, including Railgun, also saw rapid gains of about 40% in just 24 hours.

This surge is linked to wider use of privacy messaging tools and backing from the Ethereum Foundation for privacy research. Experts believe this growing sector could work alongside Bitcoin ETF inflows to support overall market stability.

Conclusion

Based on the latest analysis, Bitcoin ETF inflows are influencing both immediate price moves and longer term market confidence. This week’s $2.7 billion inflow emphasizes Bitcoin’s position as a digital hedge and signals strong interest from institutions. As altcoins dip and privacy coins gain focus, Bitcoin ETF inflows are still shaping the market direction.

Investors are watching $BTC around $120,000 to $126,000, since ETF activity could decide if the rally continues or pulls back briefly. With interest in both ETFs and privacy coins, the crypto market is showing steady growth even with short term ups and downs.

Summary

Bitcoin ETF inflows 2025 reached $2.7 billion this week, keeping $BTC strong even as XRP, Dogecoin, and Solana fell slightly. XRP dropped near $2.78, while DOGE and SOL saw short term selling after recent gains. Solana has drawn $2.7 billion this year, showing interest beyond Bitcoin.

Privacy coins such as Zcash and Monero are seeing gains. Analysts say the ETF inflows are keeping $BTC stable between $120,000 and $126,000 and boosting overall market confidence.

Stay updated on crypto price movements and track Bitcoin ETF inflows 2025 only on our platform

Glossary

Bitcoin ETF: A fund to buy Bitcoin through the stock market.

Pullback: A small drop in a cryptocurrency’s price.

Krypto ETP: A product that tracks crypto prices, like an ETF.

Privacy Coins: Coins that hide transaction details, like Monero or Zcash.

Resistance Level: A price where sellers usually stop the price from rising.

Frequently Asked Question About Bitcoin ETF Inflows 2025

How much money went into Bitcoin ETFs this week?

$2.7 billion went into Bitcoin ETFs this week, showing that many investors are interested.

Why did XRP, DOGE, and SOL prices drop?

These coins went down a little because some people sold to take their profits.

Is Bitcoin still doing well?

Yes, Bitcoin is still strong because ETF money and big investors are supporting it.

Are Bitcoin ETFs helping the crypto market?

Yes, Bitcoin ETFs are helping the market stay stable and giving investors more confidence.

Why are privacy coins gaining attention now?

Privacy coins like Zcash and Monero are getting more popular because people want to keep their transactions private.

Read More: Bitcoin ETF Inflows Near $3B as XRP, Dogecoin, and Solana See Short-Term Pullback">Bitcoin ETF Inflows Near $3B as XRP, Dogecoin, and Solana See Short-Term Pullback

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.